Our "leaders" still can’t work out a debt deal with just 7 days left until the Government shuts down (and we’re already at the end of our bonus time as Treasury has been juggling the books for three months just to allow us this much). I wrote extensively about this over the weekend so we can move on – just as we moved on in Chat yesterday evening when my 6:09 pm Alert to Members was to go long on the Dow Futures (/YM) over the 12,500 line (now 12,543, up $215 per contract), Russell (/TF) at 830 (now 831.80, up $180 per contract) and, of course, shorting oil (/CL) below 99.50 (now $98.97, up $530 per contact) so the winner of the morning is oil! Congrats to all the players with a lovely start to our week!

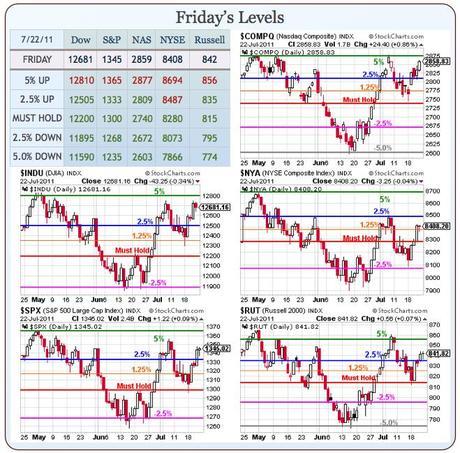

On the whole, we were just protecting our bearish bets as I remained very grumpy into the weekend on Friday. Those of you who followed our suggestions from Friday’s post were no doubt pleased because, at the time, we were short the Dow Futures at 12,720 and the Russell Futures at 842.60 with $1,100 and 1,260 moves from there to Sunday night’s flip-flop respectively.

We also picked the S&P (/ES) short at 1,346 (now 1,331) and the only one that isn’t working is the Nasdaq (/NQ) – back at the same 2,415 we had in Friday Morning’s Futures. Well, it’s not the only one – gold went over our $1,605 shorting target this morning, after giving us a quick gain on Friday. This is not good for our GLL August $22 calls (.40 on Friday) or our ZSL Sept $11/15 bull call spread at $2, offset with the sale of SLW Sept $44 puts for $1.20 for net .80 on the $4 spread but a nice re-entry opportunity today – if you are still a believer.

We also picked the S&P (/ES) short at 1,346 (now 1,331) and the only one that isn’t working is the Nasdaq (/NQ) – back at the same 2,415 we had in Friday Morning’s Futures. Well, it’s not the only one – gold went over our $1,605 shorting target this morning, after giving us a quick gain on Friday. This is not good for our GLL August $22 calls (.40 on Friday) or our ZSL Sept $11/15 bull call spread at $2, offset with the sale of SLW Sept $44 puts for $1.20 for net .80 on the $4 spread but a nice re-entry opportunity today – if you are still a believer.

We’re more agnostic now. We were bearish into the weekend expecting pretty much what happened – NOTHING, and now we’re waiting to see what actually happens and how the markets react. The Shanghai Composite freaked out this morning and dropped 3% – only saved by the closing bell as the Government moved to shut down counterfeit Apple Stores and bullet trains went off the rails. The Hang Seng wasn’t as worried – down only 0.7% while the Nikkei was off 0.8% and India couldn’t have cared less and gained 0.8%

Europe opened down about 1% but is recovering and almost flat at 8 am despite Moody’s cutting Greece to "Yucky, smelly junk" – the worst rating they have ever given to a nation with running water. Moody’s Alastair Wilson warns, "Our experience is that relatively small restructurings have been often followed by deeper defaults." That’s not helping Italian Banks, who closed limit down one day last week and are still falling this morning, with some down about 5% already. We got good news out of Europe with Ryanair’s profits jumping 49% for the Q. RYAAY was one of our featured trade ideas last Tuesday, when my comment in Member Chat was:

Airlines/Asaenz – I like RYAAY as they got killed recently on no particular news (but Q2 is tricky for them). I would go light, in case they miss with the March $25/30 bull call spread at $1.90, selling he $22.50 puts for $1.60 for net .30 on the $5 spread that’s currently $1.15 in the money. UAL may be a falling knife here but, then again, so could Ryanair but I like RYAAY’s business model better (more flexible).

That one is nicely on track for the maximum 1,566% gain and I’m very pleased with that call as UAL went the other way last week so a nice bonus warning people off that one! We had taken a bearish stance on the debt fiasco last week with Friday’s trade ideas including an SQQQ Aug spread, a bearish move on FAS, the GLL & ZSL trade ideas mentioned above, shorting oil futures (/CL) at the $100 line, a GMCR Jan bear spead and a bullish January play on AAPL and a March trade idea for SONC that was featured in this weekend’s Stock World Weekly.

That one is nicely on track for the maximum 1,566% gain and I’m very pleased with that call as UAL went the other way last week so a nice bonus warning people off that one! We had taken a bearish stance on the debt fiasco last week with Friday’s trade ideas including an SQQQ Aug spread, a bearish move on FAS, the GLL & ZSL trade ideas mentioned above, shorting oil futures (/CL) at the $100 line, a GMCR Jan bear spead and a bullish January play on AAPL and a March trade idea for SONC that was featured in this weekend’s Stock World Weekly.

