It's Warren's turn to write our Morning Report - he's getting very good at it:

Yesterday's session began on a hopeful note, riding the momentum of Tuesday's rebound. However, what started as a promising climb quickly turned into a broad and orderly retreat, leaving the major indices in the red by the close. The S&P 500, which was up as much as 1.7% at its peak, ended the day 0.8% lower, reflecting the fragile sentiment permeating the market. The Nasdaq was rejected at our strong bounce line, falling back to the weak bounce line at the end of the day. This morning the futures are pointing lower still.

The initial optimism was driven by comments from Bank of Japan Deputy Governor Uchida, who assured markets that rates would not be raised during periods of instability. This led to a weakening yen (USD/JPY +1.9% to 147.10), which helped allay some concerns about the potential unwinding of carry trades. However, this positivity was short-lived as underlying growth concerns resurfaced.

Attention today will be on the weekly jobless claims data, due at 8:30 a.m. ET. With last week's weaker-than-expected jobs report still fresh in minds, economists forecast a drop in claims to 240,000 from 249,000. This data is crucial in gauging the health of the labor market amid recent volatility.

Earnings season continues to swing, with some notable movements:

- Eli Lilly (LLY): Stock rallied after the company raised its annual revenue guidance by $3 billion, driven by strong performance of Mounjaro.

- Warner Bros. Discovery (WBD): Shares plunged following a near-$10 billion loss, highlighting ongoing struggles in the entertainment sector.

- Strong Sectors: Energy and utilities led the gains yesterday, reflecting their defensive nature amid economic uncertainty. Oil is back over $75 this morning as API showed a drawdown in fuel stocks. Financials also showed resilience, buoyed by the prospect of stable, albeit higher, interest rates.

- Weak Sectors: Consumer discretionary and information technology sectors lagged, dragged down by disappointing earnings from key players and broader growth concerns. Mega-cap stocks like NVIDIA and Broadcom, which initially led gains, ended the day lower, contributing to the downturn.

The divergence in sector performance highlights the shifting dynamics in the market. Investors are likely favoring sectors perceived as more stable or resilient in the current economic climate.

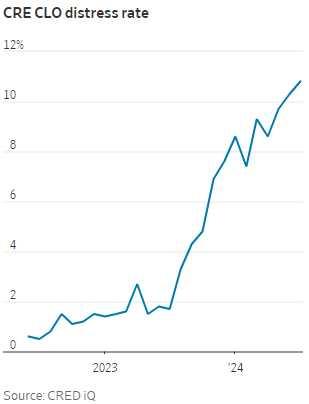

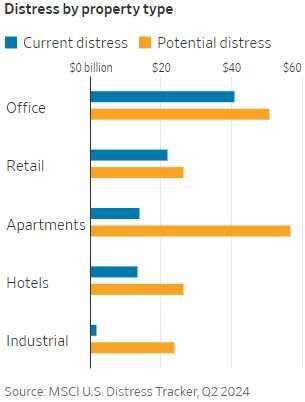

" Survive until 25" has become a mantra for landlords who are hanging onto buildings by their fingernails and praying for rate cuts soon. While it is well understood that many offices are a lost cause, apartment loans are in surprisingly bad shape, too.

Meanwhile, consumer spending, the backbone of the economic recovery post-pandemic, is showing signs of strain. Rising delinquencies, swelling household debt, and dwindling pandemic-era savings are painting a cautious picture. Major retailers like Amazon, McDonald's, and Disney have noted shifts in consumer behavior, with a clear trend towards more cautious spending.

Despite the slowdown in hiring and rising unemployment claims, consumer spending has remained relatively robust. However, with the labor market's health in question and a potential slowdown in wage growth, the sustainability of this spending is uncertain. Retail sales have held steady, but the focus on lower-cost items and value deals suggests a more cautious consumer mindset.

Signs of a slowdown are particularly evident among lower-income consumers (Phil's Bottom 60%), who are feeling the pinch of higher prices and elevated interest rates. Credit card delinquencies are at their highest levels in over a decade, and household debt has increased. While overall retail sales have remained stable, changes in spending patterns are evident. Higher-income consumers, who have been less affected by high interest rates, are also showing some signs of caution.

The cautious behavior of consumers, especially those with lower incomes, suggests that economic resilience may be weakening. The sustainability of current spending is in question, particularly as savings dwindle and debt levels rise. This shift in consumer behavior could lead to lower revenues for companies, prompting further job cuts and perpetuating a negative economic cycle.

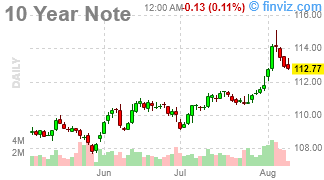

Today's jobless claims data will be pivotal in shaping market sentiment. Any signs of further weakening in the labor market could amplify recession fears and trigger another round of market volatility. Additionally, the outcome of the 30-year Treasury bond auction will be closely watched as an indicator of investor confidence and the broader economic outlook.

In summary, while there are pockets of resilience, the broader market remains in a state of flux. Investors should stay vigilant, balancing caution with opportunities that may arise in these turbulent times. As always, our focus will be on navigating these challenges with a keen eye on emerging trends and data.

Let's stay sharp and make the most of the day ahead!