I’ve been investing in stocks for several decades. Here’s what I’ve learned.

I’ve been investing in stocks for several decades. Here’s what I’ve learned.

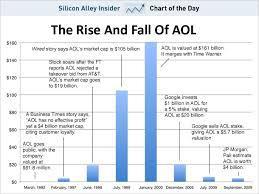

In 2000, during the dot-com bubble, I owned AOL stock, going up and up and up. I thought it was crazy, but held on for the ride. Then came AOL’s buyout of Time-Warner. My rule of thumb is that mergers are bad for the acquiring company; the touted benefits rarely materialize. So I told my broker I wanted to sell my AOL stock. He tried to dissuade me, calling this merger the greatest thing ever.

Am I relating this to show how smart I was? Nope; I heeded my broker’s advice and didn’t sell. What is the lesson? I wasn’t so smart. My broker wasn’t either. Neither was Time-Warner. You can’t expect to outsmart the market or beat the market.

Everybody aims to pick stocks that will do better than average. Thousands of people are paid a lot of money for that. But the very fact that so many very smart people are trying is what makes it unachievable – they all cancel each other out.* Since they’re all so smart, with so many analytic tools at their disposal, so much information, computer programs and models, etc., no one can truly outperform the rest – except by mere luck.

Now, since YOU surely aren’t smart enough to beat all that firepower in picking stocks, it might instead seem sensible to buy into a mutual fund, which employs hot-shots to do it for you. There are thousands of funds. Which to choose? Well, you can look at their track records and see which has performed best.

But here’s the thing about track records. Suppose all those mutual funds picked stocks by a random dartboard method. The results would form a standard bell-shaped curve – most performances would be middling, a few much above or below the average. If you choose the one that came top — what are the chances it will again be the best next year?

Economists call this “reversion to the mean.” In a given year, out of a thousand mutual funds, inevitably one will clock the best performance. Does that indicate its guys are actually smarter than all the other very smart guys at all the other funds? Not likely! More likely it’s just natural random fluctuation around the mean (average) performance. So next year, its results will fall back to the average – “reversion to the mean.”**

Then too there’s “efficient market” theory. This says every piece of information relevant to valuing a stock is already folded into its price. You can’t really know something about a stock, affecting its future prospects, that the market doesn’t know (unless it’s “insider information,” illegal to trade on). Thus again it’s not normally possible to profit from trading stocks by being smarter than the market.

So you’d expect the entire universe of mutual funds to produce a return simply matching the market average. But actually it doesn’t. All that frenetic activity costs money, and they charge investors a percentage for their services, which makes the net return less than the market average.

Every prospectus warns, “future results may not replicate the past.” Otherwise investing would be a snap and everyone would be a millionaire. The caveat is true on the largest scale. You’ve been told that in the long run, stocks do such-and-such; the market returns X%. And that may indeed be accurate concerning a very long past time span. But future results may not replicate the past. In fact, the future is quintessentially uncertain. The only certainty is that it will differ from the past.

Nevertheless, over the long term, stocks should provide a return for a simple reason. Their values are ultimately grounded in company earnings. And the typical company typically does earn profits. ***

A key consideration is the ratio between a company’s stock price and earnings. This P/E ratio for the whole market has, over the long term, averaged around 15 or perhaps somewhat more. If the market’s average P/E is much higher, stocks may be over-valued; and vice versa. Today’s P/E is above trend, at about 25.

If you want to just capture the market’s long-run tendency to produce a return through earnings, there’s a simple option: index funds that just track the performance of an index like the S&P 500. Since there’s no need for hot-shot analysis, fees to investors are typically quite low.

* Remember that in general, whenever a share of stock is sold, somebody else is buying it.

** This was explained well in Leonard Mlodinow’s book, The Drunkard’s Walk.

*** “Return” is the sum of dividends plus stock price appreciation. Earnings not paid out as dividends accumulate within the company and increase its net worth.