These charts were made from the Economist / YouGov Poll done between December 13th and 15th of a random national sample of 1,000 adults, with a margin of error of about 4 points.

Economists tell us the recession caused by the financial crisis of 2008 is over. And if you look at how the rich and the giant corporations are doing, you might be convinced of that. Both have recovered nicely, and are now making more money than ever.

But that recovery still has not reached Main Street. Wages for the working and middle classes are stagnant (and still falling when inflation is taken into account), good jobs are still being outsourced to low wage countries, the middle class is still shrinking, the income and wealth gap between the 1% and the 99% is growing wider, and a significant majority of the new jobs being created are low wage (and low benefit) jobs.

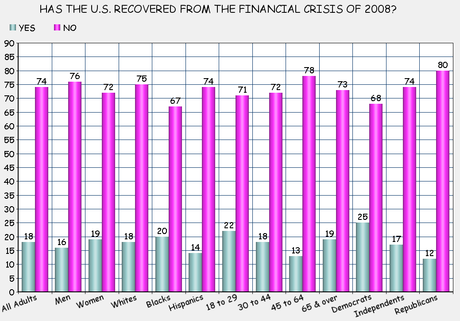

And the American people know that. About 74% of the general population says this nation has still not recovered from the financial crisis of 2008. And that feeling is strong throughout all demographic groups -- including all genders, races, ages, and political persuasions. The people want the U.S. economy fixed, and they are disgusted with the politicians for playing political games instead of compromising for the good of the country.

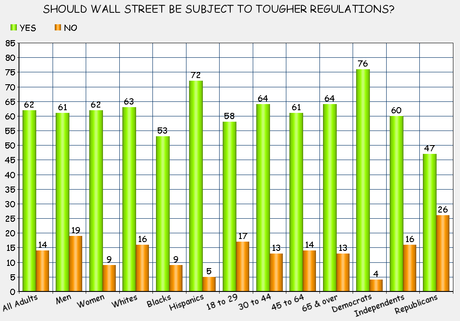

The Republicans, who are now in control of Congress, think the answer is more trickle-down economic policy -- the idea that giving the rich, the corporations, and Wall Street bankers more will benefit all Americans. And they have already started back down that failed path. The recent budget bill they forced on us contained a rider which will let Wall Street bankers once again play the market with consumer money instead of their own (assuring they will get another bailout when they screw up again).

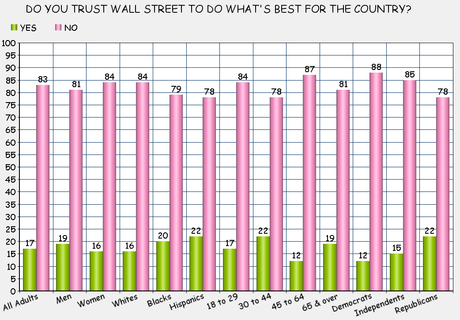

They are playing a dangerous political game by returning to those trickle-down policies -- and it could easily come back to bite them in the butt. That's because the American people no longer trust Wall Street. A whopping 83% say they do not trust Wall Street to do what's best for the country as a whole. They believe Wall Street will happily toss most Americans under the bus to make a few more dollars in profit -- and they don't think Congress should be lessening the regulations on Wall Street. In fact, a significant majority (62%) would like to see tougher regulation of Wall Street.

---------------------------------------------------------------------

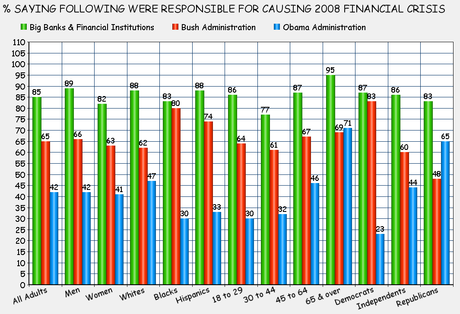

That same poll asked another question, and the answers were very strange. They asked who was responsible for the financial crisis of 2008 (see chart below). It seems appropriate to me that the group held most responsible were the big banks and financial institutions of Wall Street. After all, it was their greedy and criminal mismanagement that caused the market crash that kicked off the recession. And I can understand that a majority also blamed the Bush administration, since it was the Republican policies that allowed Wall Street to screw up so badly.

But I was amazed (and somewhat shocked) that 42% of Americans (and 71% of seniors and 65% of Republicans) also said the Obama administration had some responsibility for the 2008 financial crisis. How can that be, when President Obama didn't take office until 2009? I have to think a lot of Americans are just accepting the Republican lies (that Obama was responsible for their own misdeeds) without bothering to consider the facts or doing any independent/rational thinking on their own.

How can we maintain a democracy when this many people refuse to look at obvious facts?