How do you get to Early Retirement as quickly as possible and buy a property outright? Here in the UK we have an in-built fascination with owning your own property. Continental Europeans, on the other hand, tend to either stay at home for an extended period of time or rent. MUFF has been interested in this debate for some time and the impact it would have on our financial freedom plans. In order to illustrate the differences I have posted an Open Office spreadsheet with some hypothetical scenarios. You can open the spreadsheet in the financial section of the toolkit and have a play with the parameters. It contains:

How do you get to Early Retirement as quickly as possible and buy a property outright? Here in the UK we have an in-built fascination with owning your own property. Continental Europeans, on the other hand, tend to either stay at home for an extended period of time or rent. MUFF has been interested in this debate for some time and the impact it would have on our financial freedom plans. In order to illustrate the differences I have posted an Open Office spreadsheet with some hypothetical scenarios. You can open the spreadsheet in the financial section of the toolkit and have a play with the parameters. It contains:- An example of when getting a mortgage is beneficial

- An example when renting could be a good choice

- An example of early retirement

You can play with the parameters for savings, property cost, rental rates, mortgage, income and inflation expectations for your unique circumstances.

You can play with the parameters for savings, property cost, rental rates, mortgage, income and inflation expectations for your unique circumstances.Arguments for buying through a mortgage

- You have your own place to call home and do with as you wish - this is a huge desire of ours.

- Putting down roots - brings some stability to your life as you have committed to a community for a prolonged period of time

- Inflation will erase the "value" of the mortgage over the years. In the past periods of high inflation (10-15%) combined with fixed mortgage rates and wages rising with inflation effectively wiped out the majority of the burden of the mortgage.

- As a diversification of your assets. It is a more illiquid asset but we are not creating a large number of new houses in the UK. We are on an island. So you could argue for asset scarcity in the UK with the right property.

- Status - when we say we rent in the UK you can tell people think that we are lower middle class. Can't afford their own property in their 30's poor them! On the other hand you are accepted as middle class.

Arguments for Renting

- Flexibility - early in life when you are unsettled, perhaps searching for love or moving around for a perfect job, renting is possibly the best choice.

- Renting can be very cost effective. You can rent just what you need for that point in time such as a small flat. When you buy, I would argue, you have some idea of the future in mind so a bigger property than your current needs is usually purchased.

- You do not have to pay directly for wear and tear, decorating, home insurance.

- Helps keep you consumerism in in check!? I mention this as if you only have a small space filling it to its max can be quite easy. Once it if full it will probably stop you from buying more stuff. On the flip side you may not want to stay in. You will spend you money out and about having a good time.

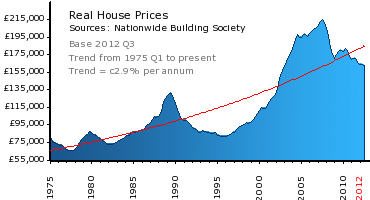

- You are missing out on capital appreciation. House prices have easily doubled in the UK over the past ten years. So on that measure if you got in at the start housing was a clear winner versus renting. Housepricecrash.co.uk have been covering house prices in the UK for years without actually witnessing a house price crash (like has been seen in the US after the financial crisis of 07). Timing is everything in all investments.

Arguments for Financial Freedom

- With a mortgage typically over 30 years the repayment of the capital and interest is two times the value of the property.

- Renting is "dead money" - you have nothing to show for it.

- Early Financial Freedom aims to minimise the cost of a mortgage or renting by purchasing your primary residence outright as quickly as possible and at the same time have an income to live off.

- In saving hard and investing when you are young you will reap the benefits early.

- Financial freedom requires you to be careful with your spending to maximize your savings. Foregoing the "normal" consumerist items early in life can be difficult when you are trying to "fit in".

- Learning how to budget and invest wisely can make a huge difference to your life and the future of your family. It can be fun at the same time, instill discipline and help put money into perspective. By this I mean how to understand its value and place in your life to facilitate health, food, shelter and happiness. Appreciation of the periodic monetary thrills in life can then have more meaning.

MUFF

NEXT UP MUFF LIFE GOALS FOR HAPPINESS

Welcome New MUFF Readers! Take a look around. Start at the first article, browse the all posts or just go for a Random Post

Keep in Touch: RSS Feed, follow MUFF on Twitter or subscribe to posts by email: