The main USP of LIC policies is the bonuses they offer on their plans. So, it becomes important to know the updated rates for better decision-making.

The latest bonus rates announced by LIC were for the year 2020-21 for all of its traditional plans. LIC has not revised the bonus rates for the 2023-24 fiscal year as well. So you can continue to use the previous rates for your calculations.

Let’s first understand the types of bonuses declared by LIC and how to calculate the bonus on a plan based on these bonus rates.

Types of LIC Bonuses and Additions

There are four types of bonuses declared by LIC.

#1. Simple Reversionary Bonus

You get a bonus on your policy every year till your policy matures, which is the Simple Reversionary Bonus.

Simple Reversionary Bonus is declared per thousand of the Sum Assured Amount in each financial year and added to your policy amount. SRB is paid at the end of the maturity period or on the death of the policyholder, whichever is earlier.

For instance, if you are holding a Jeevan Laabh Policy with a Sum Assured amount of Rs. 10 lakhs and policy term for 25 years. The bonus declared this year is Rs. 47, then your bonus amount would be Rs. 47,000 for the current year that you will receive on maturity.

Read: How much commission LIC agent earns

#2. Final Additional Bonus (FAB) or Terminal Bonus

Final Additional Bonus (FAB) is the second type of bonus declared by LIC. FAB is a one-time payment and paid only to those policyholders who have a policy of longer duration, and have paid premiums for the complete tenure. Policies having Guaranteed Additions are not eligible for FAB.

Given below is an indicative list of Final Additional Bonus.

#3. Loyalty Additions

Loyalty Addition is a non-guaranteed bonus that is given as an appreciation of being a long-term loyal customer of LIC. Loyalty Addition is also declared per thousand of sum assured.

There are some exceptions, In some policies, Loyalty Addition is declared after completion of a certain policy period. For example, in Jeevan Saral Policy, policyholders get loyalty additions after completing a minimum of 10 years.

Similar to FAB, policyholders (or nominees) get LoyaltyAddition at the end of the maturity period or on death whichever is earlier subject to completion of the minimum policy period.

Read: Top life insurance companies in India

#4. Guaranteed Additions (GA)

Some of the LIC Policies offer Guaranteed Additions which means that policyholders will get an assured amount of sum for a specific period.

For example, the Jeevan Shree-1 policy provides Guaranteed Additions of Rs.50 per year (per thousand of sum assured) for the first five years of the policy. Another such policy is Komal Jeevan.

Similar to other bonuses, you get it at the time of maturity or claim.

Check out – LIC Jeevan Shanti review

How to Calculate LIC Bonus

You are now aware that LIC declares bonuses as per thousands of sum assured. To calculate the bonus, you have to divide your sum assured amount by thousand (1000) and then multiply it by the given bonus rates for that year (You will get the latest bonus rates in the next section).

Bonus Amount = Bonus Rate x (Sum Assured/1000)

For instance, You have bought a policy New Children Money Back Plan (832) with a sum assured of Rs. 10 lakhs and the policy term is 25 years.

The bonus declared for terms above 20 years is Rs. 38 (for the year 2021-22).

Let’s calculate:

Bonus Amount = Rs. 38 x (10,00,000/1,000) -> Rs. 38 x 1,000 -> Rs. 38,000.

Simple !!

Check out – How to find LIC policy number

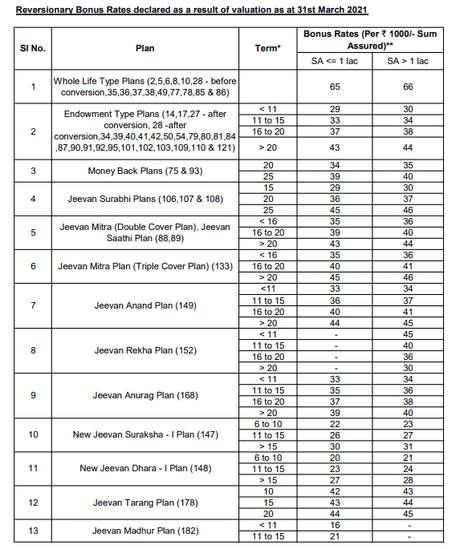

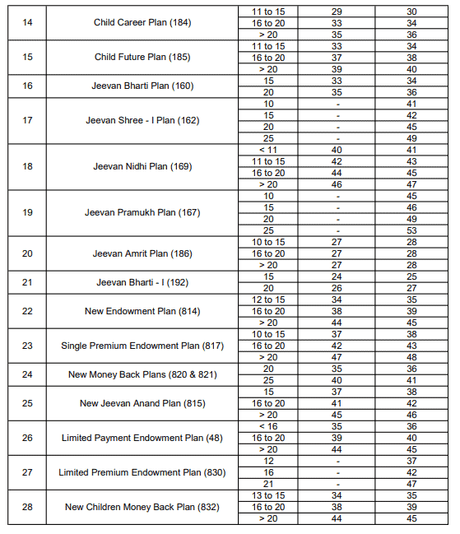

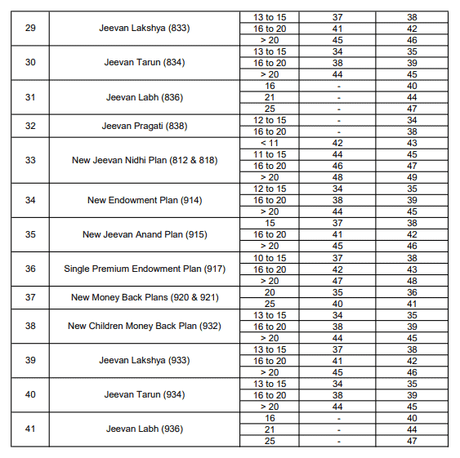

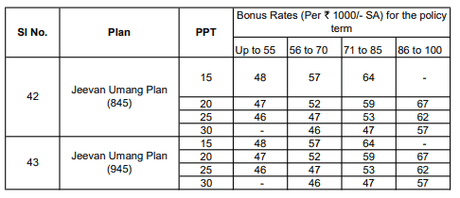

LIC Simple Reversionary Bonus Rates for 2022-23

I am sharing the latest reversionary bonus rates as listed on LIC ‘s official website. You can go through the table below to understand how much reversionary bonus you are getting in the year 2021-22 on your insurance policy.

Also read – How to surrender LIC policy

Conclusion

Now you can easily calculate bonuses on your insurance plans and get a clear estimate of your returns. Any question? Let me know in the comments.