A 2011 study by the Pew Center on the States found that state governments had an unimaginably massive shortfall of $1.26 trillion at the end of fiscal 2009 in pension and health-care benefits funds for retired teachers, corrections officers and millions of other public workers. The ever-increasing shortfall is driven by inadequate state contributions, an aging population and market losses that accompanied the 2008 recession. The shortfall is so grave that retiree costs are beginning to crowd out critical services. (Source: Washington Post)

DCG has posted about California’s and Chicago’s public pension problem. See:

- California taxpayers have never paid more for public worker pensions, but it’s still not enough

- Judge rules that 2014 law overhauling Chicago pensions is unconstitutional

Now the proverbial chicken is coming home to roost for the State of Illinois.

Elizabeth Campbell and Tim Jones report for Bloomberg, Oct. 14, 2015, that Illinois will delay pension payments as a prolonged budget impasse causes a cash shortage. The spending standoff between Republican Governor Bruce Rauner and Democratic legislative leaders has extended into its fourth month with no signs of ending.

Comptroller Leslie Geissler Munger said her office will postpone a $560 million retirement-fund payment next month and may be late in its December payment as well. But the pension systems will be paid in full by the end of the fiscal year in June. Munger said that the postponement is “the least of a number of bad options. For all intents and purposes, we are out of money now.”

The state still is making bond payments because “We prioritize the bond payments above everything else,” Munger told reporters.

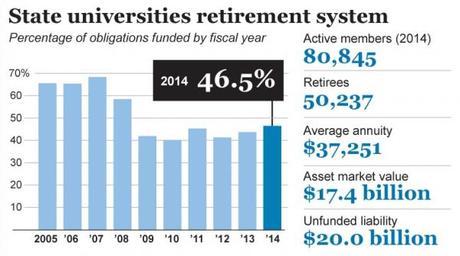

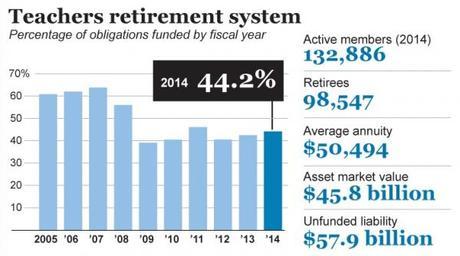

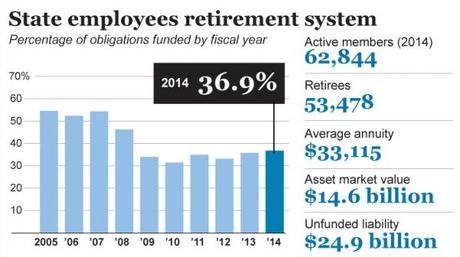

Below are three graphs showing the shortfalls in Illinois’ pensions for state universities, teachers, and state employees (Source: ZeroHedge)

Chicago’s school system is bankrupt, requiring nearly $500 million in funding from the state to plug a gaping budget hole. At the same time, the state is doing nothing about egregious government waste and inefficiency. A report by Reuters has identified nearly a dozen cases of nepotism, where state legislators have spouses and children on government payroll.

Meanwhile, Chicago mayor Rahm Emanuel is turning to a massive property tax increase to pay for the city’s unfunded pension obligation.

Jon Coupal, President of California’s Howard Jarvis Taxpayers Association, writes for California Political Review, Oct. 6, 2015, that Emanuel wants a $543 million increase in property taxes to cover police and fire pensions, as well as additional taxes and fees to close a projected $745 million budget shortfall.

Emanuel threatens that public safety will be decimated without the massive tax increase, as 20% of the police force and 40% of firefighters will lose their jobs.

How much this will cost the average homeowner is not yet clear. Emanuel is seeking approval from the Legislature to exempt those homes worth less than $250,000 from the increase, which means owners of more valuable homes would absorb the entire burden.

Emanuel’s tax plan has already led to a decline in home values, as shown by the Case-Shiller Home Price Index. Buyers may not be so ready to cut a deal that will see them inheriting a massive property tax hike.

Coupal emphasizes that Emanuel’s plan highlights the importance of California’s Proposition 13, which prohibits city governments from doing exactly what Chicago is doing. As a result, a number of Californian cities have been forced to file for bankruptcy in recent years, largely due to exploding government employee pension debt.

In California, Prop 13 limits increases in property taxes to 2% a year, gives voters the final say on new local taxes, and requires a two-thirds vote of each house of the Legislature to increase state taxes. That’s why Prop 13 is hated by state politicians, most of whom owe their election to their government employee union allies. If they can eliminate the impediments to tax increases established by Proposition 13, the politicians will be in a much better position to repay and reward their political benefactors.

Meanwhile, in Chicago, the city’s budget director has already gone on record as saying Mayor Emanuel’s property tax increase is not enough, which just goes to show, once again, that elections have consequences. But it’s a lesson that Democrat voters are determined to ignore.

~Eowyn