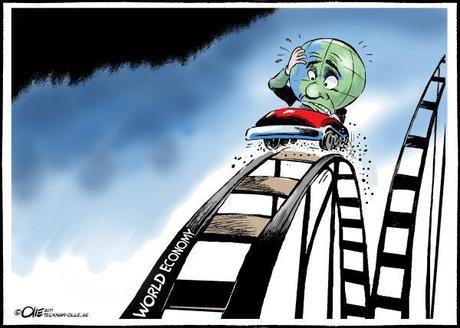

We are now officially getting silly, with Germany falling another 3% this morning, now down close to 30% in less than a month (see David Fry’s chart) with the banking sector off 50% and more. To keep that in perspective, the S&P is down less than 20% and even our super-lame Transports (which go down with oil for some reason) are down "just" 24%. So – do we have another 10% (at least) left to fall or is it kind of ridiculous that AAA-rated Germany, with arguably the World’s strongest economy, should drop 30% in 30 days?

It looks like EWG is going to open around $19.50 this morning and you should be able to sell the Sept $19 puts for $1+ or the Jan $17 puts for $1.25+, giving Germany another 16% buffer before you have to give that $1.25 back at net $15.75, which is back at the non-spike lows of the crash.

The VIX spiked up to $42.50 yesterday, that’s higher than it was in April’s sell off and that made an excellent short at the time. You can sell VXX Sept $45 calls for $3.25 and buy the $45/40 bear put spread for $3.40 for net .15 on the $5 spread. If the VIX and VXX do move higher, a 2x roll to the Sept $55s (now $1.60) is about even or the Dec $62 calls are currently $3.10 so it would take a pretty major, sustained move up in volatility for the short puts to really hurt.

Here we are, back at our March lows for the Nikkei and 15% BELOW the March lows for the DAX and 10% below the March lows for the S&P. REALLY? Were we too optimistic in March by 15%? We just had earnings reports and the numbers were generally fine – it’s the outlook that got gloomy, due to all the economic uncertainty. That’s what happens when your Congress is a bunch of buffoons who are willing to sacrifice the Nation and it’s Citizens in order to improve their political posture…

Other than the imaginary problems of debt (it’s been worse) and austerity (a poor solution to address the debt non-issue) and the real problem of the deficit (easily fixable by collecting taxes and cutting military spending) and a slightly slowing economy (caused by the idiotic austerity measures), what is the reason exactly that IMAX (got ‘em), for example, has fallen 60% since June?

Other than the imaginary problems of debt (it’s been worse) and austerity (a poor solution to address the debt non-issue) and the real problem of the deficit (easily fixable by collecting taxes and cutting military spending) and a slightly slowing economy (caused by the idiotic austerity measures), what is the reason exactly that IMAX (got ‘em), for example, has fallen 60% since June?

$15 – are you freakin’ kidding me? That’s under $1Bn in market cap for a rapidly expanding company that dropped $100M to the bottom line last year! Yes, this year is going to be more like $60M for various reasons but that’s still pretty good. You can sell 2013 $15 puts for $4 for a net $11 entry, another 26% discount off the current price.

XOM hit $70, dropping their market cap below $350Bn, neck and neck with AAPL to be the World’s most valuable company. But XOM has $400Bn in sales and is on pace to drop $40Bn to the bottom line this year WHILE PAYING A 2.5% DIVIDEND. REALLY?!? Even if you don’t like XOM at $70, you can buy the stock and sell the 2013 $55 calls for $18.65 which drops your net to $51.35 so a 7% profit if you are called away (better than T-Bills). I prefer to pair that trade with the sale of the 2013 $57.50 puts at $5.20 and that puts you in for net $46.15 and now a 19% profit if XOM holds $57.50 through Jan 2013 and the worst case is you own 2x of XOM at an average of $51.83, 26% below the current price. That net $46.15 entry makes the $1.88 dividend more like 4% while you wait.

XOM hit $70, dropping their market cap below $350Bn, neck and neck with AAPL to be the World’s most valuable company. But XOM has $400Bn in sales and is on pace to drop $40Bn to the bottom line this year WHILE PAYING A 2.5% DIVIDEND. REALLY?!? Even if you don’t like XOM at $70, you can buy the stock and sell the 2013 $55 calls for $18.65 which drops your net to $51.35 so a 7% profit if you are called away (better than T-Bills). I prefer to pair that trade with the sale of the 2013 $57.50 puts at $5.20 and that puts you in for net $46.15 and now a 19% profit if XOM holds $57.50 through Jan 2013 and the worst case is you own 2x of XOM at an average of $51.83, 26% below the current price. That net $46.15 entry makes the $1.88 dividend more like 4% while you wait.

