Governor Stephen Poloz was being interviewed on a CBC radio show and gave a clear indication that interest rates could be raised sooner than many anticipated.

His comments follow Monday speech from Governor Carolyn Wilkins where she addressed an audience speaking on the topic of diversity in the economy. The speech which was hosted by the Asper School of Business.

During the discussion, the subject of Canada’s Monetary stimulus program arose and Wilkins confirmed that the Canadian Central Bank was indeed considering reducing its monetary stimulus.

In turn this saw the CAD/USD exchange rate initially rise by around a percent. Other currencies were also affected, CAD rising against the Pound along with Yen and Euro to name a few.

The Canadian Dollar’s strength was boosted furthermore during Governor Poloz’s CBC Radio interview with him adding further fuel to the fire.

During the interview Governor Poloz stated that

“It isn’t time to throw a party, but it does suggest that the interest rate cuts we did two years ago have done their job, and that’s important to us,”

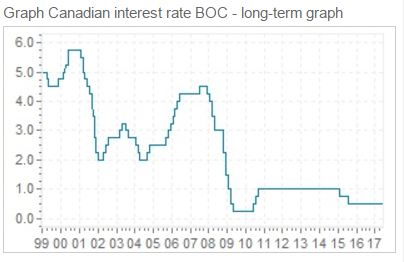

Canadian interest rates currently sit at 0.5% having been cut in 2015 as the economy battled against effects caused by the dip in oil prices.

Continuing Poloz said

“Everyone knows, I think, that interest rates have been extraordinarily low to offset some of the shocks that have been hitting our economy, beginning with the global financial crisis but then again the oil collapse we saw 2½ years ago,”

As highlighted above the Canadian Dollar enjoyed a lot of success this week following the Governor Wilson and Poloz’s admission. CAD/USD exchange rates enjoying particular success.

On Monday the pair opened trading at 0.7433 and enjoying support over the last few days. CAD/USD exchange rates currently sit at 0.7542 and have weakened shortly, no doubt in anticipation of this evenings FOMC minutes and an all but certain US Interest rate hike.