The Dow is up 250 points pre-market.

The Dow is up 250 points pre-market.

That's after bursting over 100 points higher in the last 30 minutes of Friday's session. Overall, it's a very low-volume rally, mostly short covering (we will be covering some shorts ourselves) as Trump met with Xi at the G20 and he decided Huawei isn't spying on us after all (despite slandering them all over the world) and that Trump will not put tariffs on another $300Bn worth of Chinese goods but he is keeping the tariffs already in place. Keep in mind this is all to arrive at an eventual deal that is not likely to be substantially different than the deal he broke last year – so why all the celebration?

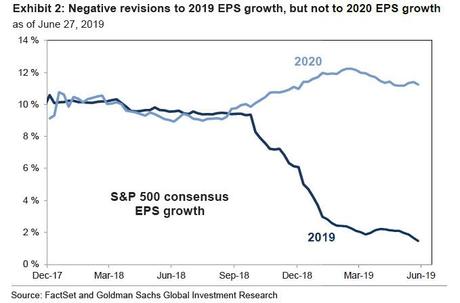

As you can see from the chart above, earnings haven't grown at all this year and it's been Valuation Expansion or Multiple Expansion that's accouted for 90% of the move in the S&P 500 for the first 6 months. Very simply, we are paying much more for the same earnings as last year. Granted a lot of companies did us "China" to excuse their shortfalls and we can imagine, with the Trade War hopefully winding down, that we'll get some real growth but that doesn't mean we're not paying too much for the growth we do get.

We know the Fed is certainly in no hurry to raise rates, so that's a big plus for the market but I'm not so sure the Fed is looking to lower rates as we are no in the 121st month of a market expansion – the longest in history (and 104 (86%) months of it came before Trump was President – in case you are wondering).

Nonetheless, Economists surveyed by Bloomberg see a 30% chance of recession over the next 12 months and growth…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!