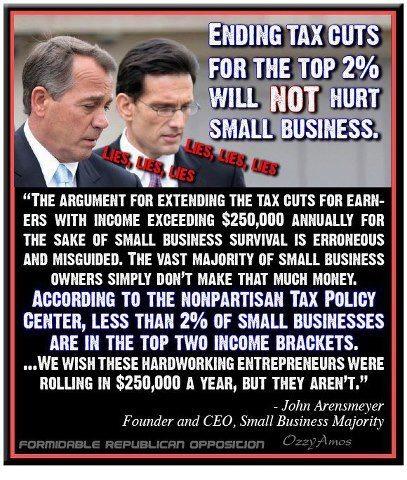

The argument that Republicans have been trying to put forth in defending the tax cuts for the top 2% is that it would hurt small businesses. Of course, that's ridiculous. Most small businesses don't clear anywhere near $250,000 (and remember, taxes are paid only on profits -- not on the amount of sales that business has). In fact, only 2% of small businesses are in the top two tax brackets (and an argument could be made that they are not really small businesses).

The argument that Republicans have been trying to put forth in defending the tax cuts for the top 2% is that it would hurt small businesses. Of course, that's ridiculous. Most small businesses don't clear anywhere near $250,000 (and remember, taxes are paid only on profits -- not on the amount of sales that business has). In fact, only 2% of small businesses are in the top two tax brackets (and an argument could be made that they are not really small businesses).But it is understandable why the Republicans would be pushing this false argument. Unless they can convince Americans of it, they will be exposed as just trying to save more money for the rich (which is exactly what they are doing). And they know they cannot regain power if most voters believe they are the party of the rich (which they are). But making more than $250,000 is not middle class -- it is at least 5 times the average salary of people in the United States, and that average salary continues to drop.

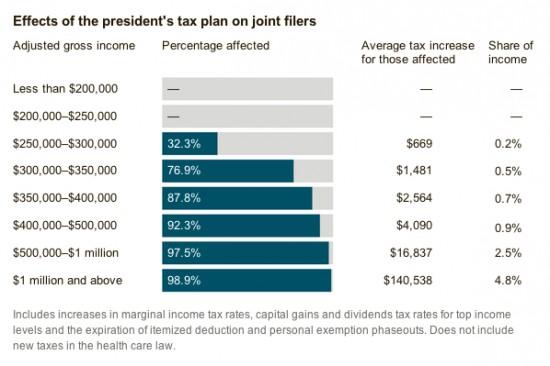

They also make it sound like those making above $250,000 would no longer receive any benefit from continuing the Bush tax cuts for those making less than $250,000 a year. But that's not how our tax system works. Those in the top 2% would continue to receive the tax cut on the first $250,000 they earn. They would just not continue to get a tax cut for the amount they earn above $250,000. And even then the tax rise on money above $250,000 would not be onerous. It would amount to less than 1% all the way up to $500,000 (see the chart below).