The last week has proved challenging for GBP/EUR Exchange rates with the first blow coming yesterday. Many had expected inflation to continually rise however it wasn’t to be. Today also proved troublesome for the GBP/EUR pair with the ECB’s comments which failed to curtail markets.

UK inflation level eases

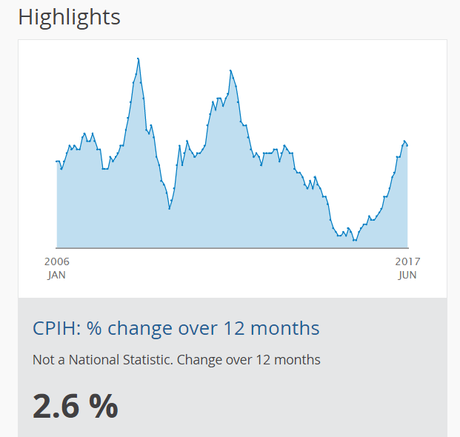

Many had assumed that inflation would continue to increase and a level of 2.9% was estimated. Continual inflation would have then compelled the Bank of England’s Governor Mark Carney to seriously consider increasing interest rates and act upon his last comment. However, inflation eased from 2.9 to 2.6% essentially putting discussion of a rate rise on ice.

Draghi Fails To Dilute Appetite For The Euro

GBP/EUR Exchange Rates accelerated a near 1.3% loss this afternoon with the combined effect of Brexit negotiations memos and Draghi’s inability to stifle the markets appetite for the Euro. In his latest press conference rates remained at a steady 0.0%. The central bank had insinuated that it could start to taper its monetary policy however that was delayed. Whilst also stating that if intervention would need for whatever reason to be increased the ECB were prepared to act.

Many still expect tapering to be a question of when and not if despite Mario’s comment. The expected execution time being September or October.

Draghi who addressed market from Frankfurt stated in his traditional manner, stating

“If the outlook becomes less favourable, or if financial conditions become inconsistent with further progress towards a sustained adjustment in the path of inflation, the Governing Council stands ready to increase the program in terms of size and/or duration,”

Brexit Negotiation Fall Out

The pound was dealt a further blow following Draghi’s comments. This time the protagonist being the release the details of progress or more lack of it from this week’s Brexit negotiations.

The main points of contention being the UK’s Brexit payment and the rights of citizens in the UK. The Head of the EU’s negotiation team Mr Michel Barnier accused David Davis’s plans of lacking clarity.

Mr Barnier also stating during today’s press conference held earlier today that any lowering of standards would directly affect their access to EU markets.

Relating to concerns around citizens right the report also stated that UK citizens living in the EU may also lose eligibility to live in another European country.

GBP/EUR Exchange Rates Following The Latest Inflation Data, ECB and Brexit Meetings

Following a short-lived rally last week, the GBP/EUR exchange rate has sunk to an 8 month low. Currently sitting at 1.1158 the pair as mentioned has lost roughly 1.34% today. The pair having fallen from an opening rate of 1.1307.

GBP/USD Exchange Rates also lost pace with the currency pair falling from opening levels of 1.3024 to a day low of 1.2939, however unlike GBP/EUR exchange rate the pound has managed to claw back some losses and has closed at 1.2971 losing 0.4% over the day.