This is how the Fed "fixes" the market.

This is how the Fed "fixes" the market.

Yesterday, the Chicago Fed's Charlie Evans said he would be "quite pleased" with 2.5% core inflation, a 25% increase in the Fed's Inflation Target. That was at 10:30 and the Dollar took a nose-dive all day, lifting the market over key techincal lines to give us the impression of market strength but, what we really got was Dollar weakness.

Equities are priced in Dollars so, if the Dollar is weak, you need to trade more of them for the same share of stock – the stock didn't get more valuable, your Dollar got less valuable but the chart doesn't know that, does it? Here's an interesting way to look at the market: This is the S&P 500 priced in Gold:

That's interesting, isn't it. Priced in Gold, this market peaked out back in 2018 at 2.450 and fell almost 50% to 1.325 (SPX/Ounce of Gold) and is now back to 1.78, still 27% off the highs. Of course gold isn't an absolute measure of the market but there's a reason GOLD (Barrick Gold) was our Stock of the Year for 2020 – inflation was always going to happen given our current monetary policies – the question was only "how much" and the Fed is now saying "a lot".

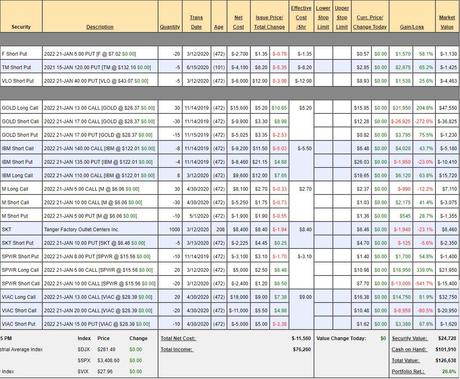

Speaking of our Stock of the Year, I'm going to be taping a segment for Money Talk this evening for airing tomorrow and we'll be talking about our Money Talk Portfolio, which features our Stock of the Year and plenty of other good picks so let's see who we want to add. Remember, the rules of the Money Talk Portflio are we only make our trades once per quarter, on the show, so we weren't able to take full advantage of the sell-off but we are still chugging along with a very nice 26.6% gain for the year so far:

- F – If we were assigned this position our net entry would be $3.65 so I'm not worried about this one. $1,130 (42%) left to gain.

- TM – This one is too expensive if it goes wrong so we should cash it

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!