8,000 infections, 170 deaths.

8,000 infections, 170 deaths.

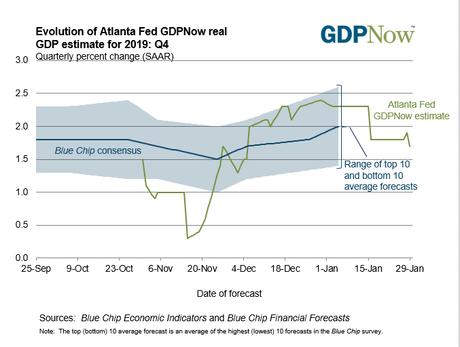

That's the number we're up to this morning but it is less than 9,000 so not getting wose though the rise in deaths to 170 is disturbing from 106 yesterday. 1.7% is the number I'm more concerned with as that is the Fed's most recent estimate for our Q4 GDP and you would think they would know but this is just the first estimate for Q4 – so the number we hear this morning is a lot more like a guess than a statistic anyway.

We guessed we hadn't heard the last of the coronavirus in yesterday's Live Trading Webinar (replay available later today) and we shorted the S&P (/ES) Futures way back at 3,285 and they are already down to 3,245 for a $2,000 gain, per contract (you're welcome!) and the Nasdaq (/NQ) Futures we shorted at 9,142.50 are now down to 9,037 for a gain of $2,110 per contract – not bad for a day's "work", right?

In the bigger picture (there's always a bigger picture) we're simply retesting Monday's low's and we made a lot less money than we did on Monday because, on the whole, we only had a strong bounce which quickly failed and now we're retesting the lows so, if we only get a weak bounce now and that fails – look out below! But, for now, we'll take our quick profits ooff the table and re-enter shorts below the 28,500 line on the Dow (/YM) Futures with tight stops above.

Here are the bounce lines for the S&P 500, as calculated by our Flawless 5% Rule™:

We predicted all the index bounces on Monday for our Members in our Live Chat Room at 10:52 and, so far, the indexes have done exactly what we expected, which is actually bad because we expected this would be the start of a breakdown… Oh well…

What we're looking for today is signs that the rate of viral infections is slowing (more important than deaths acellerating) and, chart-wise, we'll be looking for more than a weak bounce. If the weak bounce line isn't taken and held into the close – it will be time for more hedges. Remember, I can only tell you what is likely to happen and how to profit from it – the rest is up to you!

IN PROGRESS

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!