Banks offer different interest rates on different savings schemes. Interest in the invested money is calculated differently for different schemes. For instance interest on Fixed Deposits is compounded quarterly while interest on Provident Fund is calculated on a monthly basis.

Let’s dive into the details of interest calculation by banks on different accounts.

#1. How Banks Calculate Interest on Fixed Deposits

Banks calculate compound interest quarterly on fixed deposits.

Fixed Deposit Interest Formula

Maturity Value (A) = P x (1 + r/n)nt

So for the maturity value of Fixed Deposit of Rs.1,00,000 fetching interest @ 8.7% p.a. after 5 years would be

- Principal Amount (P) = Rs.1,00,000

- Rate of Interest (r) = 8.7% = 0.087

- Number of Period (t) = 5 years

- Frequency of Compounding Interest (n) = 4 (quarterly)

Maturity Value (A) = P x (1 + r/n)nt

=1,00,000 X (1 + 0.087/4)4×5

= 1,00,000 x (1 + 0.087)20

= 1,00,000 x (1.087)20

= 1,00,000 x 1.53778

Maturity Value (A) = Rs. 1,53,778

Interest Earned = A-P = Rs. 1,53,778 – Rs. 1,00,000 = Rs.53,778

Always Remember: Higher the compounding periods, greater the interest you will get.

The current fixed deposits interest rates are quite low but only compounding can help your money grow.

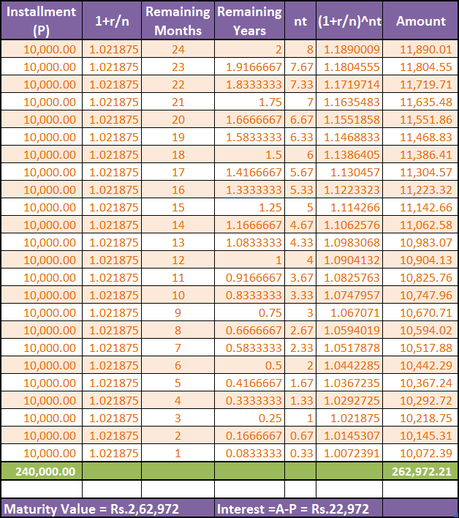

#2. How Banks Calculate Interest on Recurring Deposits

The calculation of interest on recurring deposits is similar to that of a fixed deposit. Banks consider each deposit/installment as a separate deposit and interest is calculated separately on each installment for the remaining period.

Recurring Deposit Interest Formula

The formula is same as of Fixed Deposit

Maturity Value (A)= P x (1+r/n)nt

For instance, Recurring Deposit of Rs.10,000 for 2 years @ 8.75% would get you:

- Here (P) is each installment = Rs.10,000

- Rate of Interest (r) = 8.75% = 0.0875

- Number of Period (t) = 2 years

- Frequency of Compounding Interest (n) = 4 (quarterly)

For easy understanding, I have shown the interest calculation in a tabular form

Travel lovers can check out my American express platinum travel credit card review and Citi PremierMiles credit card review to save on your next travel.

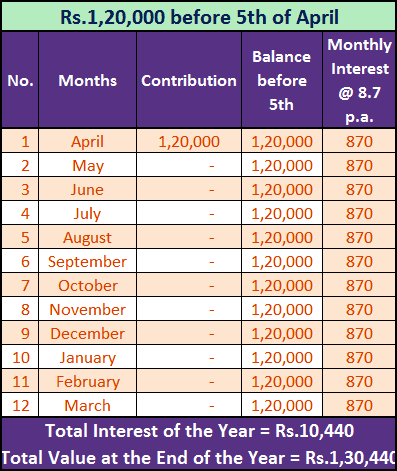

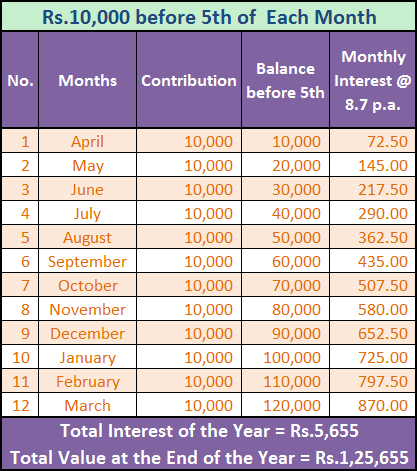

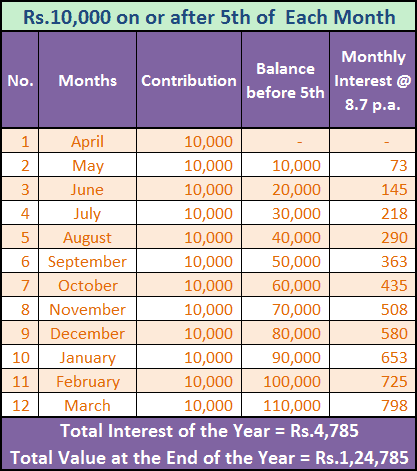

#3. How Banks Calculate Interest on the PPF

The date of deposit plays an important role in Interest calculation on PPF. Because interest is calculated on the balance carried forward from the last month plus the amount deposited before the 5th of the month.

Any deposit after the 5th of that month doesn’t get that month’s interest.

Let’s see how PPF interest rate is calculated, considering three instances. (Assuming the interest rate as 8.7% p.a.)

1. Single Contribution of Rs.1,20,000 on or before 5th April.

2. Monthly Contribution of Rs.10,000 before 5th of each month

3. Monthly Contribution of Rs.10,000 on or after the 5th of each month.

You can clearly see the difference in the interest amount based on the difference in the timing of contributions made.

The current PPF interest rate is 7.1%. If you are a salaried employee and want to get higher returns with safe investment, then you can invest in VPF as well. VPF interest rate is higher than PPF interest @8.50%.

Remember – The interest earned in a year is added back to your account at the end of the year only.

You may like to check out the benefits of a superpremium Axis Reserve credit card.

#4. How Bank Calculates Interest on a Savings Account

The interest on a savings account is calculated on a daily basis on the closing balance of the day. The interest is credited to the account every 6 months.

Let’s understand with an example.

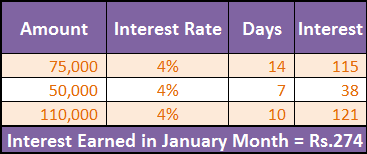

Sanyam having account balance of Rs.75,000 on 1st January, he withdraws Rs.25,000 on 15th January and deposited Rs.60,000 on 22nd January. He will earn interest for January month as below.

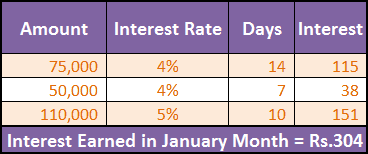

Some banks also provide interest in dual rates. This means a higher interest rate on higher balance such as 5% for balance above Rs.1 lakh and 4% below Rs.1 lakh. In this case, interest will be calculated as follows:

You would like to check the latest EPF interest rate and NSC interest rate

Conclusion

Now you have understood what mechanism banks follow to calculate interest on different accounts. This will give you more clarity to decide where to invest based on the interest method applied.

Not only given schemes in this article, but you can also use the same compounding interest formula to calculate any investment scheme interest if that scheme is incurring compounding interest.

How much clarity did you get bank interest calculation? Let me know in the comments.