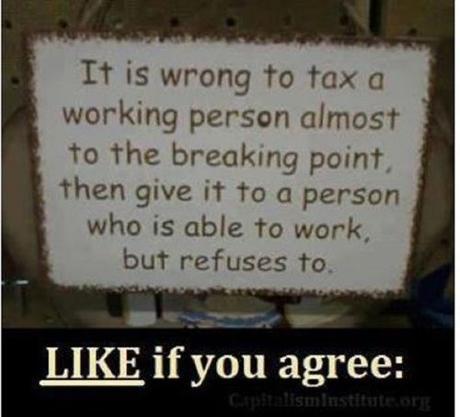

Why are we demonized for speaking the truth?

H/t FOTM’s Trail Dust

H/t FOTM’s Trail Dust

More than a year ago, in May 2012, Lance Roberts wrote that “Without government largesse many individuals would literally be living on the street.” As much as 1/5 or 22.5% of the average American’s income is dependent on “government transfers.”

One of those “government transfers” are Social Security Disability benefits.

There are two types of Social Security Disability benefits:

- Social Security Disability Insurance (SSDI): Earned disability benefits for those who have held jobs for significant periods of time and paid at least partially into Social Security before becoming disabled.

- Social Security Disability (SSI): Unearned disability benefits for individuals who have petitioned to be classified as disabled, although many of them have never worked and have never paid into Social Security.

Under Obama, the number of Americans claiming disability has surged to the highest levels on record since the beginning of the last recession. What is most notable, however, is when the surge of disability claims began – exactly two years from the beginning of the financial crisis. This was when the 2 years of extended unemployment insurance began to run out.

Unlike welfare, disability isn’t term-limited, and in some cases it’s become permanent unemployment insurance for the unemployable or those who simply refuse to work.

Today, more than 28 million Americans who are of working age have a disability – a level higher than at any other time in recorded history. There are approximately 11 million SSDI or earned recipients and approximately 7 million SSI or unearned recipients.

But how many of those on disability are actually disabled?

Luke Rosiak reports for the Washington Examiner, July 30, 2013, that a study by the Social Security Administration found some disturbing, but unsurprising, attributes of disability recipients:

- Recipients of federal disability checks often admit that they are capable of working but cannot or will not find a job.

- Returning to work is not a goal for 71% of the SSDI recipients, and 60% of the SSI recipients.

- Most have never received significant medical treatment and not seen a doctor about their condition in the last year, even though medical problems are the official reason they don’t work.

- Those who acknowledge they’re on disability because they can’t find a job say they make little effort to find one.

- Of those who say they’re actually looking for a job, most say they’re looking only for part-time jobs that will allow them to keep their disability benefits.

- The unearned disability recipients are in less pain than their counterparts who had paid into the system. In other words, they are using SSD as a substitute for welfare. These individuals are typically overweight, uneducated and from broken homes.

- There are practical barriers to weaning recipients off the disability rolls. The jobs they’d be candidates for often don’t provide health insurance, which is essential for those with medical problems, and they’d rather receive the SSD benefits. Many also say they don’t have transportation to work.

- 72% of the small number of SSDI recipients who started a job while on disability got cash under the table, as did 70% of the small number of SSI recipients who started a job while on disability.

- 24% of the SSDI recipients lack even GEDs, as do 43% of the SSI recipients.

- Only 18% of SSDI and 15% of SSI recipients said, during the past 4 weeks, they could not do social activities with family or friends because of their physical health or emotional problems.

- As many as 96% of SSDI and 91% of SSD recipients admit whatever physical health or mental problems they have do not hinder or limit them from the kind or amount of work or other daily activities they do. In other words, they are not really so disabled they can’t work.

- 47% of SSDI and 41% of SSD recipients are obese; 30% of both groups are overweight; only 21% of SSDI and 25% of SSD recipients are of normal weight.

- 28% of SSD recipients had never worked for pay, i.e., they never had a job!

- Most SSD recipients don’t bother to educate themselves about or avail themselves of government programs to wean them off disability, such as the Plan for Achieving Self-Support, Earned Income Exclusion, and Continued Medicaid Eligibility after they get off disability benefits.

- Many disability recipients also receive other government welfare benefits: 28% of SSDI and 81% of SSD recipients are on Medicaid; 80% of SSDI and 42% of SSD recipients are on Medicare; 18% of SSDI and 52% of SSD recipients are on food stamps.

- The lack of a spouse is a significant factor: 54% of SSDI and 88% of SSD recipients are not married.

- 11% of SSDI and 21% of SSD recipients have been receiving disability benefits for 20 years or more.

Source: Public use file round 4

America’s national debt now exceeds our GDP and is closing in on $17 trillion. It doesn’t take an Albert Einstein to know that our super-extended welfare state cannot continue as it is. Indeed the danger signs are already visible.

In four years, by 2016, the first of the Social Security funds — Social Security Disability — will be in full collapse.

Brian Faler reports for The Washington Post, May 30, 2012:

“The disability program pays benefits averaging $1,111 a month, with the money coming from the Social Security payroll tax. The program cost $132 billion last year, more than the combined annual budgets of the departments of Agriculture, Homeland Security, Commerce, Labor, Interior and Justice. That doesn’t include an additional $80 billion spent because disability beneficiaries become eligible for Medicare, regardless of their age, after a two-year waiting period. The disability program is projected to exhaust its trust fund in 2016, according to a Social Security trustees report released last month. Once it runs through its reserve, incoming payroll-tax revenue will cover only 79% of benefits, according to the trustees. Because the plan is barred from running a deficit, aid would have to be cut to match revenue.”

~Eowyn