What a couple of weeks!

What a couple of weeks!

We had our S&P 500 Death Cross at the Ides (March 15th), as expected but, since then, we have rocketed back over the 200-day moving average with the S&P gaining 10% in two weeks while Oil prices hit $110 and the Fed tightened rates and polar temperatures were 50-70 degrees above normal and 2.5M Ukrainians became refugees while Putin bombs civilian targets AND threatens the West with Nuclear War. Am I missing anything? Oh yes, a new strain of Covid forces shut-downs in China and inflation is getting worse and the Global Economy is slowing.

Why shouldn't the market be rallying? Well, just the reasons above but, as we experienced during our own Portflio Reviews last week – it's hard to let go of our equity positions – mostly because there's nothing better to do with your money and, if you are a Russian Oligarch, where else to move you Billions quickly and quietly other than US Equities?

It is very, very hard to move Billions of Dollars around, especially when you are sanctioned but you can always find some Bankster in some country who's willing to open a new account (or existing acocunts that are happy to trade for you) and AAPL alone, for example, trades 90M shares a day at $174, that's $15.6Bn you can put into AAPL without drawing too much attention. XOM does 20M shares daily at $83, that's $1.66Bn, etc. Thousands of places to hide your money.

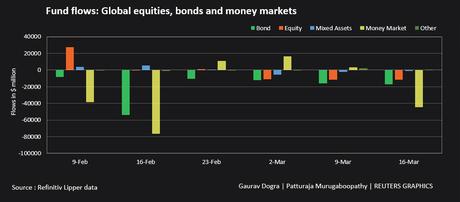

In fact, globally, while the US markets were gaining $10Tn, Global Equity Funds had $11.8Bn worth of outflows and Global Bond Markets saw $17Bn worth of outflows – the 7th consecutive week of outflows and the biggest one since $52Bn was removed the week of Feb 16th:

As you can see, on a Global scale, investors are fleeing everything – yet the US markets are going higher. This is NOT a sign of health – it's a sign of panic. We just haven't started to panic – yet. That might change over the weekend as Showtime's EXCELLENT show "The Circus" will be titled "The Nuclear Option" on Sunday. Their coverage of the war has been the best I've seen on TV.

As noted by Queen, nothing really matters in the markets and that's because money is flying into US equities while it's flying out of everything else. Putin's worth $250Bn and 75% of that is his 15% stake in Gazprom and what's the one thing Russia is still able to do? That's right – sell oil and gas. So, not only has Putin not suffered from these sanctions but he's making $30 more per barrel sold than he was before he started the war. As Donald Trump says – Putin is a very smart man!

As noted by Queen, nothing really matters in the markets and that's because money is flying into US equities while it's flying out of everything else. Putin's worth $250Bn and 75% of that is his 15% stake in Gazprom and what's the one thing Russia is still able to do? That's right – sell oil and gas. So, not only has Putin not suffered from these sanctions but he's making $30 more per barrel sold than he was before he started the war. As Donald Trump says – Putin is a very smart man!

His other big holding is Gunvor Group and they are the World's largest commodity traders. Do you think they are doing poorly with Putin's war sending the prices of commodites flying? Is anyone stopping them from trading? Perthaps this is what the war is all about – boosting Putin's holdings while the rest of Russia collapses, which will allow Putin to buy the rest of Russia for pennies on the Dollar or kopeks on the Ruble, I suppose…

By the way, you can tell Putin is a Republican (aside from the unbridled greed) because he has those "shark eyes" – that souless stare that is bereft of compassion, where you know the words that are coming out of their mouths are only what they think you want to hear and not at all what they really mean. Pay attention next time you are watching them on TV – you'll see what I mean…

You want to know what the opposite of a Republican is?

"And the men who hold high places

Must be the ones who start

To mold a new reality

Closer to the heart" – Rush

We still have until Thursday before Q1 ends and we never bet against window-dressing. Our hedges are firmly in place (see Wednesday's Report for our adjustments) and yes, when the market is going up it's cheaper to add hedges – so we do. If you wait for it to head lower – the cost of your hedges go up considerably – it's like waiting until you are deep in the desert to buy water.

There are still plenty of things to buy and we bought some this week but yesterday we sold calls on AAPL and that is a very good sign that the market is too toppy – because we love AAPL – but too much is too much and 10% in two weeks is TOO MUCH!

Have a great weekend,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!