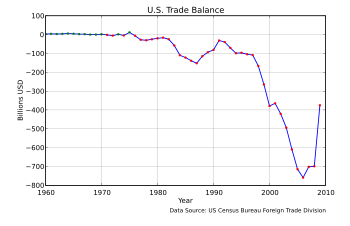

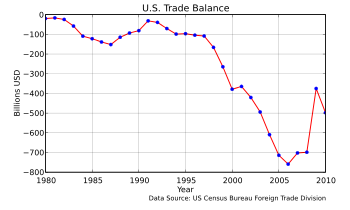

English: United States Balance of Trade, 1960–2009. Data Source: US Census Bureau Foreign Trade Division: http://www.census.gov/foreign-trade/statistics/historical/gands.txt Green dots: Positive trade balance Red dots: Negative trade balance (i.e., trade deficit) (Photo credit: Wikipedia)

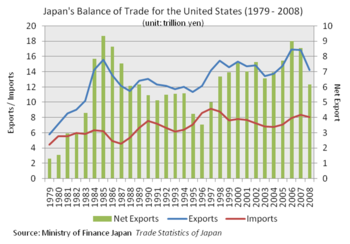

English: Japan’s balance of trade for the US (1979 – 2008) 日本語: 日本の対米国向け貿易収支の推移(1979年~2008年) (Photo credit: Wikipedia)

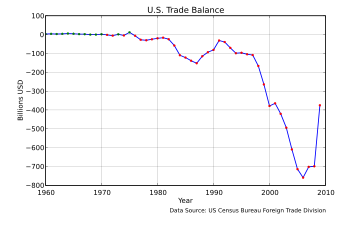

English: United States Balance of Trade, 1960–2009. Data Source: US Census Bureau Foreign Trade Division: http://www.census.gov/foreign-trade/statistics/historical/gands.txt Green dots: Positive trade balance Red dots: Negative trade balance (i.e., trade deficit) (Photo credit: Wikipedia)

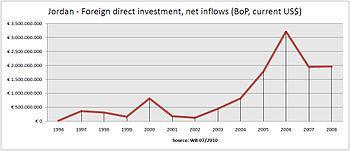

English: Foreign direct investment incoming in Jordan (Photo credit: Wikipedia)

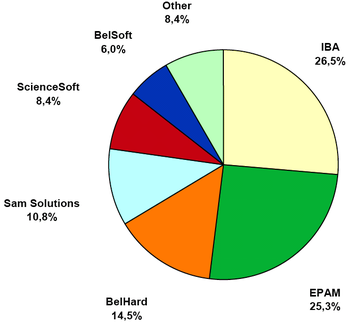

English: graph shows the leaders of Belarusian export-oriented programming market (market shares) (Photo credit: Wikipedia)

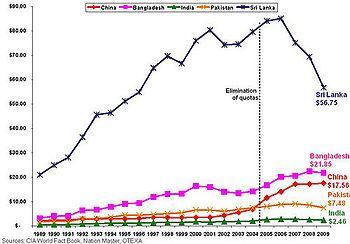

English: Chart comparing major apparel exporting companies exports to United States. (Photo credit: Wikipedia)

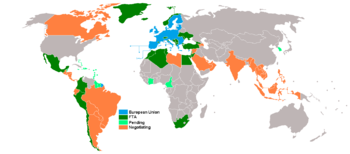

English: EU and free trade agreements countries (Photo credit: Wikipedia)

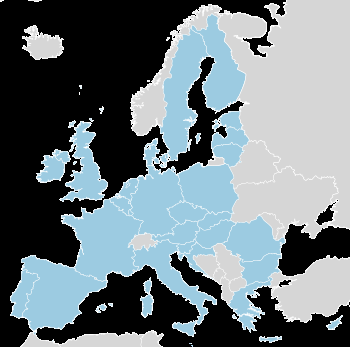

European Union (Photo credit: Wikipedia)

A line chart showing the United States Balance of Trade, 1991 – 2005. Data Source: US Census Bureau Foreign Trade Division http://www.census.gov/foreign-trade/statistics/historical/gands.txt Line chart generated in a spreadsheet, then edited in GIMP. Data is US government data in the public domain. Chart is self-made and donated to the public domain. Chart created by Tom Cool (www.tomcool.us) (User:Tomcool) on 1 April 2006. (Photo credit: Wikipedia)

There are many important factors involved in selecting international entry modes for a multinational organization. Some of them will impact trade balances. Each entry mode is suited to situational circumstances.

