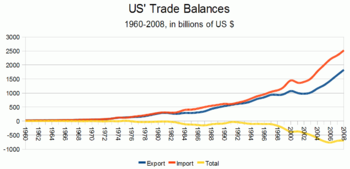

English: U.S. Trade in Goods and Services – Balance of Payments (BOP) Basis (Photo credit: Wikipedia)

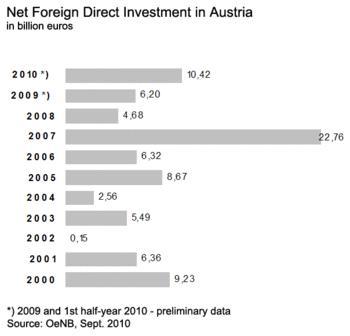

English: Net Foreign Direct Investment in Austria (Photo credit: Wikipedia)

![EU Foreign Direct Investment [SEMINAR] EU Foreign Direct Investment [SEMINAR]](https://m5.paperblog.com/i/93/933342/foreign-direct-investment-decisions-for-inter-L-YdLgOg.jpeg)

EU Foreign Direct Investment [SEMINAR] (Photo credit: ALDEADLE Alliance of Liberals and Democrats for EU)

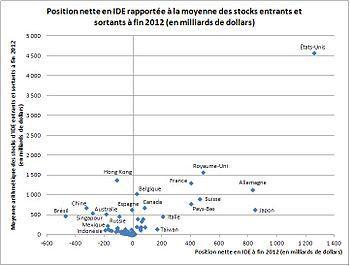

English: Net FDI position and average stocks of outward and inward FDI by country at end-2010 Français : Position nette en IDE et encours moyens des IDE entrants et sortants par pays à fin 2010 (Photo credit: Wikipedia)

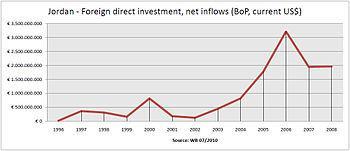

English: Foreign direct investment incoming in Jordan (Photo credit: Wikipedia)

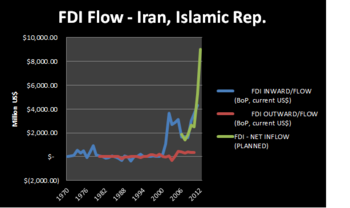

English: Foreign direct investment, net inflows, Iran (2000-2007). (Photo credit: Wikipedia)

The Flower of the East Marina, a multi-billion dollar FDI project in the tourism sector in Iran. (Photo credit: Wikipedia)

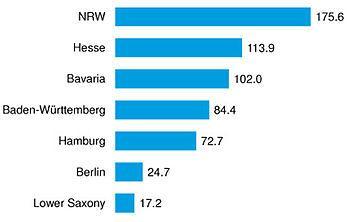

English: Graphics depicting foreign direct investment in Germany in 2007 (Photo credit: Wikipedia)

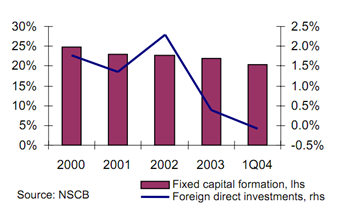

English: Fixed Capital Formation and FDI in the Philippines (Photo credit: Wikipedia)

English: Outward FDI stock at the end 2010 (in billion dollars) Français : Stock d’IDE sortant à fin 2010 (en milliards de dollars) (Photo credit: Wikipedia)

![EU Foreign Direct Investment [SEMINAR] EU Foreign Direct Investment [SEMINAR]](https://m5.paperblog.com/i/93/933342/foreign-direct-investment-decisions-for-inter-L-NLbRSE.jpeg)

EU Foreign Direct Investment [SEMINAR] (Photo credit: ALDEADLE Alliance of Liberals and Democrats for EU)

English: Balance of Payments in Lithuania, Quarterly Data (Photo credit: Wikipedia)

Exchange Money Conversion to Foreign Currency (Photo credit: epSos.de)

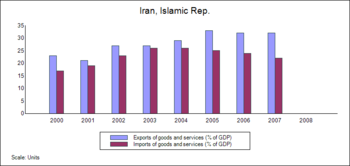

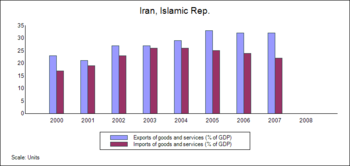

English: Balance of trade, Iran (2000-2007). Historical data: World Bank. (Photo credit: Wikipedia)

Many factors influence a company’s decisions to invest in foreign markets.

Here’s my Foreign Direct Investment Pinterest Board.

http://www.pinterest.com/socialmediaevie/foreign-direct-investment/ (click here for my Pinterest board)

Foreign direct investment (FDI) is an in a country by an individual or company of another country, either by buying a company in the target country or by expanding operations of an existing business in that country.

