In the words of Sam Cook…

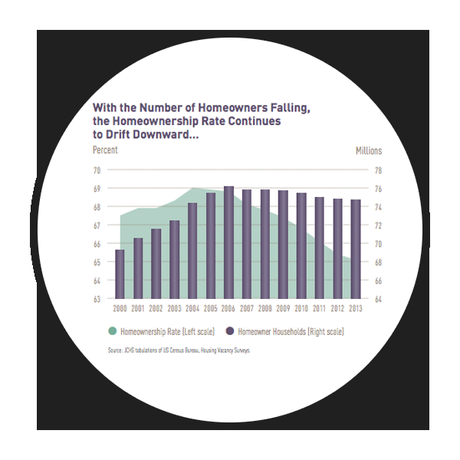

“A change is gonna come.” After almost a decade of homeownership decline, the traditional profile of a homebuyer is becoming least likely to purchase a home, says the Harvard Joint Center on Housing Studies in their recent report State of the Nation’s Housing.

Rising home prices and interest rates – along with continued tight credit – have played major roles in the evolution of today’s homebuyer. After seven straight years of decline, however, stabilization may be in sight. The 0.3 percent decline to 65.1 percent in 2013 has been the smallest drop in homeownership rates reported since 2008.

Despite rising home prices, the cost of homeownership is still affordable by historical standards. The $780 monthly mortgage payment on a median-priced home would have been a record-setting low at any point prior to 2010. Of course, this is juxtaposed to the 10 percent jump in median prices for existing properties, higher interest rates, and below-average payment-to-income ratios in every metro area.

Young Adults

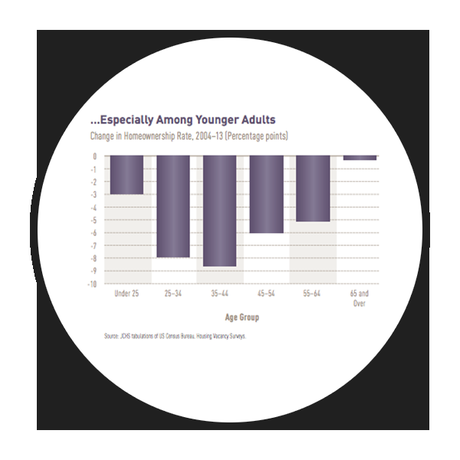

The decline in homeownership has been most dramatic among younger adults. As many seek alternatives to the rising costs and immobility of homeownership, young adults turn to the rental market. In turn, 25 percent of renter growth in the past 8 years can be attributed to consumers aged 35 and younger.

The trend may be a reflection of the movement of baby-boomers into the market. Between 2004-13, borrowers aged 25-34 dropped a staggering 8 percent in homeownership. There are two possible explanations of this. First, as married couples account for 49% of young-adult first-time homebuyers, fewer young adults are getting married. Between 2003-14, young married-couple households dropped by more than 914,000. Second, fewer young adults have high incomes. As a result, the traditional profile of a first-time homebuyer has become least likely to purchase a home while single-person and non-family households have increased by over a million.

The Marketing Impact

While the traditional family model isn’t extinct, it is clear that the composition of the American household is changing. For better or worse, the market share of the nuclear family is being allocated to single-person, single-parent, multi-generational and non-family households. Financial institutions can develop a stronger competitive advantage if they understand their opportunity to develop, package, and market services to these new household types.

It should come as no surprise that these new homebuyers are attracted to a different type of home. For one thing, the amount of space becomes less important during the home searching process. Single-person homebuyers’ focus on amenities, features and finishes. They have a particular interest in technology capability as well. Overall, the most important aspect for these homebuyers is the practicality of the home. Condos, townhouses, or small, detached homes become preferable to traditional models.

There must be an appreciation of these evolving markets. The finance industry must accept, as a philosophy of their brand, that this shift has happened. Likewise, Products must be marketed that actually meet this shift and cater to these emerging markets.

Minorities

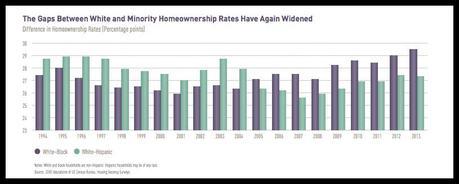

The decline in homeownership rates among minorities has also been sharp. Black households dropped 6 percentage points since 2012 while Hispanic and Asian households saw a 4 percent decline. By comparison, White homeowners dipped 3 percentage points. This has contributed to a widening gap between white-minority homeowners.

As the population grows more diverse, the large difference in white-minority rates will push the national homeownership rate downward. This is apparent among younger age groups, which have experienced both the largest growth in minority share and the largest drop in homeownership in the last two decades. At the end of 2011, 32 percent of all first-time buyers were minorities (Hispanics accounted for 14 percent).

Tightened credit may have an impact on minorities, as Hispanics and Blacks were much more likely to have their applications rejected. Denial rates for conventional purchase mortgages among Hispanics (25 percent) and Blacks (40 percent) are nearly two to three times those among whites.

The Marketing Impact

Despite the current decline in homeownership rates, the market share of minorities is growing. Congruently, the traditional multicultural marketing paradigm, originally developed within a different socio-economic context, is losing relevance and becoming less effective. This means for the finance community that marketing to minorities is becoming more important and equally more challenging.

Marketing to minorities is not as simple as translating English brochures or changing website photos to appear more culturally relevant. To effectively reach minority and non-English speaking groups, financial institutions must create material that resonates within a particular segment of the population. It involves getting to understand how these communities feel toward home buying and homeownership. It also requires a modest commitment of funds and a dedicated communications partner skilled at strategically communicating with minorities where they are, what they’re reading, what they’re watching and what they’re searching for online.

Avoiding minorities altogether places institutions at compliance risk. According to the Fair Lending Compliance Manual, step 2 of the FDIC exam procedures reads, “Determine whether the institution’s activities show a significantly lower level of marketing effort toward minority areas or toward media or intermediaries that tend to reach minority areas.” Likewise, excluding marketing programs in regions with significantly higher percentages of minority groups’ also present regulatory risk. Consider how GE Capital was charged $225 million last month for not offering a product to Hispanics and Spanish-speakers.

Of course, the declining homeownership rates of minorities will continue until the market climate changes. The vestiges of discriminatory lending practices must be eliminated and access to mortgage capital for low-wealth and low-income borrowers must be restored. According to another Harvard study, needed now are structural reforms that reduce the presence of government and encourage the return of private mortgage capital.