Money in the bank is paying 5% and 5% is 20x earnings with (technically) NO RISK. Unless the growth is SPECTACULAR. How spectacular? Well, we'd need to see a path to 20x and let's say we're generous and giving it 3 years...

32x would be a $1.2Tn company making $38Bn so getting to $60Bn (20x) means they have to be growing at 17% annually. If you're not seeing that kind of growth, you're simply not going to get to 20x, are you? META made $38Bn last year and, historically, has grown 12% but this year they expect to LEAP to $52Bn and on to $60Bn in 2025 - 50% is A LOT of growth to expect in one year and last year, their Q1 earnings were $5.7Bn so they'll need to be closer to $10Bn to be on track for $52Bn - that's the kind of pressure the Magnificent 7 are under.

Will they deliver? No one seems to think they won't so we'll have to wait and see what actually happens and, aside from those usual suspects - we have over 100 S&P 500 companies reporting their earnings this week.

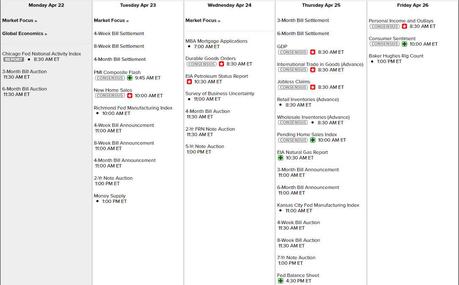

On the Data front, it's a busy week and we kicked it off well with the Chicago Fed National Activity Index up 0.15 vs 0.09 expected. The 3-month average is still -0.19 so nothing to celebrate - especially as Personal Consumption is still down. We are STILL holding note auctions. This week it's the 4-week, 8-week, 4-month, 6-month, 2-year (2 types), 5-year and 7-year for another $300Bn as the insanity continues.

Tomorrow we get Home Sales, PMI and the Richmond Fed, Wednesday is Durable Goods and Business Uncertainty. Thursday is GDP for Q1 (first look - 2.7% expected) along with Inventories and Home Sales again. Friday is Personal Income and Outlays along with Consumer Sentiment - both very important indicators as to how stressed out Consumers are.

And that's it, April is pretty much in the bag and then we have a holiday in May and then the year is half over - wow! So we'll take this meaningless Monday to relax and we'll see how things look tomorrow but, unless we get some truly magnificent earnings - today is just the pause before the pullback continues. Be careful out there,

And that's it, April is pretty much in the bag and then we have a holiday in May and then the year is half over - wow! So we'll take this meaningless Monday to relax and we'll see how things look tomorrow but, unless we get some truly magnificent earnings - today is just the pause before the pullback continues. Be careful out there,