Some entry modes are more appropriate under certain environmental variables with specific advantages and disadvantages. The entry mode(s) should match a company’s international strategy.

Global strategy addresses the organization’s guide to globalization. It describes how the company will pursue a global presence in the world’s marketplace. Where should the organization build manufacturing facilities and other value chain activities to optimize the use of precious resources and build a global competitive advantage.

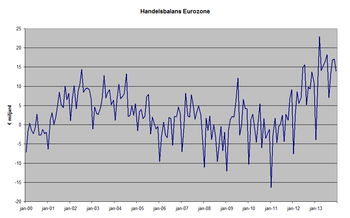

Graph of montly trade balance figures of the Eurozone, in billions of euros, used in Handelsbalans, to be updated monthly, source: Eurostat (Photo credit: Wikipedia)

When companies pursue a global strategy, they prefer an entry modes that offers tight control over international activities. The pursuit of a multinational strategy involves more decentralized decision making.

“As a single economy, the EU is the largest trading partner of the US with $367.8 billion worth of EU goods going to the US and $268.6 billion of US goods going to the EU as of 2011, totaling approximately $636.4 billion in total trade.[3]

The designated entry mode will impact the balance of trade data as displayed in the following graphs:

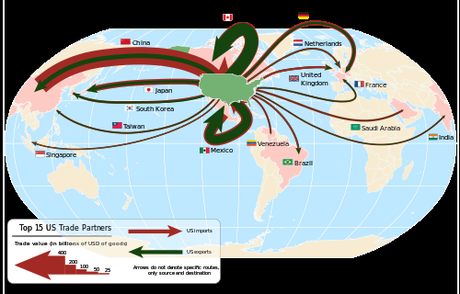

Partners of the United States represent 73.9% of U.S. imports, and 71.7% of U.S. exports as of December 2011.[1]

These figures do not include services or foreign direct investment, The largest U.S. partners with their total trade (sum of imports and exports) in billions of US Dollars for calendar year 2012 are as follows: [2]

A flow map of the largest trade partners of the US

This list does not include the European Union (EU), which includes five (Germany, UK, France, Netherlands and Italy) of the above states in a single economic entity.

English: United States Balance of Trade, 1980–2010. Data Source: US Census Bureau Foreign Trade Division: http://www.census.gov/foreign-trade/statistics/historical/gands.txt (Photo credit: Wikipedia)

The United States is also the primary export or import partner of several countries. The percentages on these tables are based on 2012 data as shown on the CIA World Factbook. Some countries are repeated from the previous table.

| Region Percentage |

|

Region

Percentage

|

|

|---|

An international entry mode is “the institutional arrangement by which a firm gets its products, technologies, human skills, or other resources into a market.” Companies seek entry into a given marketplace for various reasons: manufacturing or sales, desired level of control

The most common method of buying and selling goods internationally is exporting and importing. Exporting involves shipping the goods and services out of the port of a given country. The seller is an “exporter”; the buyer is the “importer”. Exporting and importing commercial quantities of goods normally requires the involvement of customs authorities. An export’s counterpart is an import.

List of countries by leading trade partners (Photo credit: Wikipedia)

Companies use countertrade when exporting and importing products when they are unable to use a specific country’s currency. Countertrade involves selling goods or services that are paid for with other goods or services.

Developing and emerging markets often rely on countertrade to import goods due to lack of hard currency. Some of the former communist countries in Eastern and Central Europe use countertrade as well as nations in Africa, Asia, and the Middle East.

