I love the smell of Napalm in the morning!

I love the smell of Napalm in the morning!

That's the classic line from Apocalypse now that I'm often reminded of during Member Chat, when people start to get nervous about a market sell-off. Rober Duval says "It smells like victory" and laments that "Some day this war's going to end." and THAT is how a prepared trader should feel about a market pullback.

Rather than victory, it smells like OPPORTUNITY – even if you are not on the right side of the trade. It's an opportunity to stress-test your positions and check your portfolio balance because, if you can survive this – you can probably survive anything.

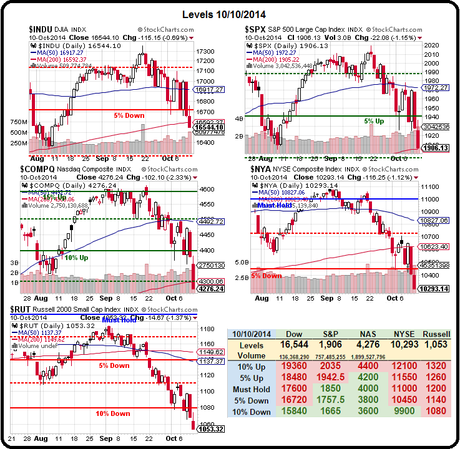

From a balance perspective, we're primarily concerned with the sum of our Long-Term and Short-Term Portfolios and, currently, that's $175,178 (up 75.2% for the year) and $561,856 (up 12.4% for the year) for a combined $737,034 – up 22.8% from where we began the year ($600,000) despite the sharp pullback in the market. That's BALANCED!

We just had an extensive conversation in our Live Member Chat Room about portfolio allocations and scaling into positions, so I won't re-hash the strategy here but I will say that, if you are not weathering the market storm well enough to be in a buying mood – you're doing it wrong!

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!