4th time's a charm?

4th time's a charm?

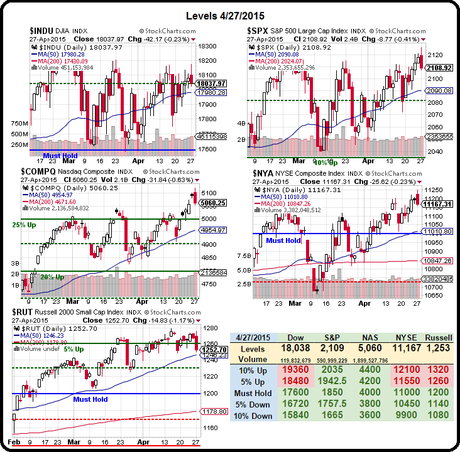

Not so far as we're once again failing the 2,100 line on the S&P and the Russell took a deep dive yesterday, from 1,275 back to 1,250, failing to hold its 5% line and testing the 50-day moving average at 1,246, which really must hold today or we will have a lot of technical reason to worry about the market.

Last week I asked "Can Low Volumes Drive us to New Highs" and, so far, the answer is clearly: No, they can't. Not the kind that are sustainable, anyway. In that post, I mentioned that we were shorting /ES (S&P Futures) at 2,100 and /TF (Russell Futures) at 1,170 with tight stop above "simply because the reward to risk ratio is high on those plays – so why not?"

While the Russell's up and down moves gave us several wins last week (with a huge one yesterday), the S&P has spent the whole week over the line so this morning is the first chance to test our short on that index. Futures contracts on the S&P pay $50 per point, per contract – so we're talking big money from little drops.

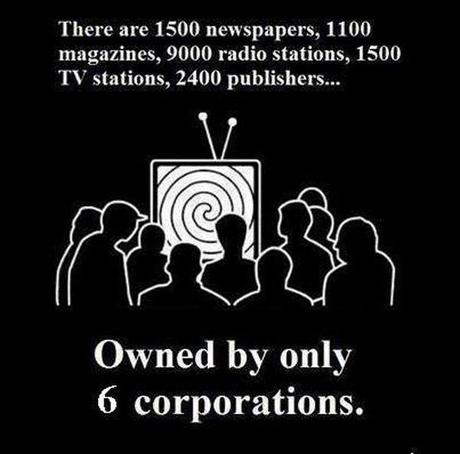

2,090 is the S&P's 50 dma so look out below if that breaks but we'll expect it to be bouncy – if we test it at all – as it's the end of the month on Wednesday, so windows must be dressed and we have the Fed, who usually manage to save us when the markets are turning lower by eliminating or adding a word to their meeting statement, which allows the MSM to spin it whichever way pleases their Corporate Masters. There, that's all you need to know for Econ 101 these days…

2,090 is the S&P's 50 dma so look out below if that breaks but we'll expect it to be bouncy – if we test it at all – as it's the end of the month on Wednesday, so windows must be dressed and we have the Fed, who usually manage to save us when the markets are turning lower by eliminating or adding a word to their meeting statement, which allows the MSM to spin it whichever way pleases their Corporate Masters. There, that's all you need to know for Econ 101 these days…

Also testing a major line today is the Nikkei (/NKD on the Futures) at 20,000. That's a nice, round number you would think would hold up – especially with their Government and Central Bank pulling out ALL of the stops to do WHATEVER it takes to goose the markets over there. Nonetheless, Japanese Retail Sales COLLAPSED in March, falling 9.7% from last year's levels and down 1.9% from weak February sales that were blamed on the weather.

“It’s becoming clear that Japan’s recovery is very sluggish,” said Kiichi Murashima, an economist at Citigroup Inc. “With a tight labor market and better consumer sentiment, we don’t have to change the view that spending will pick up gradually. But uncertainties are growing about the strength of the economy and that’s worrisome for the BOJ.”

Speaking of Corporate Media shenanigans, Shigeaki Koga, a regular television commentator and fierce critic of the political establishment in Japan, abruptly departed from the scripted conversation during a live TV news program to announce that this would be his last day on the show because, as he put it, network executives had succumbed to political pressure for his removal. Koga was the former Minister of Economy and Trade and has been critical of Japan's insane money-printing machinery and the Government pressured the station to shut down his criticism – successfully.

