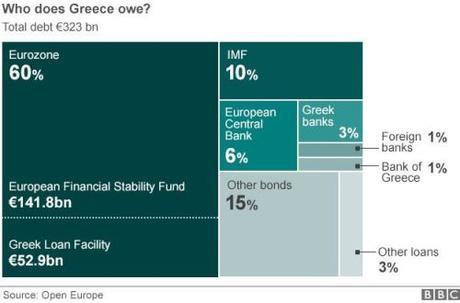

An awful lot of debtl…

BCC: Greek banks are to remain closed and capital controls will be imposed, Prime Minister Alexis Tsipras says. Speaking after the European Central Bank (ECB) said it was not increasing emergency funding to Greek banks, Mr. Tsipras said Greek deposits were safe.Greece is due to make a €1.6bn (£1.1bn) payment to the International Monetary Fund (IMF) on Tuesday – the same day that its current bailout expires. Greece risks default and moving closer to a possible exit from the eurozone.

Greeks have been queuing to withdraw money from cash machines over the weekend, and the Bank of Greece said it was making “huge efforts” to keep the machines stocked. Greek banks are expected to stay shut until 7 July, two days after Greece’s planned referendum on the terms it had been offered by international creditors for receiving fresh bailout money. The Athens stock exchange will also be closed on Monday.

Eurozone finance ministers blamed Greece for breaking off the talks, and the European Commission took the unusual step on Sunday of publishing proposals by European creditors that it said were on the table at the time.

But Greece described creditors’ terms as “not viable”, and asked for an extension of its current deal until after the vote was completed. “[Rejection] of the Greek government’s request for a short extension of the programme was an unprecedented act by European standards, questioning the right of a sovereign people to decide,” Mr. Tsipras on Sunday said in a televised address.

“This decision led the ECB today to limit the liquidity available to Greek banks and forced the Greek central bank to suggest a bank holiday and restrictions on bank withdrawals.”

The Greek prime minister said he had sent a new request for an extension to the bailout. “I am awaiting their immediate response to a fundamental request of democracy,” he said.

The temporary closure of banks in Greece, and the introduction of capital controls, is very bad news for Greece. Greek people will have less money to spend and business less to invest; so an already weak economy will probably return to deep recession.

As for the impact on the rest of the eurozone, corporate treasurers and wealthy individuals will wake up on Monday wondering if their money is safe in the banks of other weaker eurozone economies.

Following the news from Greece the euro fell by nearly two US cents against the dollar in early Asia Pacific trade, Reuters reported.

The announcement comes after a particularly turbulent few days for Greece. The current ceiling for the ECB’s emergency funding – Emergency Liquidity Assistance (ELA) – is €89bn (£63bn). It is thought that virtually all that money has been disbursed.

The ECB was prepared to risk restricting ELA because the failure of the bailout talks cast new doubt on the viability of Greek banks – some of their assets depend on the government being able to meet its financial commitments, the BBC economics correspondent Andrew Walker reports.

He adds that it is a fundamental principle of central banking that while you do lend to banks that are temporary difficulty, you only do so if they are solvent.

See also:

- Greece introduces “cashpoint tax” in desperate bid to raise revenue and stop run on banks as country teeters on brink of bankruptcy

- Greece’s economy sinks into a black hole

- Bank runs in Greece as country spirals out of control

- What happens when Greece defaults?

As of 9:00pm last night, the AP tweeted this: @AP: BREAKING: Greece officially announces bank closures for 6 days, limits on ATM transactions.

Not good at all.

DCG