For decades it’s been gospel that a corporation’s mission is just to maximize shareholder value. But now a group of over 180 heads of top U.S. companies has met and signed a statement saying they must also serve the interests of employees, customers, suppliers, and the wider society.

“Profit” is a dirty word; often coupled with “obscene.” We’re told X corporation or X industry “sucked” X dollars from the economy, as if the plain numbers bespeak evil. What’s never said is how much (or how little) return on invested capital those profits represent. Who’d invest in a business, with all the risks, without the prospect of a reasonable return?

That’s what creates the cornucopia of goods and services making our lives what they are. And the jobs enabling us to pay for them. Some of my friends fantasize a utopia where we get all that without anyone “sucking” profits. But I don’t see them forgoing earnings on their own industriousness.

Maybe you have a different idea that didn’t occur to Smith — government providing everything. That’s what “socialism” actually means. Like in the USSR — where goods and services were notable for their absence. (People said, “we pretend to work and they pretend to pay us.”)

But do businesses in fact garner “obscene” profits? Well, there’s one salient test. I’ve invested in corporate stocks for three decades, and I’ve done nicely, but certainly not obscenely. If corporations were really “sucking” exorbitant returns, we could all easily get rich by buying their stocks. That’s obviously not so.

Which brings us back to the concept of companies existing basically to benefit shareholders. Here are two key points:

First, corporate managers actually work for shareholders, entrusted with a fiduciary duty to serve shareholder interests. Anything they do that’s inconsistent with shareholder interests is an unethical breach of that fundamental duty, an abuse of their trust. Remember too that shareholders includes pension funds, retirement accounts, university and charity endowments, etc. Earning them a return on their investments is by itself a social good (with no conceivable substitute).

This wealth creation is the fundamental logic of free market capitalist economics. Assail capitalism all you like, but this has raised global average real dollar incomes around sixfold in the last century. It wasn’t socialism.

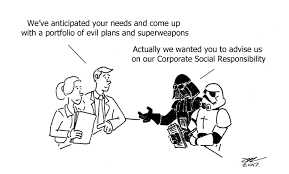

So where does corporate social responsibility, and the recent declaration by all those CEOs, fit in?

You don’t need a code of “corporate social responsibility” to know that profit maximization doesn’t allow for ripping off customers with shoddy products or failing to pay workers or contractors what they’re due, like Trump. Et cetera. Profit maximizing is always constrained by the universal rules of societal participation. A corporation is in reciprocal relationships with its stakeholders like workers and customers, and such relationships entail responsibilities. Fulfilling them is the necessary premise for being an enterprise operating in a society.

Economist Milton Friedman was the leading voice who saw profit maximizing and a company’s social responsibility as two sides of the same coin. He argued (like Smith) that a business making money does advance the public interest; and also stipulated the assumption that profits are earned legitimately, that is, by creating customer value (and not, for example, by fraud). And, further, that businesses compete.

I always remember one of my first cases as a government regulatory lawyer. My agency went after a small upstart moving company for breaking the rules. Its crime? Rates too low! Who were we protecting? Certainly not the public. Rather, the established movers who hated competition.

Advertisements