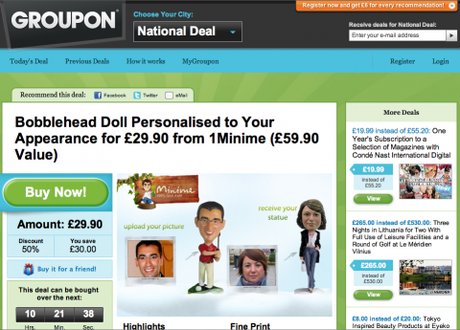

Groupon - is the super-star start-up's meteoric rise skidding to a halt?

filed for a $750 million initial public offering (IPO) in June.drop an “unconventional” metric that disguises just how much money the company has been losing.

It now emerges that Groupon, which has failed to make a profit in three years of operation, made a net loss of $102.7 million in the second quarter of 2011, up from $36.8 million in losses for the same period last year. Revenues also increased sharply over the same period but this was offset by the company’s rapidly expanding staffing, operational and marketing costs.

CEO Andrew Mason attempted to reassure both regulators and investors in his revised letter to potential stockholders. Referring to the controversial metric which had hitherto hidden the extent of Groupon’s unprofitability, he said “While we track this metric internally to gauge our performance, we encourage you to base your investment decision on whatever metrics make you comfortable.” Unfortunately for Groupon, there seems to be a distinct lack of such metrics available to investors.

- When analysts attack. Investor scepticism about the Groupon value proposition has been building for some time now. Immediately after Groupon’s initial IPO filing in June, Forrester Research analyst Sucharita Mulpuru wrote in Forbes that “there is no rational math that could possibly get anyone to the valuation Groupon thinks it deserves.” John Shinal at MarketWatch took up the theme, claiming, “You have to go back to the most extreme excesses of the dot-com era to find an example of a company asking investors to take it on faith that if it can just get big enough, it will find a way to make a profit.” Shinal also took Mason to task over his advice to investors to find metrics that made them “comfortable.” “Memo to Mason,” he said. “Net income has been a worthy standard for decades for measuring the performance of publicly traded companies, not a mere comfort blanket. Using that standard, Groupon simply doesn’t measure up.” Ouch.

- Does Groupon even work? And Groupon’s critics don’t even stop at its financials; some of them question the validity of its entire business model. In a detailed, damning blog post at TechCrunch, Rocky Agrawal picked apart why Groupon’s proposition didn’t make sense for small businesses in the long term. “Groupon is not an Internet marketing business so much as it is the equivalent of a loan sharking business,” he wrote. “In many cases, running Groupon can be a terrible financial decision for merchants… Groupon touts a win-win proposition. But the reality is that Groupon usually wins and merchants usually lose.” In an ominous sign for Groupon’s credibility with its merchant-base, Agrawal’s article was tweeted 7,000 times and received 13,000 ‘likes’ on Facebook.

- The bigger picture. Of course, investors’ jitters are not helped by the current stock market turmoil. And Groupon is just one of several high-profile planned IPOs in the tech sector this year, some of which could be in trouble, according to The Financial Times. But despite the pessimistic outlook, some commentators see a potential upside for Groupon. Richard Waters, blogging at The FT, pondered whether the looming economic downturn might in fact benefit companies like Groupon. In a recession, he argued, “consumers will be even more on the lookout for deals. Groupon could turn out to be one of those businesses with built-in insulation in tougher times.” Andrew Mason will be hoping that that is the case.