The outburst created a public firestorm, and not only because of the spectacle of Mr. Koga, a dour-faced former top government official, seemingly throwing away his career as a television commentator in front of millions of viewers. His angry show of defiance also focused national attention on the right-leaning government’s increased strong-arming of the news media to reduce critical coverage.

The outburst created a public firestorm, and not only because of the spectacle of Mr. Koga, a dour-faced former top government official, seemingly throwing away his career as a television commentator in front of millions of viewers. His angry show of defiance also focused national attention on the right-leaning government’s increased strong-arming of the news media to reduce critical coverage.

“The Abe government is showing an obsession with the media that verges on paranoia,” said Keigo Takeda, a former editor in chief at Newsweek Japan who is now a respected freelance journalist. “I have never seen this level of efforts to micromanage specific newspapers and TV programs.” Scholars describe a mood of fear spreading beyond the news media into the broader society, including in education where the Abe government is pressing textbook publishers to adhere more closely to the official line on topics like the 1937 Nanjing massacre and the use of so-called comfort women in wartime military brothels.

"You know, I think I've been universally short-tempered and testy with both male and female reporters. I'll own up to that." Oh, sorry, that wasn't Shinzo Abe, that was Rand Paul… ![]()

Indeed a study by Yale and Berkeley professors have noted that "It is also deeply puzzling. Republicans are gaining more influence even though Americans seem less satisfied with the outcomes of increased Republican influence. Poll after poll shows that major GOP positions are not all that popular… On basic economic issues, people at the center of the ideological spectrum express views similar to those of the typical voter a generation ago. On many social issues, such as gay marriage, middle-of-the-road voters have actually moved left. Yet the Republican Party keeps heading right."

Indeed a study by Yale and Berkeley professors have noted that "It is also deeply puzzling. Republicans are gaining more influence even though Americans seem less satisfied with the outcomes of increased Republican influence. Poll after poll shows that major GOP positions are not all that popular… On basic economic issues, people at the center of the ideological spectrum express views similar to those of the typical voter a generation ago. On many social issues, such as gay marriage, middle-of-the-road voters have actually moved left. Yet the Republican Party keeps heading right."

Despite the evidence of increasing Republican extremism, elite discourse—in journalism, academia, and foundations—resists the notion that Republicans are primarily responsible for polarization and deadlock. To argue that one party is more to blame than another for political dysfunction is seen as evidence of bias, not to mention bad manners…[W]hile Fox News takes an avowedly partisan line, most of the media world retreats into self-defeating denials of the truth that stares them in the face…

Why does this matter to market investors? Because if they can make people see the opposite of what's going on in Government, if they can suppress dissent and control the political messages then CERTAINLY they are also controlling what you THINK you know about the economy. That should go without saying, shouldn't it?

Why does this matter to market investors? Because if they can make people see the opposite of what's going on in Government, if they can suppress dissent and control the political messages then CERTAINLY they are also controlling what you THINK you know about the economy. That should go without saying, shouldn't it?

You don't want to hear it and you don't want to believe it because it means your life is being controlled by powerful people who don't have your best interests at heart and that's depressing – and we hate to be depressed, don't we?

If you are depressed they give you pills because pills are better than fixing things, aren't they? Stimulus is a great big pill they give to the economy and, as evidenced by Japan's Retail numbers and our own sputtering economy - it fixes nothing at all.

Another economy on the fritz is the UK, who just announced 0.3% GDP growth from last quarter, just 60% of what was expected. This bad news is coming just 9 days before the country's general election so be prepared for some fireworks next week (and here's highlights of the last debate). Forget Greece leaving the Euro, the UK may leave the Euro if Farage's party gains enough power!

So "Cashy and Cautious" remains our mantra. Even AAPL's stellar earnings aren't enough to sway us to jump back in as AAPL was already our stock of the year and has been responsible for a very large chunk of the S&P's earnings for years – so of course they did well. But did they do well enough to support themselves above $130 and, more importantly, to support Nasdaq 5,000 and S&P 2,100 – we'll see how the week unfolds.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!