Alongside the Bank of England’s interest rate decision which saw rates remain on hold at 0.75% in a unanimous vote, Carney also highlighted the some of the challenges the UK economy could face in the outcome of a No-deal Brexit. These included a significant devaluation in the UK property market and falls in Sterling exchange rates, the latter of which will come as no surprise. The ‘worse case scenario’ outcomes were gauged in stress tests performed by the Bank of England in November, to ensure that the UK economy would be adequately prepared for Brexit, regardless of the outcome.

Despite gloomy predictions and potential challenges, Carney the Governor of the bank of England confirmed he would prolong tenure as governor until 2020.

House price plummet

The Bank of England’s test concluded that UK house prices would inevitably fall with the worse case scenario being by reductions of 35%. Its also understood that Carney informed the Brexit cabinet that Mortgage interest rates could spiral as high as 4%. Carney did, however, state that interest rates could be amended in response to the Brexit outcome.

Despite the attention-grabbing figures it’s important to highlight that this must be treated as a worst-case scenario rather than a Bank of England economic forecast.

Carney did, however, highlight that property price falls could be experienced in 2019 as the uncertainty could see potential property buyers become more tentative and delay purchasing. More positively, all of the UK’s major banks passed the stress test and would if needed to be able to navigate a harsh no-deal Brexit and continue lending.

Chequers deal to add to the economy

In a bittersweet overview, it is reported that Governor Carney also highlighted the up-sides that Theresa May’s Chequers Brexit deal could add to the UK Economy. Reports in the financial times say that Carney estimates that a Chequers type plan could add a £16billion injection to the UK economy. The chequers type deal which could boost the economy would be based on the UK having access to a free trade for agriculture and goods. The forecast which estimated the UK economy could recuperate the 1% of its economic activity that has been lost since the 2016’s EU referendum outcome.

Carneys attracts praise from remainders

Many of the comments Carney presented to the Cabinet have been leaked with Mark Carney receiving praise from LBC radio presenter James O’Brien who dubbed the BOE Governor as more patriotic than the all of the pro-Brexit Tories.

O’Brien who has often eloquently described his fears following the EU referendum outcome whilst also disparaging many of his pro-Brexit readers’ arguments, occasionally in comical fashion.

The presenter openly applauding Carney’s worse case scenario assessment of a chaotic Brexit outcome on the UK economy. The presenter said that

“Mark Carney is probably doing more to safeguard the security in this country than anybody in Parliament’’ continuing O’Brien said

“He has got one of the toughest jobs in international finance as Brexit comes closer. He won’t walk away. That’s a sign to me of immense honour, loyalty and dedication to duty.

“Which of course hardcore Brexiteers don’t know what it is. They march around like pigeons essentially claiming to be patriots whilst essentially flushing the country down the toilet.”

O’Brien’s comments will almost certainly resonate with UK citizens who voted to remain and those who now feel disenfranchised by how Brexit is shaping up. Especially as many of the principal protagonists are either attempting to split the government or have in many cases taken a back seat following the outcome.

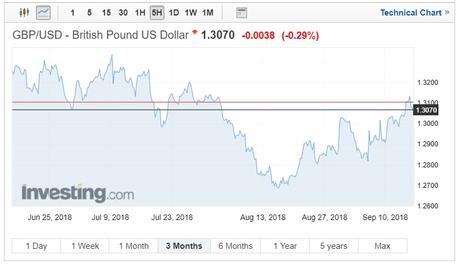

Pound volatility this week – GBP/USD touches short-term high

Despite the sobering potential outcomes delivered Carney the Pound hasn’t faired too badly this week. UK economic data managing to lead the charge regardless of Brexit up’s and down. Key data releases included UK GDP, Average earnings and Monthly manufacturing figures.

UK gross domestic product beat expectations offering Pound bulls something tangible, GDP recorded 0.3% growth against expectations of 0.2% assisted by increases in vehicle purchases and seeing GDP at its fastest rate this year.

Average earnings data also highlighted a lift in July (2.6%) with the data highlighting the fastest rise in earnings in three years. The data was also further accentuated by the UK’s low unemployment rate which remained at 4.0%

Manufacturing still finds itself in a challenging predicament with the sector grinding to its most modest increase since the referendum. The sector showed a -0.2% decrease against the forecast growth rate of 0.2%.

Over the week pound exchange rate have been trading between a familiar trading band. GBP/EUR trading at a week low of 1.1170 and a high of 1.1248.

The latest data added to the Pound’s support and arguably demonstrating despite the UK’s uncertain future that the economy does currently have some stability, naturally, this outlook will be tested in the coming months as the UK’s relationship with Europe becomes clearer.

Sterling also managed to triumph against the Dollar this week touching its highest level in 6 weeks. On Friday GBP/USD rallied to a 6-week high of 1.3135 bolting through the phycological level of 1.30 where it has remained despite a sell-off on Friday. Demonstrating GBP will almost certainly encounter resistance once it crosses the 1.30 threshold.

The data whilst encouraging for the UK will almost certainly be undermined by the wrangling of the divided UK government. GBP is artificially low because of the failings on inconsistencies of the UK government. It’s hard to argument pound rallying past its current trading bands all the time the outcome of the UK and EU’s relations remains so uncertain.