Small but respected Egan-Jones' Vice-President, Bill Hassiepen said "We are not receiving QE3 positively. The fiscal situation is a nightmare. While the Fed is seeking to support economic growth through its quantitative easing, the central bank’s massive monetization is instead causing sluggish to stagnant economic growth.” In fact, he expects growth to become stagnant within six months as a result of the Fed’s policy. The reason the country does not have a weaker rating, he said, is that it remains “the only viable reserve currency in the world.”

Does any of that sound wrong to you? Hassiepen is just the first of many who are lining up to point out that the US economy has no clothes. Retail sales data was terrible, industrial production was terrible but consumer confidence was unnaturally boosted by a 10% rally in the stock market due to QExpectations. Which report does the MSM latch on to? Consumer Confidence – of course! Why bother going over silly data facts when people have opinions we can discuss?

The Federal Reserve’s “money printing,” Hassiepen said, has not “really contributed to the improvement in the general economy” so far. Instead, all it has done is increase inflation and the cost structure in the general economy, as will the new round of QE just announced Thursday. “We actually think this is going to cause unemployment, not employment,” he said. the Fed’s policy will reduce household’s disposable income and raising costs will also “lead companies to lay off people,” he said.

The Federal Reserve’s “money printing,” Hassiepen said, has not “really contributed to the improvement in the general economy” so far. Instead, all it has done is increase inflation and the cost structure in the general economy, as will the new round of QE just announced Thursday. “We actually think this is going to cause unemployment, not employment,” he said. the Fed’s policy will reduce household’s disposable income and raising costs will also “lead companies to lay off people,” he said.

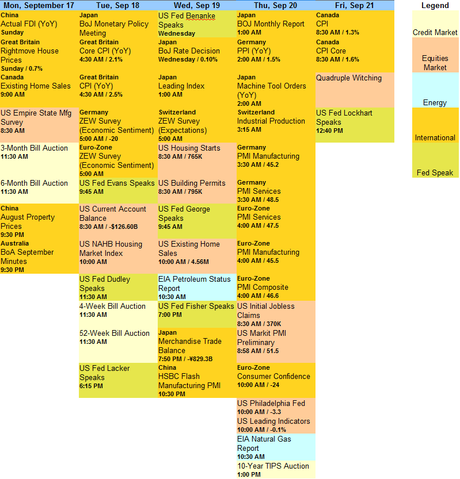

I'm not saying we shouldn't enjoy our free money that the Fed is doling out but let's take it with a grain of salt and not assume it's going to be a cure-all. As you can see from the chart above, after a VERY brief moment of euphoria post QE2, we did drop 5% the following two weeks. While we did get a nice pop last week – this week is the expiration of September options contracts and, as you can see from our Global Economic Calendar (thanks StJ!), it's a major data week with lots of Fed speak as well as potential economic mine-fields.

As noted in Friday morning's post, we shifted our short-term positions to neutral in the face of overwhelming monetary easing (see post for updated $25KP positions) but, during Friday's Member Chat, not only were we unable to find things to get bullish about, but we found new ways to short oil at $100 (DUG) and added a general TZA hedge as it hit a very attractive $13.50, dropping the Jan $10/14 bull call spread down to $1.50, which gives you a nice 133% upside without even selling any offsets.

As noted in Friday morning's post, we shifted our short-term positions to neutral in the face of overwhelming monetary easing (see post for updated $25KP positions) but, during Friday's Member Chat, not only were we unable to find things to get bullish about, but we found new ways to short oil at $100 (DUG) and added a general TZA hedge as it hit a very attractive $13.50, dropping the Jan $10/14 bull call spread down to $1.50, which gives you a nice 133% upside without even selling any offsets.

That was our last trade for Friday, a bearish one. As offsets, we updated our Twice in a Lifetime list and there were many good long-term bullish candidates there but, short-term, we're just not convince the Dollar can move below 78.50 and we've yet to see the market make any actual progress on its own so it remains to be seen if any actual capital will move into equities or if this "rally" has all been nothing more than a repricing of stocks and comodities against a Dollar that our own Federal Reserve is doing everything in it's power to destroy the value of.

As noted in Dave Fry's chart, we think the Financials are the prime beneficiaries of QE3 but, like Egan Jones, we see no reason this will help the broader economy. Nor will the new IPhone 5 help the non-AAPL retail sector as we all know what the big present under everyone's tree will be this year (hint, not a kindle) and thee things are not cheap – those are discretionary consumer bucks being drained away by AAPL this Christmas!

As noted in Dave Fry's chart, we think the Financials are the prime beneficiaries of QE3 but, like Egan Jones, we see no reason this will help the broader economy. Nor will the new IPhone 5 help the non-AAPL retail sector as we all know what the big present under everyone's tree will be this year (hint, not a kindle) and thee things are not cheap – those are discretionary consumer bucks being drained away by AAPL this Christmas!

We already call the Nasdaq the AAPLDaq as AAPL is back to 20% of the index and accounts for 75% of the indexe's gains this year as the move from $400-$700 is 75% and 20% of that is 15% and the whole Nasdaq "only" went from 2,650 to 3,200 – up 20%. So the other 99 stocks that make up the Nasdaq composite have only combined to add 5% to the index - and that INCLUDES a couple of AAPL suppliers, who have been flying as well. The United States of America is becoming a one-industry country – the very definition of a Banana Republic – it's the Appleconomy!

The Big Apple doesn't make any AAPL products and the Empire State Manufacturing Index came in at -10.41 this morning and that's the lowest reading since April of 2009, before there was ANY QE. That's almost double the negative 5.85 logged last month and over 400% worse than the -2% expected by leading economorons. As noted this morning by ZeroHedge:

The components painted a dire picture for jobs, with the employment index sliding from 16.47 to 4.26, New Orders tumbling from -5.50 to -14.03, while, wait for it, prices rose, from 16.47 to 19.15. Re-stagflation here we come.

Market for now seems confused – since QE is priced into infinity, it is unclear if this latest datapoint confirming a recessionary economy, QE can't be more-er infiniter. Best to not respond to this, or any other macro news at all, which is precisely what the market has done.

For those who missed it, not only has Bernanke doomed the global economy to stagflation and imminent food riots, while making the richest 0.001% richer than ever, he has completely broken any linkage between the economy and the market.

We're already seeing global riots breaking out and it's convenient to blame a YouTube video for setting them off rather than the US policy of exporting inflation at the same time as we cut our crop exports, causing Global food prices to skyrocket. Is this the first time an American video has made fun of Muslims? Of course not! Then why are we so uncritical listening to the BS the MSM is feeding us now?

Not to worry though, pre-orders of the IPhone 5 were over 2M in the first 24 hours, that's $1Bn in sales for AAPL in a single day and double what the 4S did on its release so things are looking up, Up, UP in the Appleconomy. As Mick Jagger once said:

This towns full of money grabbers.go ahead, bite the big apple, don't mind the maggots… Life is just a cocktail party on the street – Big Apple – This town's been wearing tatters, it's been shattered, shattered yeah!