There are many types of countertrade:

a. Barter: Exchange of goods or services directly for other goods or services without the use of money.

b. Counter-purchase: Sale of goods or services to a country by a company that promises to make a future purchase of a country’s product.

c. Offset: Agreement that a company will offset a hard-currency sale to a nation by making a hard-currency purchase of an unspecified product from that nation in the future.

d. Switch trading: One company sells to another its obligation to make a purchase in a given country.

e. Buyback: Export of industrial equipment in return for products produced by that equipment.

Problems may arise when the price of a product declines between the barter time and the selling time. Fluctuating prices generate the same type of risk as in currency markets. Managers can hedge this risk on commodity futures markets in the same way that they hedge against currency fluctuations in currency markets.

Companies pursue exporting opportunities for many reasons:

Seal of the Export-Import Bank of the United States. (Photo credit: Wikipedia)

1. Expand total sales when the domestic market is saturated.

2. Diversify geographic sales to level receivables, payables and cash flow.

3. Learn how to conduct business in other cultures; exporting is a low-cost, low-risk entry mode.

Companies should develop a detailed export strategy. They should identify a potential market and determine whether demand exists in a particular target market. They should conduct market research and match the needs of the market to their value proposition.

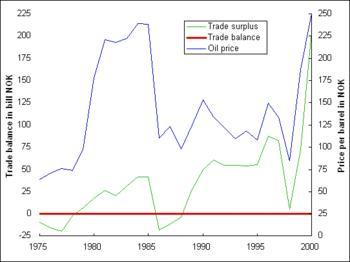

English: North Sea Oil Prices and Norway’s Trade Balance, 1975-2000 (Photo credit: Wikipedia)

As the companies expand activities, they will discover the need for an export department or division. Some companies use intermediaries to get their products into a new market abroad; other companies perform export activities in-house. They can pursue direct or indirect exporting where the company sells to intermediaries who resell to buyers in a target market. “The choice of intermediary depends on the ratio of international sales to total sales, available resources, and the growth rate of the target market.” Agents can represent one or more indirect exporters in a target market. They are compensated with commissions on sales. Some companies will hire a freight forwarder; a specialist in export-related activities like customs clearing, tariff schedules, and shipping and insurance fees.

Export and Import Financing associated with International trade poses risks for both exporters and importers. Exporters risk not receiving payment after delivery. Importers risk that delivery might never occur once payment is made. There are different types of export and import financing methods:

1. Advance Payment: the importer pays for merchandise before it is shipped. “It is used when two parties are unfamiliar with each other, the transaction is small, or the buyer has a poor credit rating.”

2. Documentary Collection: the bank acts as an intermediary without accepting financial risk. It is generally used in ongoing business relationships between two parties. “A draft (bill of exchange) is a document ordering an importer to pay an exporter a specified sum of money at a specified time. A bill of lading is a contract between an exporter and a shipper that specifies merchandise destination and shipping costs.”

3. Letter of Credit: the importer’s bank issues a document stating that the bank will pay the exporter when the exporter fulfills the terms of the document. This is generally used when an importer’s has a poor credit rating. “Banks issue letters of credit after an importer has deposited a sum equal to the value of the imported merchandise. The bank pays the exporter, but the deposit protects the bank if the importer fails to pay for the merchandise.”

There are different types of letters of credit:

- An irrevocable letter of credit allows the bank issuing the letter to modify its terms only after obtaining the approval of both exporter and importer.

- A revocable letter of credit can be modified by the issuing bank without obtaining approval from either the exporter or the importer.

- A confirmed letter of credit is guaranteed by both the exporter’s bank in the country of export and the importer’s bank in the country of import.

COMMENTS ( 1 )

posted on 05 January at 18:01

Amazing blog! Do you have any helpful hints for aspiring writers? I'm hoping to start my own blog soon but I'm a little lost on everything. Would you advise starting with a free platform like Wordpress or go for a paid option? There are so many choices out there that I'm totally confused .. Any recommendations? Thank you!