However, all the financial support is routed through banks. Term loans for CAPEX are released in the name of machinery & equipment suppliers while the Working capital is made available in the form of OCC. The sanction could be through fund based or non-fund based or mixed.

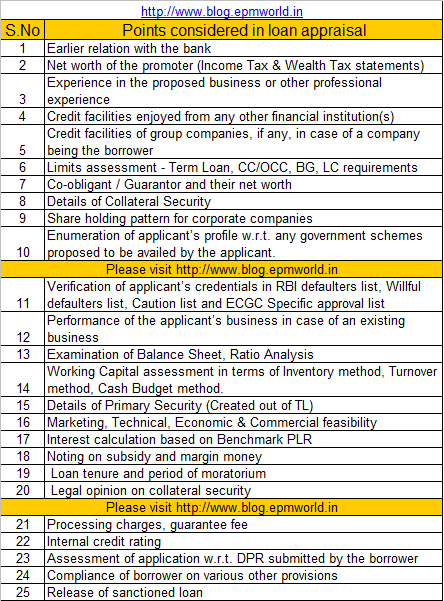

Every prospective borrower of loan would get a common question as to whether bank will sanction loan for the project. Even the regulating authority of respective government schemes would not be able to confirm about the prospects of loan sanction.

I have attempted to draw important points evaluated by banks in the sanction of loan. Mind these are not exclusive. If you feel you have answers for most of the things, you will sure get loan from the Bank. After all, Banks are always keen to lend money where they find business i.e. confidence and assurance that the borrower will not default in loan repayment. Hence, it is the duty of borrower to satisfy the business requirement of banks so that he become eligible to draw deserved financial support. Once a healthy relation is formed with a banker, we can always be sure about drawing further support in the name of extended Term Loan or extended Working Capital or any other mode.

Loan sanction is a cumbersome process. Depending upon the availability and submission of various data by the borrower, it would take a minimum of 4 weeks time for a new loan application for a start-up project.

You may also like -