The JRC identified the possible lead markets at regional and city level for electric and hydrogen fuel cell vehicles. (Credit: Flickr @ Zero Emission Resource Organisation http://www.flickr.com/photos/zero_org/)

The JRC identified the possible lead markets at regional and city level for electric and hydrogen fuel cell vehicles. (Credit: Flickr @ Zero Emission Resource Organisation http://www.flickr.com/photos/zero_org/)

A study by the Joint Research Center (JRC), the EU in-house scientific service, identified the possible lead markets for electric vehicles and hydrogen fuel cell vehicles in the European Union.

Which demographic, economic, political and social factors are important for developing lead markets for electric vehicles and hydrogen fuel cell cars, both potential breakthrough technologies for a more sustainable future transport system? Several JRC studies revealed that infrastructure availability, privileged access to dedicated lanes, parking facilities, adapted city centers, commuting behavior, the environmental footprint and fuel cost savings are important drivers. With the help of experts these were analyzed at regional and city level in order to identify possible early-adopter markets for these innovative technologies.

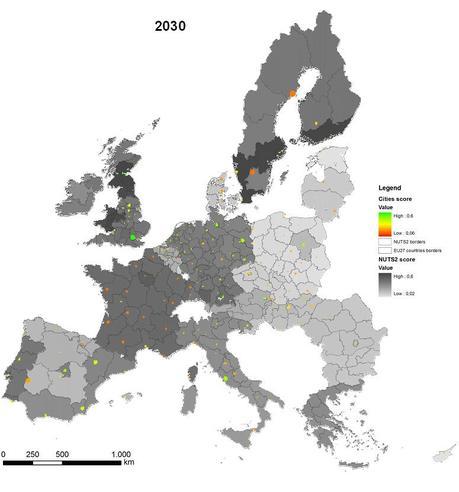

Lead market score for Plug-in hybrid electric vehicles potential of European regions and cities in EU27 in 2030 according to a JRC study. (Credit: Joint Research Center / EU). Click to enlarge.

In a business-as-usual scenario, in 2020 the experts envisage only a few insular lead markets for electric vehicles and a relatively limited number of more connected lead market regions in 2030. In a more optimistic scenario, there could be a wider distribution of electric vehicles in 2030 across most of Germany, the Netherlands, France, the UK, Ireland, and Italy. The cities of London, Madrid, Berlin, Paris, and Rome would show high electric vehicle sales under this scenario.

The JRC assessments have indicated that in 2030 Sweden, Finland and Austria show, according to our analysis, one of the highest lead market scores for hydrogen fuel cell vehicles. According to the study the difference of the lead market potential between the EU15 and EU12 would be smaller in 2050.

With the help of a fleet impact model, the JRC also calculated that the deployment of hybrids, plug-in hybrid, battery electric, and fuel cell vehicles can—depending on the scenario—decrease CO2 emissions in EU-27 passenger road transport by 35–57% and primary energy demand by 29–51 Mtoe (million tonnes of oil equivalent) in 2050 versus the baseline scenario. These improvements would be realized by the higher efficiency of advanced vehicles and by the fact that electrified cars could be fueled by a decarbonized European electricity and hydrogen mix. The research also showed that, already in the 2020 to 2030 timeframe, technology learning effects can lead to acceptable payback periods for electric drive vehicles owners.

The results of these studies can help policy makers to identify measures that could foster the development of electric and hydrogen lead market regions. This is especially crucial as a large scale deployment of hydrogen and electric vehicles goes together with the development of the related infrastructure needs. Lead markets for electric vehicles will be the nuclei for further market replication and spread. Furthermore, the JRC’s work can be used to guide cohesion policies aiming at a sustained and widespread deployment of these environmentally friendly vehicles across the EU.