Nasdaq 12,000.

Nasdaq 12,000.

If you recall, Nasdaq 5,000 was a big deal in 1999 and then we crashed and didn't get back there until late 2016, when Trump was elected and tax-free fever was sweeping the land. Our National Debt was $18.15Tn at the time but 4 years later, the debt was up to $27.75Tn and the Nasdaq was at 11,500 in the fall of 2020 - as we waved goodbye to President Trump (well, more like dragged him out in January). Losing Trump didn't stop the Nasdaq, it kept climbing all the way to 16,600 in December of 2021 - up another 6,100 points in just a year.

Yet, somehow, people didn't think that was riduculous and unsustainable. What could those companies have done to justify a 50% pop in valuation in 24 months, let along the 120% pop of the previous 4 years? Noting is the correct answer, as it turns out and now we are back to 12,000, which is still 20% above 10,000 – which is the next real support line.

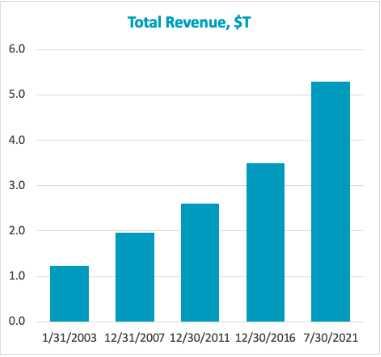

The chart on the left is for the entire Nasdaq Composite, not just the 100 but it includes them and, as you can see, Revenues were up about 50% since 2016 so profits certainly were not up 200% – MAYBE 100% and there was no realistic way we were going to get to 200% – even without Covid, Deficits, Global Warming, Supply Chain Disruptions, Labor Shortages, Commoditiy Shortages, Inflation and War.

Once investors started to recoginize these things were not "transitory", they began to factor them into their forward earnings expection and PRESTO! – the…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!