Mobile devices have become major tools to perform tasks related to business, education, recreation, nowadays through sophisticated mobile applications. Moreover, their use in the mobile commerce domain has also surfaced extensively in the past few years. The era of cashless payment thus stems out of this very vibrant trend and is spearheaded by the latest mobile wallet technology. Here, it would be interesting to know more about this sensational outbreak in the technology domain.

What are mobile wallets?

Source: Mobileleadersalliance

Just like you keep all your debit/credit cards or loyalty cards, etc., in your conventional wallet, a mobile wallet also lets you do the same, but digitally. Technically speaking, it is like a digital container that helps you to manage multiple mobile commerce services. You can use it to store digital formats of your loyalty cards, tickets, receipts, vouchers, supporting payment cards, and so on.

Mechanism

Mobile wallets exploit the facilities of Near-Field Communication (NFC) chips and SIM card to act as a smart mode for cashless payment. To pay through mobile wallets, the customer opens an app, enters a PIN, and selects the desired payment account and customer loyalty programs (if any). He/she then simply taps the mobile device to a contactless payment system to confirm the final payment.

Advantages

The new technology promises loads of benefits for ardent tech savvy users worldwide:

- Ensures simplicity and security during transaction through virtual wallet.

- Involved charges are very low as compared to fund transfer through traditional ways.

- Encourage mobile operators to keep on introducing innovative modules in the mobile commerce marketplace.

- Swifter checkout emancipates from being stuck up in long queues.

- Sets free from carrying original cards everywhere.

- More secure business in the wake of handling less real cash.

- Better utilization of existing coupon/reward/loyalty programs.

- Enhanced customer engagement.

- Paves way for more customer friendly marketing strategies .

- Used readily by users for transactions in multiple domains including retail, online commerce, travel & transport, etc.

Facts and Figures

The popularity of mobile wallets is widespread and it accompanies bright future for sure as can be inferred by a slew of survey reports and findings by renowned bodies.

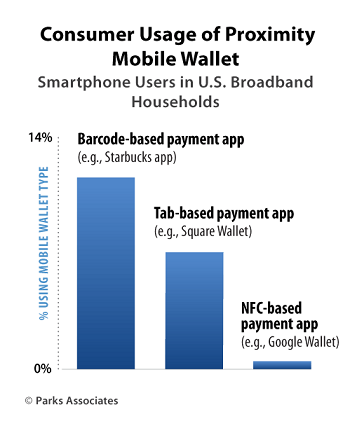

One such research report by Parks Associates revealed:

- One out of every five smartphone owners in the US (20%) used at least one mobile wallet in 2013.

- This usage of mobile proximity is expected rise up to a significant 43% by 2017, taking the number of users from 40 million to 113 million.

- NFC based apps may get overshadowed owing to the heavy use of barcode based payment apps, followed by tab based payment apps.

Source: Parksassociates

Moving ahead, as per a Gartner report released in June, 2013:

- The value of mobile payment transaction has witnessed 44% increase from $163.1 billion (in 2012) to $235.4 billion (in 2013)

- The global mobile transaction is expected to grow by 35% each from 2012 to 2017, to cross the $720 billion mark, with above 450 million mobile payment users.

Another report entitled “Mobile Wallet Market” published by Allied Market Research reveals:

- Mobile wallet market is expected to rise at a CAGR of 12.5% worldwide, between 2012 and 2020.

- By 2020, the global mobile wallet market is anticipated to touch $5,250 billion.

- By 2020, above 70% mobile users are expected to embrace mobile payment modes. Out of these 15% have already adopted the trend.

All these reports indicate a trend what could well be the most revolutionary move in the history of mobile commerce. Not surprisingly, sensing the gravity of this wave, a thick of mobile app developers are on their way to develop concrete mobile wallet systems to grab the attention of technology friendly mobile customers.

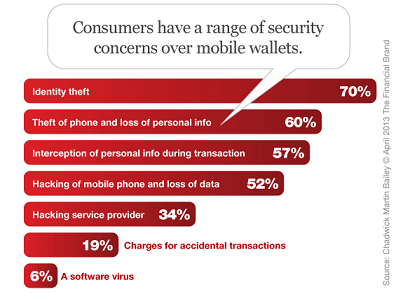

Security Concerns

When it comes to ensuring security during monetary obligations, people still prefer relying on traditional financial institutions, while technology takes the back seat.

Source: Thefinancialbrand

The same holds for mobile wallets as it is likely to leave the consumers with a spate of concerns such as:

- The fate of their money in case of phone or SIM card theft.

- The fate of transaction in case of a dropped connection due to low mobile battery.

- Whether they can get their money back on being cheated in a fraud.

- Whom to approach in the wake of such fraudulent act.

In order to convince the end users shop with mobile wallets, it is imperative for service providers to address all such requisite security and privacy issues satisfyingly. Alongside, they also need to safeguard the users against backup mechanisms and solution failure, e.g., in case the phone is stolen.

Service providers

The mobile wallet technology is still in its nascent stage as of now and holds loads of promises for future to grow and nurture globally. Currently, Google Wallet and Isis are among the biggest players in this field that allow the users to pay using cashless payment systems through their NFC enabled mobile devices. Companies such as Square, Paypal, TabbedOut, Weve also have their own versions of mobile wallets alongside Apple’s Passbook, which lets you save and manage loyalty cards, offers and coupons, tickets, boarding passes, etc. Recently, Accenture has also forayed into this profitable market with the integration of “big data” analytics capabilities and recommendation tools as an extension of its digital payment services.

To summarize, the mobile wallet phenomenon has almost revolutionized the mobile commerce world with its sophisticated payment mechanism. The method is pretty advanced and is currently being used in the best parts of the world, however it still needs to be embraced by a thick of users in the rest part of the globe. In addition, concerns related to security issues also need to be addressed significantly. While survey reports postulate a bright future ahead for this upscale technology in the wake of its successful implementation in the coming times, the mobile commerce is sure to gain deep roots. Taking a leaf out of it, enthusiastic service providers worldwide have already ventured with leading mobile developers to come up with streamlined mobile wallet apps.

Finoit is ever ready to embrace brand new technology to help its clients develop utilitarian apps to simplify the most complex tasks of life. Endorsed well by sizable team of experienced mobile app developers, the company is equally capable of developing flawless apps to adhere to the mobile wallet concept as well.

To know more about the mobile app development services at Finoit, feel free to contact us.