Oh, hello Mr. Seoul,

I dropped by

Stick around while the clown

to pick up a reason

who is sick does the trick of disaster

Asia was in turmoil last night as news of the death of Kim Jong Il hit the wires. South Korea’s Kospi Index fell 3.4%, both the Shanghai and Hang Seng fell more than 2% at their opens but, along with the Nikkei, they all finished strong and down about 1.25%. My comment on the matter to Members at 11:29 last night was:

Meanwhile, Dear Leader has died and that shot the Dollar back to 81 and knocked the futures down half a point. Asia is down more like 2% as no one is please with Jr. taking over in South Korea. I always find that amusing when leaders who are hated die and the markets react negatively – as if the next guy could be worse. Markets just hate uncertainty but China is in charge of N. Korea – I doubt Kim’s son is going to suddenly declare war or whatever it is people are worried about. He’s just 27 and probably not suicidal

If anything (but I’m going to bed), I’d take oil long off the $93 line (/CL), which is where we liked them Friday. Gold already zoomed back to $1,600 and has been rejected there so far and the Dollar doesn’t look that strong above 81 so far.

So far, my logic is holding up as things have already calmed down and oil topped out at $94.50 at 5:30, for a nice $1,500 per contract gain in less than 6 hours. I find it easier to trade futures off news like that than they are to play during the US Market hours as the moves internationally, still seem to make a little sense while the moves in the US market are often pure nonsense.

So far, my logic is holding up as things have already calmed down and oil topped out at $94.50 at 5:30, for a nice $1,500 per contract gain in less than 6 hours. I find it easier to trade futures off news like that than they are to play during the US Market hours as the moves internationally, still seem to make a little sense while the moves in the US market are often pure nonsense.

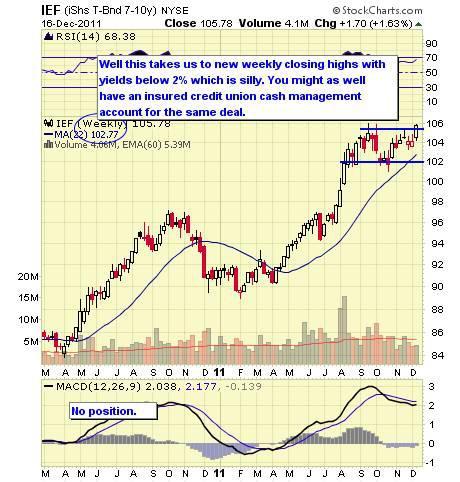

Speaking of nonsense, David Fry agrees with me on Treasury rates as we are now falling below what you can get in an FDIC-insured deposit, which I consider the non-panic limit for rates. Unfortunately, we do get plenty of panic at a drop of the hat these days and TLT shorts were our big loser last week but we stuck with them for January, hoping things calm down…