Mark Carney Governor of the BOE provided a wake-up call for the British public this week delivering his no deal economic predictions. The Bank’s predictions which covered UK growth, effects on employment, currency volatility and property prices, drove the pound lower. The Pound lost ground against both the Euro and Dollar.

Whilst the Bank was keen to stress that these weren’t forecasts but more presumptions the assessment provided a bleak reading for markets and investors. Although the assessment from the BOE may have served as a mode to induce support for Theresa May’s plan, the bank’s warning has attracted immediate criticism.

Bank of England Mark Careys assessments of no-deal outcome

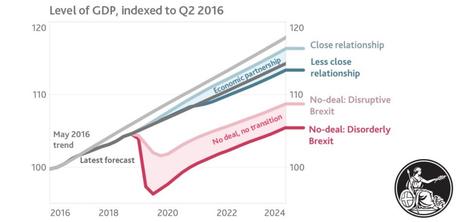

The UK economy realised its largest quarterly growth number since 2016 just a few months ago however despite this momentum, under the cloud of Brexit Carney has predicted the worst-case scenario could drive growth significantly lower. The bank envisages that GDP could fall by up to 8% in 2019, exceeding the levels of contraction seen in the financial crisis.

The bank also provided another potential growth assessment covering a disruptive but not disorderly Brexit. This depicted growth falling but not to the same extent of a disorderly Brexit. However, even more sobering was that these differentials were compared to the bank’s pre-referendum trend and the bank’s previous growth forecast.

As calls for a final say on the Brexit outcome become louder, growth assessments should only bolster the argument. The financial crisis spelt misery for many and one would imagine the possibility of growth levels contracting to levels last seen I the crisis would encourage people to back May’s plan or vote to remain if a second referendum was sought.

The analysis also warned of the potential crash in property prices with losses of 30% in the house prices being announced in the event of a disorderly Brexit. This figure was also branded as ‘No-deal hysteria by Brexiteers, Rees-Mogg slammed the banks and said Carney had ‘gone from being discredited to being hysterical’. Meanwhile, Chancellor Philip Hammond warned all outcome were all worse than remaining in the EU.

The Bank of England also covered the implication to UK unemployment by disorderly Brexit stating that unemployment could increase from its current level of 4.1% to 7.5% a huge role reversal for an economy which has realised its lowest unemployment levels 43 years just a few months ago. The UK is currently experiencing an exodus of EU workers as Brexit comes to a head. Levels of EU workers leaving the UK are at the highest levels since 1997, creating a huge gap in the labor market and creating issues for UK firms in hiring staff.

In addition to this, governor Mark Carney also suggested that inflation levels could rise rapidly forcing the Bank to increase interest rates. Estimates of up to 6.5% were suggested as the cost of importing a weaker pound and general cost would increase significantly.

In terms of future Pound values, the Bank highlighted the likelihood of a sharp decline in Sterling’s value eroding much of the UK’s buying power. The bank also provided a grim outlook for Pound bulls which depicted a potential 25% loss in value of the Pound, with a Pound weaker than parity against the Dollar and Euro assumed in a disorderly no-deal Brexit outcome. Notable losses against other currencies would also be anticipated.

Mark Carney highlights the positives of May’s deal

In a complete divergence from the Bank’s worst-case scenario outlooks of a disorderly Brexit Carney stated May’s deal had the ability to provide economic growth to the UK. Insinuating that under the deal the UK could see a growth boost relative to its current forecast. The bank believing that the retention of close trading ties with EU could see the economy grow by up to 1.75% over the next five years.

A more detached partnership the bank believed could still deliver growth of 0.75% over five years, presuming a hard border between northern and southern Ireland could be avoided.

Whilst all outcomes are at least in terms of growth and trade terms worse than remaining with even the best outcome equating to a 1% drop in GDP. May’s deal would appear to have the support from the Bank arguably delivering politically on Brexit whilst modestly supplementing the UK economy. The disappointment the PM faces is that currently, the BOE appear to be the only entity willing to back the deal and therefore worryingly the possibility of a no deal outcome seems more likely than the adoption of her deal.

BOE assessment prompts Pound decline

The Bank of England No Deal warning prompted a significant drop in the Pound with GBP falling against a basket of currencies. Following the announcement GBP – EUR fell from 1.1310 to 1.1279 a decline that continued until the Friday.

Friday saw a slight reprieve for the Pound driven by weaker eurozone inflation rates which showed a drop from 2.2% to 2% in October. The drop in inflation has questioned the chances of an ECB rate rise in the coming month and allowed the GBP to gain some momentum against the Euro.

The Pound endured a relatively turbulent week with the dollar, relishing solid gains following the FED’s more dovish assessment on future rate hikes. The GBP-USD pair touching 1.2845 following Brexit driven losses. On Friday the pair closed at 1.2748 with pound losing 0.3% against the dollar in the final trading session of the week.

This pair could see further movement next week with the G20 summit serving as the stage for talks between Trump and Xi; plus a potential opportunity for May to gain further support on her Brexit deal.

Traders are anticipating further devaluation on the GBP-USD pair with the pound expected to sink lower due to the lack of support for May’s deal.