Courtesy of David Grandey

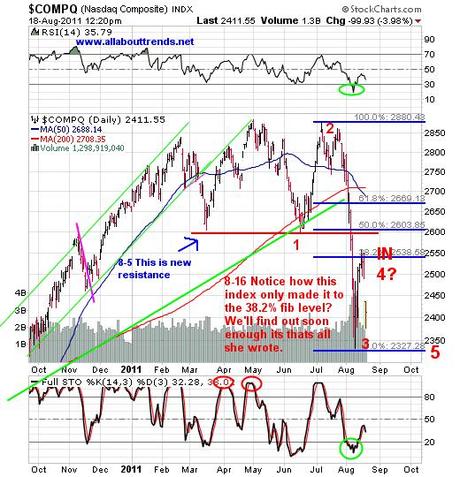

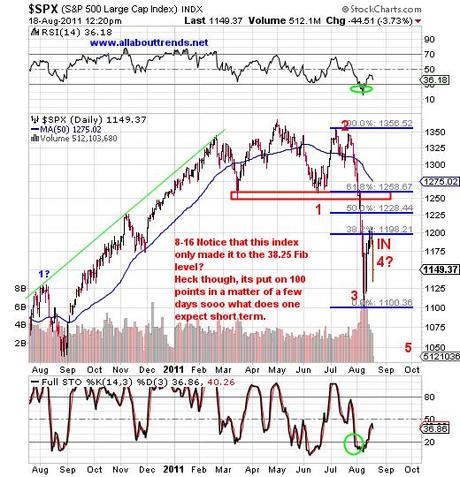

What it also means is that if that happens then odds favor Wave 5 is underway and that means retest of face of fear lows if not lower.

Tuesday we tagged the 38.2% Fibonacci level and Wednesday as well. It’s starting to act as inability to bust through higher. If that was it to the upside (leaders the last two days sure are saying it was) then this market is really weak.”

Over the weekend we said:

“Right now we still need to treat this as just a Wave 4 bounce. We’ll know in the next few days if that was it and a retest of the lows for Wave 5 down is in the works.”

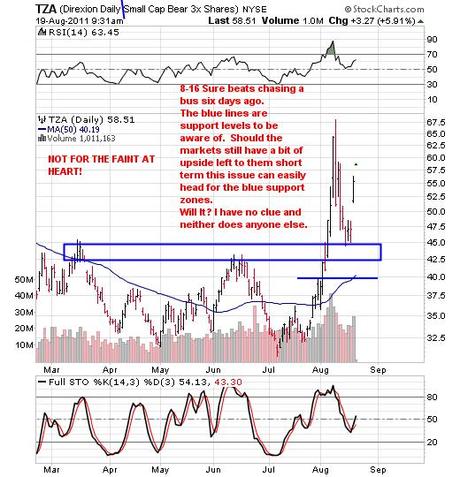

TZA — INVERSE ETF

46.14 to 58.51 in 2 days — a total gain of over $1,500 based on a 125 share position

SHORT SELL TRADE — TSLA

WHAT’S NEXT

The S&P 500 September 2010 lows are at 1050. IF when all said and done this Wave 5 we are currently in doesn’t stall out at a retest of recent lows (1130ish) here, then the next stop COULD be that 1050. We’ll find out soon enough. What is interesting is that the 1050 level could be construed as the neckline of a developing monster 1-year head and shoulders top.