The UK experienced economic contraction between the months of April and June, the last shrinking taking place in 2012, highlighting concerns that the UK could be sliding into recession. The UK’s economic output fell 0.2% in the last quarter raising the fear that the UK could finally be feeling the uncertainty of Brexit.

UK economy is faltering, but why?

The first quarter of the year saw a 0.5% growth in the UK economy as manufacturers stockpiled goods in the anticipation of the possibility of issues caused by a No deal or disruptive Brexit. This activity artificially boosted the economy, the UK manufacturing sector enjoying the biggest quarterly rise since the ’80s.

This activity has been blamed for distorting the UK GDP figures this year and exasperating the latest GDP reading.

Other reasons for the economic contraction included vehicle manufacturers closing down production lines earlier in order to contingency plan or Brexit.

Despite the stark data, recently appointed chancellor Sajid Javid rejected calls that the UK was heading for recession stating that:

I am not expecting a recession at all. And in fact, don’t take my word for it. There’s not a single leading forecaster out there that is expecting a recession, the independent Bank of England is not expecting a recession. And that’s because they know that the fundamentals remain strong.

Despite his assurances that the economy is stable, the Bank of England recently revised down growth forecasts, offering little comfort.

Bank of England cuts its forecasts

The Bank of England’s main forecast which understands the UK leaving the European Union in an orderly fashion revised its growth figure from 1.5% to 1.3% this year. The same growth expected in 2020 revised down from 1.6%.

In the event of No-deal Brexit interest rates would automatically be cut from 0.75%; a level that was unanimously voted to remain unchanged at 0.75% earlier this month.

Inflation is expected to increase above its current 2% in the coming years as prices increase due to a generally weaker Pound exchange rate and higher costs of goods.

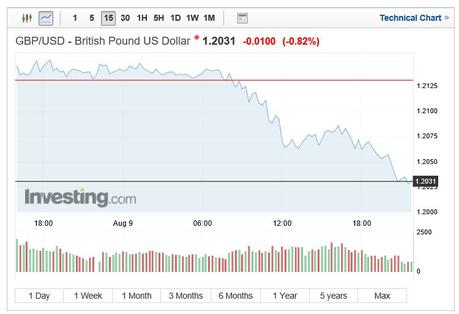

Pound exchange rates fall further

Support for the pound has been thin on the ground as the likelihood of No-deal Brexit now seems unavoidable despite Tory party assurances that they are keen to renegotiate. The EU have been clear on this point and will neither re-discuss the Irish backstop or withdrawal agreement terms. In turn, Prime minster Johnson and his cabinet have focused on beefing up plans for a disruptive departure from the EU. This rhetoric condemns pound exchange rates to lows close to those seen during the 2007 financial meltdown.

Pound – Euro this week tumbled from a high of 1.0947 to a low of 1.0738 where it closed on Friday.

The likelihood of GBP receiving support this week seems modest, data is thin on the ground and even more, positive news from the UK retail figures, Inflation data or average earning numbers would seem unlikely to spur on the Pound.

Cable exchange rates have also seen a significant fall this week with GBP-USD tumbling to 1.2028 on Friday.

The Pound now appears to be highly susceptible to further losses this week with none of the aforementioned data likely to assist with a turnaround in Sterling’s fortune. The only reprieve Sterling could see this week might be in the form of a meeting between Boris Johnson and Leo Varadkhar, the first time Johnson has discussed Brexit with a representative of the union. Whilst it’s still understood that the withdrawal agreement and the Irish backstop are not up for negotiation the fact that dialog will start could be viewed as a positive or provide markets with guidance.

Probability of the UK falling into recession

Whilst this week’s GDP data could be easily explained away with the manufacturing stockpiling seen in the first quarter, the UK would appear to be walking a tightrope as things stand.

The office of national statistics believe the UK economy will only narrowly avoid recession. Key economists now believe a one in three chance of a technical recession likely. Not all the bad news runs parallel with Brexit, the US’s trade war with China has wheel-clamped the global economy and the UK is also feeling the slowdown facing its key trading partners especially the US. Business confidence remains low and factory outputs have stagnated.