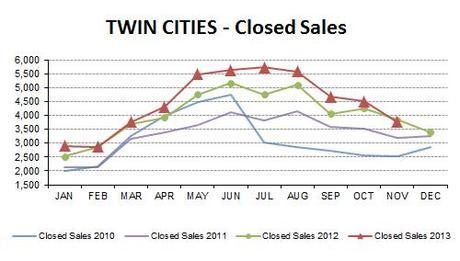

November real estate market stats for the Twin Cities are in and while they show a holdiday drop in new listings...

...as well as pending and closed sales...

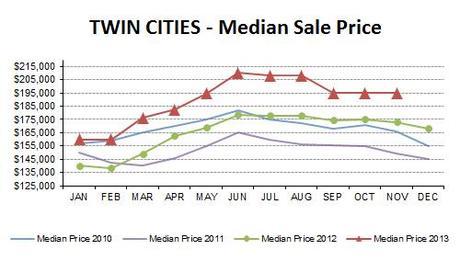

...median price price has been holding steady at $195,000 for the last three months, up 13.4% compared to last November.

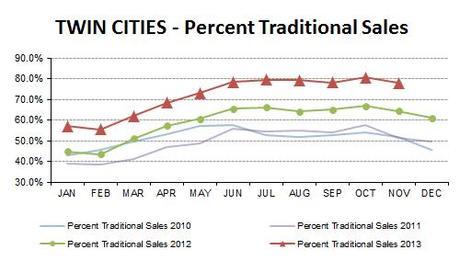

This is likely due at least in part to a big decline in the percent of distressed sales... resulting in a significant increase in traditional sales (not foreclosures or short sales). Traditional sales increased 13.6% over last year, while foreclosures dropped 34.7% and short sales dropped 57.6%. There are fewer distressed properties being listed and sold than at any point in the past five years.

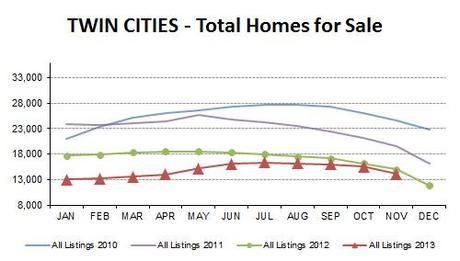

These are signs that our residential real estate market continues to get stronger. Sellers still have the advantage because of the low number of homes available for sale, but the year-over-year inventory gap is narrowing.

We currently have a 3.2 month supply of inventory (5-6 months is considered balanced between buyers and sellers), and sale price is an average 94.5% of list price (the highest November ratio since 2005).

The figures above are based on statistics for the combined 13-county Twin Cities metropolitan area released by the Minneapolis Area Association of Realtors, with the historical chart coming directly from them.

Never forget that all real estate is local and what is happening in your neighborhood may be very different from the overall metro area.

- Click here for local reports on 350+ metro area communities

- Click here for current interactive market analytics by area, city, county, neighborhood or zip code

Sharlene Hensrud, RE/MAX Results - Email - Twin Cities Real Estate Market

RELATED POSTS

- October 2013 Twin Cities Market Update... townhomes in shortest supply, condos show biggest price gain

- September Market Update... continuing seller's market with a return to normalcy

- Foreclosures at lowest levels since 2007

- It's a seller's market again... 6 things that are different this time