These are the kind of trade ideas we use in Member chat as we look to pick up excellent opportunities along the bottom (even if we’re not there yet). We’ve been doing a little bit of bottom fishing this week and I made some aggressively bullish calls on the Futures (Russell (/TF) 650, Nasdaq (/NQ) 2,050 and Oil (/CL) $80) in my early morning Alert to Members and those are doing quite well this morning ahead of Dudley’s 8:30 comments – the only major news of the morning and, of course, we’re not going to be greedy as the Dollar is testing 74 again and, if that holds – down we go again!

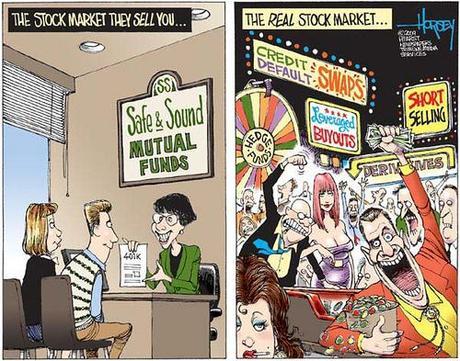

When we scale into our positions, like the ones above, we don’t care if the markets fall another 20% because we’ve already got that kind of protection built in. In fact, if they don’t fall another 20%, we will be slightly disappointed as we won’t get to buy more shares cheaply but, in a flat or up market, we lock in very nice gains anyway. It’s a simple strategy and also very boring – perfect for long-term portfolios geared towards real retirement savings and not the gambling casino short-term markets have turned into!

When we scale into our positions, like the ones above, we don’t care if the markets fall another 20% because we’ve already got that kind of protection built in. In fact, if they don’t fall another 20%, we will be slightly disappointed as we won’t get to buy more shares cheaply but, in a flat or up market, we lock in very nice gains anyway. It’s a simple strategy and also very boring – perfect for long-term portfolios geared towards real retirement savings and not the gambling casino short-term markets have turned into!

Of course we’re not giving up our hedges either – just taking a few bullish positions now that we are retesting our own 20% drops. While we don’t want to overcommit – we also don’t want to miss the kind of pop we might get if the Fed turns the FREE MONEY spigots back on – something that becomes more and more likely the lower the markets fall.

Another odd thing I’ve noticed this week is how the entire Gang of 12 has launched a coordinated attack on investor confidence. This morning, JPM stepped up to the plate and batted down expectations for Q4 GDP to 1% – from 2.5%! Q1 2012 has been lowered from 1.5% to 0.5% – these are 66% downward growth revisions! BUT – it’s NOT a recession. At this point, the markets are pricing in negative growth, not just NO GROWTH.

Hedge Funds are at their most bearish levels since July of 2009 (when they were wrong!) as the economic slowdown and European debt crisis spur the biggest losses in almost three years. An index of hedge fund assets from International Strategy & Investment Group dropped to 45.8 on Aug 16th, showing the most short selling in two years. The ratio of bullish to bearish investments in U.S. equities has dropped to 11.7 from this year’s peak of 13.2 in May, according to New York-based Data Explorers, which provides research on short sales and stock lending.

Hedge Funds are at their most bearish levels since July of 2009 (when they were wrong!) as the economic slowdown and European debt crisis spur the biggest losses in almost three years. An index of hedge fund assets from International Strategy & Investment Group dropped to 45.8 on Aug 16th, showing the most short selling in two years. The ratio of bullish to bearish investments in U.S. equities has dropped to 11.7 from this year’s peak of 13.2 in May, according to New York-based Data Explorers, which provides research on short sales and stock lending.

Barton Briggs agrees with me this morning, saying stocks may be experiencing a classic retest of the lows of 10 days ago and close to reaching a bottom. “If analysts and investors really believed the S&P earnings estimates, the market wouldn’t be selling where it is… The market is already priced for a 10-15% percent decline in earnings.” Bill Dudley once again failed to give us a hint on QE3 with Jackson Hole now one week away, but we did get the nice pop in the futures that we expected ahead his speech anyway (all gone now except oil) so congrats to those players (less now with the mess TOS made of their account transitions!).

J.D. Power reduces its forecast for auto sales in FY11 and FY12, by 300K and 600K respectively, noting the anticipated "snap-back" following the Japan earthquake never hit. A rep says, "ascending from the recession is proving to be just as bumpy as the decline into it." So no – we are NOT gung-ho bullish by any measure but we are getting "bottomish" here – time to do a little fishing while we wait – PATIENTLY – for a real tun back up.

Have a great weekend,

- Phil