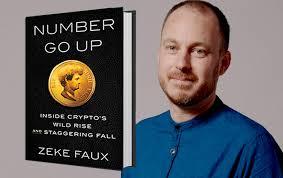

Number Go Up — Inside Crypto’s Wild Rise and Staggering Fall — is a 2023 book by the aptly named Zeke Faux, an investigative journalist. The cover image is a coin with Sam Bankman-Fried’s portrait and the words “Nihil Valet” (Latin for “worth nothing”).

I wrote about cryptocurrency — Bitcoin the main one —back in 2018. To recap: the idea was to break free from governmental money systems and all their associated oversight. Using a blockchain, a kind of public database indelibly recording every transaction (yet they’re anonymous).

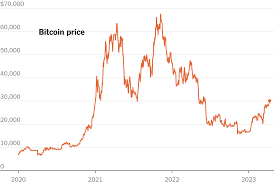

Bitcoins are created by “mining,” which entails solving a complex mathematical puzzle requiring vast computer (and hence electric) power. Bitcoin’s value started at 9¢ in 2010, since undergoing wild fluctuations, with a high over $65,000.

This inspired numerous crypto copycats, introduced via “initial coin offerings” (ICOs) mimicking “initial public offerings” for securities. But these aren’t shares in businesses or promises to pay (like bonds). They’re worth only what the market deems them worth.

But what makes a dollar worth a dollar? Writer Yuval Noah Harari has called this a fiction kept aloft because people believe it. The government won’t redeem a dollar bill for something of tangible value, like gold. Then again, what underlies gold’s value? That too is a cultural meme.

Yet such universal shared belief does make a currency work. Crypto instead is viewed mostly with (justified) suspicion. It also fails as a store of value, with its big fluctuations. And the crypto world is rife with fraud, most “coins” being plain out scams, while they’re vulnerable to hackers chronically stealing them. All kind of defeating the thing’s initial rationale.

Moreover, the anonymity facilitates money laundering and other sorts of criminality. Law enforcement cannot “follow the money.” Faux explored the horrific world of “pig butchering” — South Asians lured to Cambodia with seemingly attractive job offers, then brutally imprisoned and forced to make scamming phone calls — the payments to be in untraceable cryptocurrency.

Much of the crypto world has been tethered to “Tether,” itself a cryptocurrency but purporting to be a “stablecoin” pegged at $1 and safely backed by real assets. Many billions worth. But Faux was skeptical, and much of the book concerns his fruitless efforts to demystify Tether’s finances (though it has survived the recent crypto meltdown).

Meantime, cryptocurrency has never gained a foothold in the economy or population generally, nor in the world of conventional finance. El Salvador’s authoritarian President Nayib Bukele (who calls himself “the world’s coolest dictator”— ha ha) did declare Bitcoin a national currency, but Faux, visiting there, found almost nobody using it.

So the notional value of these “coins” is basically grounded within the “crypto bro” cult. It’s because they bid it up among themselves that Bitcoin’s price inflated so fantastically. Some thus did make oodles of money, which fed the faith.

It’s this cult phenomenon that Faux’s book is mainly about, portraying its acolytes. Mostly young, weird, sketchy, flaky people, without scruples, heavily into drugs, and conspicuous consumption to flaunt their newfound wealth.

While reading this, I heard a talk on why beliefs often defy facts and reality. It spoke of a doomsday cult involving Jesus, aliens, flying saucers, and the rest of humanity slated for annihilation on a certain date. Which came and went uneventfully. Bummer for the cult. But then its guru claimed to receive a message saying that actually the group’s steadfastness had saved the world. So they sallied forth with redoubled faith.

That’s the kind of psychology sustaining the crypto realm.

By the way, I’ve profited myself. Finding nice looking gold-colored “Bitcoins” available on eBay for under $1 each in bulk, I’ve sold hundreds at $1.99 — three for $4.95.

That didn’t put me in Bankman-Fried’s league. Once heralded as the world’s youngest mega-billionaire, his FTX firm — a cryptocurrency exchange and investment vehicle — imploded with billions mysteriously missing, and he’s headed for a long prison spell.

Then his main rival outfit, Binance, similarly blew up, as did a bunch of others. Seems to be the standard story in crypto-world. Yet, as Faux predicted, true believers are undeterred. Bitcoin had previously crashed to $16,000 but is now back up to $50,000. The power of faith!

My past essay on the subject predated the NFT craze — an offshoot even more surreal. NFTs are “Nonfungible Tokens,” associated with art works, video snippets, and the like. The biggest thing here was “Bored Apes” — thousands of bizarre cartoon pictures of simians with various garbs and distortions, often used as people’s Twitter avatars. Faux, just to gain entree to a big New York Apefest party, bought one for $20,000.

Illustrated in the book. Maybe kinda funny, even cool — but $20,000?? Seriously?

But wait. Faux explains that an NFT does not mean actually owning the “art work.” Instead it’s merely your name registered into the blockchain as having bought that NFT. Anyone else could still download and use the image itself. So Faux’s $20,000 bought just the right to say he’d spent $20,000.

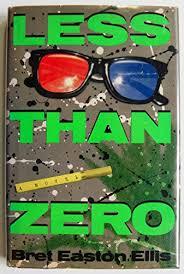

Yet that itself constituted the coolness in which the NFT fools — er, connoisseurs — were seeking to wrap themselves. Faux’s chapter on this, describing that New York party scene, made me suddenly feel like I was reading some Bret Easton Ellis novel set in a future dystopia whose supercilious denizens are unrecognizable as everyday humans.

Indeed paying sums even into the millions for “art works” that were, let’s face it, no Leonardos, Renoirs, or Picassos, nor even Banksys — really just crap — of which anyhow they weren’t even gaining exclusive possession!

Faux managed to quickly unload his $20,000 NFT with only a slight loss. But the bubble soon totally burst, and today NFTs are approximately worth — to quote a Bret Easton Ellis title — Less Than Zero.