When we first made the decision to go on our next RTW trip over 2 1/2 years ago, we took a focused look at our income to determine how much money we could save to travel on. At first, this math seems to be quite easy as you can just look at any extra income and multiply it out over the number of months you have to save. But for most long-term travelers, simply saving left over money from spending is not enough to get you to your dream trip. Instead, dedication is necessary to find other ways to save by reducing unneeded spending and increasing your earnings potential.

When we first made the decision to go on our next RTW trip over 2 1/2 years ago, we took a focused look at our income to determine how much money we could save to travel on. At first, this math seems to be quite easy as you can just look at any extra income and multiply it out over the number of months you have to save. But for most long-term travelers, simply saving left over money from spending is not enough to get you to your dream trip. Instead, dedication is necessary to find other ways to save by reducing unneeded spending and increasing your earnings potential.In the past we've touched on these topics, citing ways to earn money before you travel and other financial tips to increase your savings, but we never really got to the bottom of the major savings issue that long-term travelers face. Earnings and savings are important, but getting into the mindset to stay dedicated to your new plan is ultimately what will make or break your dream. Because without this complete dedication, your dreams will most likely fall flat.

The following are some of our favorite ways to get into the mindset to save for long-term travel. These are designed to keep the drive to save high and also include a few ways we have cut back to boost our potential to record levels.

Set an Unrealistic Goal

We have to begin with one that is likely to get a lot of confused thoughts. Because for this mindset, you must become slightly unrealistic!

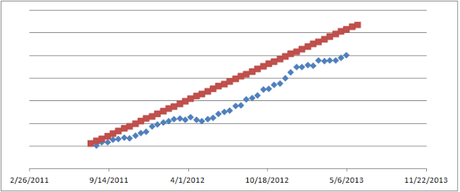

When we first started saving for our RTW trip, I put together a spreadsheet that I would update with our savings account balance each time I was paid. While putting together a running total of your savings is important, the key with this spreadsheet was not the value that we currently had at any given time, but how it has changed relative to where we wanted to be. If you set your ideal target to be slightly higher than what you can actually save, you will always have the motivation to try and put away just a little bit more.

With each paycheck I set a reach target of approximately 50% of my take home pay, just out of reach with what I thought I could save. With every check I'd increase my target savings by this value and plot it on a graph (red line above), one row for each check with a running total. In the next column I would keep a running tally of the actual money I had in our savings on payday and plot it on a second curve (blue line above). This was repeated for each payday over our the duration of my employment.

By plotting these two values on a graph next to each other I had a pretty good visual indication on how far off I was. Since my 50% target was always unattainable, if only by a little, I was always shaming myself to do better. Trying to make up that $1,000, $5,000, or $10,000 we got behind in is always a good motivator to just be a bit more frugal.

By setting an unrealistic goal, we always had something to strive for.

The one thing that we did not include in the above graph was money that was already spent for the trip that would otherwise have been in our savings. By factoring that in, our gap would have been a lot smaller in the final months. In either event, we're happy to say that we made our minimal target while being (predictably) under our reach goal.

Doesn't hurt in having a bit more shame, right?

Live Like a Graduate Student

Now, you may be wondering just how exactly I thought we could get anywhere near the 50% savings target. As it turns out, it wasn't too hard.

Prior to saving for this trip I was a graduate student, much like Angie was until just a few days ago. I've never known anything but a student's salary which was well under $15,000 per year for me and slightly higher for her. But instead of working as a graduate student, I found myself in an engineering position making roughly four times what I was during college. While others would take that instant boost in take home pay and go splurge on everything imaginable, I didn't even act like it was there.

Yep, no high living for us, and life's simple pleasures were let go.

What all did we cut out? Well, we never had smart phones, never got cable, we drive the same cars we did in high school (which are paid off), do not go on wild shopping trips, refuse to upgrade our electronics unless we have to, and second guess any major "date" that would cost more than about $20.

The exceptions to this rule? We did get a nice apartment, have a good dinner out a few times a month, and didn't skimp on our modest wedding and honeymoon. And for 2 1/2 years, that was it. For us, getting into this mindset was easy because we never upgraded into the lifestyle of having items that required monthly fees, even during college.

For those looking at ways to save money, look back to your college days and find those ways to do without that are draining your wallet. We're not talking about 3 roommates and ramen noodles, but the minor things that you take for granted now that you didn't have or need when you were younger. That extra $20/month for a smartphone, $60-$100/month for cable, and $100 date every few weeks adds up. If you could go without for a couple years while saving, well, you can do the math. You may not cut the same things we did, but a re-evaluation on your thrifty ways will do wonders for your savings ability.

If you need help, just ask yourself this: You won't be using many of these items when you travel, so why do you need them now?

Who knew being a poor graduate student was good for something other than surviving college?

Know Your 'RTW Cost'

The previous two goals helped us boost our savings capabilities immensely, but it would all have been for nothing if we did not know our RTW cost.

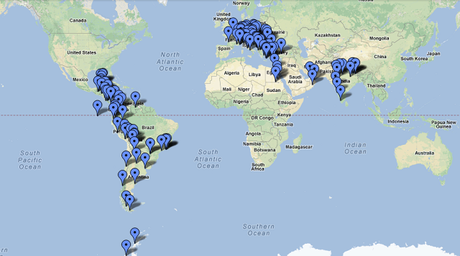

Now, even though we are leaving in just a few days, we cannot truly say that we know what the cost of our RTW trip will be. But I can tell you that we have a fairly good idea. After a few months of research into common prices of major items like transportation, hotels, food, attractions, and other spending categories, we have a fairly good plug number for what our ideal route would be. In knowing the value of our dream trip, we had another target to set out for when keeping our savings in mind.

The downside? It was a really big number.

We are firm believers that a big savings goal needs a target. Otherwise what driver do you have to save enough? It is possible for a traveler to save extra money for two years, head off, travel on that money until it is gone, and come home with a great experience. But not everyone wants that for a once (or twice) in a lifetime trip.

Will you be more motivated to save if you knew you needed a minimum of $30,000? Or would you be fine traveling with whatever you can manage to save? Neither way is incorrect as long as you're happy with it, but those with a target will almost always end up finding ways to save more. And take it from us, having more money to travel on is never a bad thing. Just try to be reasonable with balancing your number with the realistic and unrealistic goals we mentioned in the first mindset featured in this article!

Dedication

In the end, there is only one thing that will guarantee your success in saving for your long-term trip, and that is dedication. You must give yourself 100% to the goal, otherwise you'll start bleeding money and not notice it. For some this is a non-issue as you can just wait a few more months to leave. For those with fixed departures, you may not be as lucky.

Let travel consume you.

Make it your goal.

Adopt the savings mindset and enjoy it when seeing the world!