Intra-day we picked off a nice downward move on the Nasdaq with the weekly QQQ $60 puts, which went from .35 in Member Chat at 2:30 to .50 when I reminded Members "Don’t be greedy" at 3:43 so a nice, 42% gain in an hour to finish off an excellent week.

Now we’re back to watching our lines this week to see what holds but, of course, we like to short at the top of our range and go long at the bottom (Duh!) – so we’re just following through with the same old plan until we get a proper break-out – or break-down, whatever the case may be. It’s a very generous 10% range we’re bopping around in and that gives both bulls and bears plenty of room to run IF THEY ARE PATIENT and don’t try to force their entries. As we are a bit pessimistic overall, we generally are quicker to take our bullish profits while we tend to press our bearish bets – waiting for the big one.

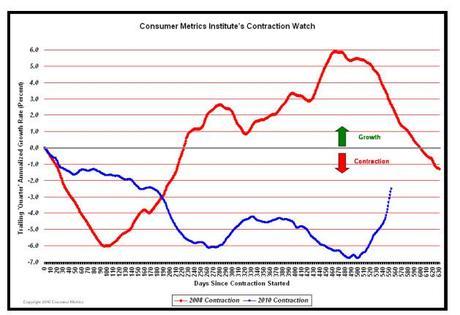

There may be a rally if we "fix" the debt ceiling but that’s not going to do Jack Shiite for the economy is it? Again, we covered this extensively over the weekend but this whole charade is a farce to distract Americans from the reality of the chart on the right, which clearly shows we are still contracting, so CUTTING Government spending while neither Consumers or Corporations are spending is probably the most sure-fire recipe for disaster since Lucy and Ethyl took over the assembly line.

There may be a rally if we "fix" the debt ceiling but that’s not going to do Jack Shiite for the economy is it? Again, we covered this extensively over the weekend but this whole charade is a farce to distract Americans from the reality of the chart on the right, which clearly shows we are still contracting, so CUTTING Government spending while neither Consumers or Corporations are spending is probably the most sure-fire recipe for disaster since Lucy and Ethyl took over the assembly line.

Speaking of things that are contracting: we got the Chicago Fed Report this morning and that came in at -0.46, which is slightly less bad than -0.55 in May. The Texas Manufacturing Outlook Survey comes in at 10:30 and tonight we get earnings from notables such as BIDU, FNF, NFLX and TXN. Tomorrow things get serious on the Data front with the Case-Shiller Index for May (too old to matter), Consumer Confidence for July (how far down will it be?) and New Home Sales (pathetic) at 10.

Wednesday is the unreliable Mortgage Purchase Index along with Durable Goods (probably awful ex-aircraft), Oil Inventories (SPR?) and the July Beige Book, which is very likely to sum up a worsening economy. On Thursday we get the usual 400,000 lost jobs no one seems to care about and Pending Home Sales, if any. Friday is the 2nd look at Q2 GDP and the Chicago PMI and Michigan Sentiment so there is NO DATA that I think will look good in the week ahead – sorry….

With all this going on, the Treasury is going to try to auction off 3 and 6-month Bills at 11:30 this morning, followed by one and two-year notes tomorrow, the 5-years on Wednesday and 7-years on Thursday so it will be interesting to see how well Eric Cantor’s TBT stock does this week (we’re long too!) as he refuses to deliver a debt deal while we ask people on Thursday to buy 7-year notes that we might default on next Tuesday – yep, this is going to be fun!

With all this going on, the Treasury is going to try to auction off 3 and 6-month Bills at 11:30 this morning, followed by one and two-year notes tomorrow, the 5-years on Wednesday and 7-years on Thursday so it will be interesting to see how well Eric Cantor’s TBT stock does this week (we’re long too!) as he refuses to deliver a debt deal while we ask people on Thursday to buy 7-year notes that we might default on next Tuesday – yep, this is going to be fun!

We don’t care – we had our pre-market futures victory and now we’ll see how well our bearish option plays perform at the open. It looks like our SQQQ play will still be makeable in early trading as the Nasdaq is so easy to pump up but poor NFLX earnings may give the bulls pause this evening and GMCR (we’re short) is looking very much like a Chinese "growth" stock – unfortunately, from an accounting perspective, using methods best explained by the accounting firm of Benes, Costanza and Seinfeld. As noted by the Grumpy Old Accountant (thanks Sam for heads up):

GMCR’s balance sheet clearly indicates why the Company isn’t performing. Over 44% of the Company’s assets are imaginary ($606.4 million in intangibles and goodwill), and almost equal total stockholders’ equity. Most of the non-goodwill intangibles originated in 2010 and relate to customer relationships and product names.

Not surprisingly, the Company is aggressively spreading out the expensing of these assets over periods of 10 to 15 years, when a much shorter period is likely warranted. This just might be another Golf Galaxy in the making with a major impairment charge lurking in the near term.

So, what’s the verdict likely to be in the forthcoming litigation? No question about it: GUILTY! Investors are guilty for overlooking the clear danger signs lurking in both the past and current financial statements.

GMCR’s managers are guilty of financial reporting fraud for issuing clearly misleading financial statements to cover poor operating performance. And the auditors are guilty for issuing an unqualified, “clean opinion,” on a restated set of financial statements for a Company with acknowledged material weaknesses associated with an ongoing SEC investigation.

Just a little side-show for what’s bound to be an interesting week!