Are you holding shares and would like to gift it to your spouse or children or any other person?

Yes!!

Read the article till the end to know about 3 main things –

- Procedure for gift or transfer of shares in Demat form.

- Taxation on the Gift of Share.

- Taxation on income from the transferred share after the transaction.

Procedure to Gift Shares

Shares can be gifted only in the Demat form from April 1, 2019. Gifting of shares to another is legally termed as Transfer of Shares. Let us see how you (donor) can gift or transfer shares to a specific person (donee):-

How to Gift Shares In DEMAT Form

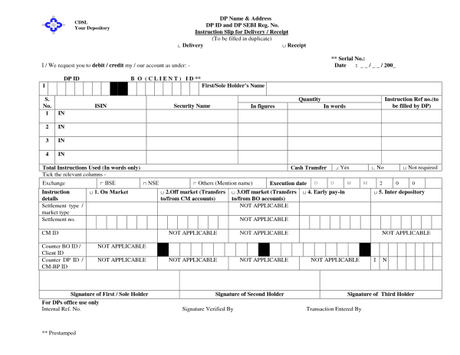

Step 1: The Donor has to initiate an off-market transaction (mutual settlement of shares between two parties without involving stock exchange) by submitting a Delivery Instruction Slip (DIS) to his DEMAT Account provider (also called Depository Participant (DP)) for transferring shares from the donor’s Demat account to the donee’s Demat account.

Delivery Instruction Slip is like a cheque-book for your bank account that you use to transfer money from your account to another’s account.

Step 2: The Delivery Instruction Slip (DIS) should have the following details:

- Name of the Donee

- Donee?s Demat Account Details

- Share/Stock to be transferred

- ISIN Number of the Company

- Quantity of the Shares to be transferred

Step 3: On the other hand, Donee has to give a receipt instruction to his DP (DEMAT Account provider) to accept these shares if he has not already given a standing receipt instruction.

Step 4: It is advisable to execute a gift deed on a non-judicial stamp paper by mentioning the details of the transaction for legal records and to avoid any tax queries in the future.

Note: Once a gift is made to the donee, it cannot be canceled.

Check out – best Demat trading account in India

Tax on the Gift or Transfer of Shares

Tax on a gift is governed by Section 56 of the Income Tax Act, 1961. The tax liability is computed keeping in mind the receiver of the gift and amount of the gift. To get a better understanding of the Tax on the gifted shares, let’s divide the donee into two categories:

- Blood Relatives

- Others

Gifting Shares to Family Members (blood relatives)

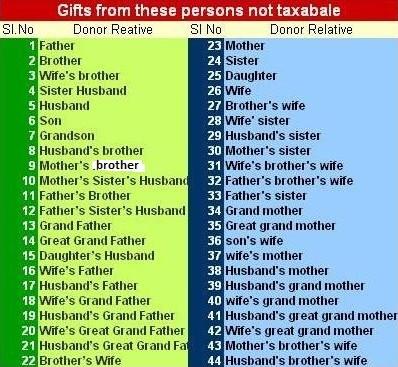

In case the donee is a blood relative of the donor then the gift is completely exempt from tax irrespective of the amount of the gift under section 56(2)(vii) of Income Tax Act, 1961.

Note: Section 56(2)(vii) defines a Relative as –

(a) Spouse of the individual;

(b) Brother or sister of the individual;

(c) Brother or sister of the spouse of the individual;

(d) Brother or sister of either of the parents of the individual;

(e) Any lineal ascendant or descendant of the individual;

(f) Any lineal ascendant or descendant of the spouse of the individual;

(g) Spouse of the persons referred to in (b) to (f).

Also read – best discount broker in India

Transfer Shares to Spouse in India

Since the spouse comes under the definition of a relative so there would be no tax on the gifting share transfer to your spouse. but the dividend received by the spouse after the transfer would be clubbed with your income and taxed accordingly.

But if you gift the same to your major child, your adult child will have to pay the tax on dividend income.

The entire list of Relatives from whom Gift is Exempt from Tax is depicted below:

If you don’t have Demat account then you can check the Zerodha review to open your first account.

Gifting Stocks to other people (Not a blood relative)

If the donee is not a blood relative of the donor as stated above, then if the gift exceeds the amount of Rs.50,000, then it is taxable in the hands of the donee. In case of shares, the fair market value of the shares will be considered as the amount of gift and if exceeds Rs.50,000 in a year, then the whole of such gift is taxable under the income from other sources in the hands of the donee.

Only on the occasion of marriage, the gifts received by the newly-wed couple would not be liable to income tax at all regardless of the amount.

Tax on Income after the shares are gifted as Gifts to the spouse, daughter-in-law and minor children are exempted from tax but the income earned from such gifts will be clubbed with the income of the donor.

But if the gift is made to the dependent major children (above 18 years) the income earned from such gift will be taxed in the hands of the children, not yours.