Higher taxes are good for the economy and lower taxes are bad for the economy, to a point.

The main thing here is to maintain relatively high taxes, or a high tax bracket, on the very rich. The very rich usually have all sorts of loopholes anyway, so they almost never pay the top rate, whatever it may be. High taxes on the rich discourage speculation and promote a more equal economy. When taxes on the rich are too low, too much money concentrates at the top and too little towards the bottom.

The result is that you do not have enough customers to buy your stuff and the market dies from lack of demand. This is the problem in the 3rd World and also in the US at the moment. There is also too much money concentrated in corporations and as a result, corporations are sitting on huge stockpiles of cash that they do not know what to do with. They do not want to invest the money in their businesses since consumer demand is dead and investment only makes sense when demand picks up.

Hence, getting rid of regulations and lower corporate taxes will do nothing to jump start the economy since the increased income will simply go into the already overflowing corporate coffers and will not be invested. And it will not be invested until demand picks up. Since reducing regulations and cutting business taxes does nothing to jump start demand, it is completely worthless as an economic stimulus.

Yet this is what the insane conservatives keep demanding as a way to jump start the economy. It’s never worked, it won’t work and it will never work, but neoliberalism is more of a religion than anything else and free marketeers are somewhat like fundamentalist religious people who go by faith and not logic or science.

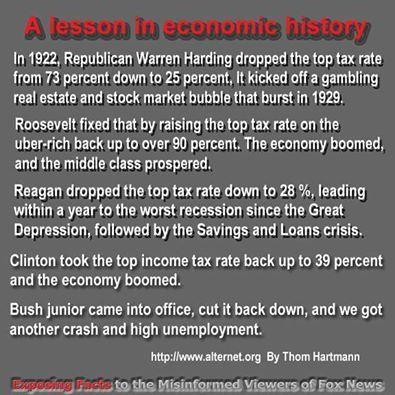

In addition, cutting the highest taxes on the rich usually fuels a wild speculative boom which inevitably in capitalism ends up in some sort of a horrific crash. The truth is that speculative booms are bad for the economy. Only a few rich people make out like bandits and everyone else is left holding the bag when the whole stupid thing crashes down once again.

The boom and bust cycle, so revered by conservatives, is actually one of the more idiotic and irrational things about capitalist economics. If aliens came to the Earth and you told them that your economic model was predicated on wild run-ups followed by horrific crashes (a manic-depressive economy) they would tell you that you were insane. Would it not be better to have the economic equivalent of a Mediterranean climate where you had relatively low but steady growth consistently across the board that lifted all classes, without wild run-ups and monstrous plunges? Would that not be the sane way to run an economy?

In addition to preventing speculative excess which is not even real economic growth, speculation is not real growth. This is because speculators produce nothing but gambling casinos in the sky. Real growth occurs when real goods are produced in some way or another (products or widgets if you will).

Higher taxes on the rich redistribute wealth downwards which increases demand by equalizing the economy. Instead of all of the gains going to the top 1%, economic growth is distributed to all classes including the lower classes who drive the real economy via their purchases.

So there you see one instance of how higher taxation leads to a booming economy whereas lower taxation leads to recessions and depressions.