• The BCG matrix based on product life cycle theory was developed by Bruce Henderson of the Boston Consulting Group in the early 1970′s. It has 2 dimensions: Market Growth Rate and Relative Market Share. It is based upon the simple observation that company’s business unit can be divided into 4 different categories: Stars, Cash cows, Dogs and Question marks.

• A company operates in various businesses or markets. Each of its businesses operate in different conditions. The corporate has to realize that each of its businesses will earn different amounts of profits and will require different amounts of investments. The corporate should learn to expect different amounts of profits from its different businesses and should invest in them depending on their requirements..

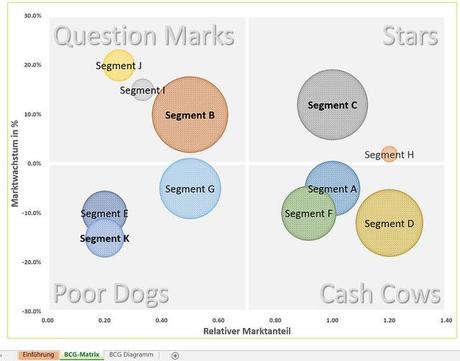

• In the BCG matrix, market growth rate is shown on the vertical axis and indicates the annual growth rate of the industry in which each product line operates. It is used as a proxy for market attractiveness i.e. higher the growth rate, more attractive is the industry to do business in.

• Relative market share is shown on the horizontal axis and refers to the market share relative to the largest competitor. It acts as a proxy for competitive strength.

• Cash flow is dependent on the box in which a product falls. Stars are market leaders and earn high revenues but require substantial investments to finance growth and to meet competitive challenges. Overall cash flow is therefore likely to be roughly in balance.

Question marks or Problem Children are products in high growth markets which cause a drain on cash flow as they incur huge marketing expenditure in reaching out to growing number of customers. They also incur costs in setting up new manufacturing units to be able to serve the growing markets. But they are low share products and therefore, do not generate much revenue. Overall, question marks are big cash users.

Cash cows are market leaders in mature, low growth markets i.e. investment in new production facilities and marketing is minimum. High market share leads to large revenues and hence, positive cash flow.

Dogs also operate in low growth markets but have low market share and therefore, earn low revenues. Except for some products near the dividing line between cash cows and dogs, most dogs produce low or negative cash flows.

The four categories based on combinations of market growth and market share are described below:

Stars (High Market Share, High Market Growth)

The business is in a market which is growing rapidly. Stars are leaders in their markets but they have to be focused on building sales or market share. Resources should be invested to maintain and increase leadership position. Competitive challenges should be repelled. If the market share falls, a star can be changed into a problem child. Eventually the growth rate of the market will decline and the star will be changed to cash cows. Therefore stars should be protected as they are the cash cows of the future. A company can be lavish with its stars as it will provide profits for a long time.

Question Marks/Problem Children (Low Market Share, High Market Growth)

The market is growing at a high rate but the market share is low. The choice is to increase investment and build market share to turn it into a star, or to withdraw support by either harvesting (raising prices while lowering marketing expenditure) or divesting (dropping or selling) or to find a small market segment where dominance can be achieved (niche).

Since the market is growing rapidly, such a company will require a lot of investment even to stay in the same position. Therefore a company has to make a swift decision. It has to pump in resources to convert it into a star or the business should be dropped. The company cannot afford to keep. a problem child in its position for a long time. It will gobble up huge amount of resources and turn no profits.

Cash Cows (High Market Share, Low Market Growth)

The market is growing at a slow rate and business is the market leader. Expenditure can be controlled as the business does not need to spend on a new manufacturing facility or reaching out to new customer segments. But the revenue is high due to high market share. Therefore cash cows earn high profits. The company’s objective should be to hold sales and market shore. If the business fails to hold on to its market share, it will be converted to dog.

Since cash cows earns profits for the company, it will be tempting to make investments in modernization of manufacturing facilities and in sophisticated branding exercises. The company should avoid any investment in excess of what is required to maintain the market share and keep on increasing it incrementally. Excess funds should be used to fund stars and question marks.

Dogs (Low Market Share, Low Market Growth)

The market is growing at a slow rate and the market share of the business is low. The business does not earn profits. The company should look as such a business closely to find out if the business has enough remnant strengths to be converted to a cash cow by making appropriate investments. Normally one or a few elements of such businesses are weak.

A business may have a good brand image but it may have outdated manufacturing facility, so the business can recover if investments are made in the upgrading of the manufacturing facility. A business classified as dog should not be an automatic candidate for closure. It may also be possible to reposition the product into a defendable niche.

But if the business is weak in many facets, the company should take swift action to retrieve as of much cash as possible from the business. For such dogs, the appropriate strategy will be to harvest to generate a positive cash flow or to divest and invest somewhere else.

Limitations of the Boston Consulting Group (BCG) Matrix

- The assumption that cash flow will be determined by a product’s position on the matrix is weak. Some stars will show a healthy positive cash flow as will some dogs in markets where competitive activity is low.

- It is over simplistic to treat market growth rate as proxy for market attractiveness and to use market share as indicator of competitive strength. Other factors like market size, brand strength are also important.

- When competitive retaliation is likely, cost of share building outweigh gains. Therefore excess stress on market shore may be harmful.

- The analysis ignores interdependence among products. A dog may complement a star. Customers may want a full product line. Dropping a product because they fall in a box may be naive.

- Some products have a short product life cycle (PLC) and profits should be maximized in the star stage instead of building them.

- Competitors’ reactions are not assessed. When a company makes investments to build the market share of a problem child, the incumbent stars are going to react. The suggested strategies for the businesses in each quadrant are simplistic and do not account for market dynamics and competitor reactions.

- The matrix does not define a market i.e. the whole market or a segment.There is vagueness about the dividing line between high and low growth markets. A chemical plant may use 3% as the dividing line, whereas a leisure goods company may use 10%.

- The matrix does not identify which problem children to build, harvest or drop.

Photo by: meinevorlagen

References