Foreign direct investment is different from portfolio investment which is a passive investment in the securities of another country such as stocks and bonds.

The purchase of physical assets or a significant amount of the ownership (stock) of a company in another country seeks obtain management control.

Nations encourage FDI in technology because it increases productivity and competitiveness. FDI allows the transfer of management skills and allows talented foreign managers to train local managers in how to operate the local facilities.

Passive portfolio investment in the securities of another country such as stocks and bonds does not involve management control. Most governments as well as the U.S. Commerce Department set the threshold for FDI at 10 percent.

FDI inflows grew around 30 percent through the 1990s and peaked at $1.4 trillion in 2000 and reached an all-time high of more than $1.9 trillion in 2007.

The Uruguay Round of GATT cut trade barriers and allowed firms to produce in the most efficient locations and facilitated exports. Companies started to invest into newly industrialized and emerging markets.

Cross border mergers and acquisitions by multinationals propelled long-term growth in FDI. Multinationals are motivated to grow sales and profits globally and to Increase a firm’s global competitiveness. Many companies invest abroad because they wish to control activities in the local market. FDI can reduce costs in: R&D, production, or distribution.

There are ”more than 82,000 MNCs with more than 810,000 affiliates drive FDI flows.” Developed countries account for about 49 percent of FDI and developing countries account for about 45 percent. The EU, United States, China, India and Japan attract the largest amount of world FDI inflows.

Trade theories offer insight into FDI. The International Product Life Cycle posits that a company will begin by exporting its product and will eventually pursue foreign direct investment as a product moves through its life cycle. In the standardized product stage, a company builds production capacity in low-cost developing nations to serve its markets around the world.

FDI attempts to circumvent trade barriers. A multinational corporation (MNC) owns or controls production facilities in one or more countries other than the home country. Companies may pursue a location-based advantage by “locating a particular economic activity in a specific location because of the characteristics (natural or acquired) of the location.” An ownership advantage is the “advantage that a company has due to its ownership of some special asset, such as a powerful brand, technical knowledge, or management ability.”

Market power theory states that a firm tries to establish a dominant market presence in an industry by undertaking foreign direct investment to control the cost of its inputs and the price of its output.Companies can gain market power through vertical integration which involves controlling upstream and downstream business activities into production. The firm may attempt to control the firm’s inputs (backward integration) or output (forward integration).

Many companies and countries have strict policies regarding cooperation and partnership agreements including how much ownership they may control in firms in other nations. A nation may demand shared ownership in return for market access and governments may use policies to shield workers and industries from exploitation or domination by large multinationals.

Developing nations and emerging markets need investment, employment, tax revenues, training, and technology transfers. A country with restrictive policies regarding FDI deplete inward investment decisions. Nations enact laws, create regulations, or construct administrative hurdles for foreign companies. “A bias toward protectionism or openness is rooted in a nation’s culture, history, and politics.” FDI has historically raised output and enhanced living standards. Companies make purchase-or-build decisions. A greenfield investment entails deciding whether to purchase an existing business or build a subsidiary abroad from the ground up. An acquiring firm may benefit from the goodwill the existing company has built over the years in the form of brand recognition and market share. Factors that reduce the appeal of purchasing existing facilities are “obsolete equipment, poor labor relations, and an unsuitable location.” Production Costs can be adversely impacted by labor regulations, benefits packages and training programs. The manufacture of components may be brought together at one central location for assembly into the final product. Unfortunately, a work stoppage in one country can halt the entire production process.

The Balance of Payments is the “Systematic accounting record of all economic transactions with the residents of one country and the rest of the world” and includes all visible and non-visible transactions of a country during a given period, usually a year and are prepared in a single currency, typically the domestic currency for the country concerned.

These transactions include payments for the country’s exports and imports of goods, services, financial capital, and financial transfers. Sources of funds for a nation, such as exports or the receipts of loans and investments, are recorded as positive or surplus items. Uses of funds, such as for imports or to invest in foreign countries, are recorded as negative or deficit items.

When all components of the BOP accounts are included they must sum to zero with no overall surplus or deficit. For example, if a country is importing more than it exports, its trade balance will be in deficit, but the shortfall will have to be counterbalanced in other ways – such as by funds earned from its foreign investments, by running down central bank reserves or by receiving loans from other countries.

International transactions that result in payments (outflows) to entities in other nations are reductions in the balance of payments accounts and recorded with a minus (–) sign. International transactions that result in receipts (inflows) from other nations are additions to the balance of payments accounts and recorded with a plus (+) sign.

The Current Account records transactions involving the import and export of goods and services, income receipts on assets abroad, and income payments on foreign assets inside the country. A current account surplus occurs when a country exports more goods and services and receives more income from abroad than it imports and pays abroad. A current account deficit occurs when a country imports more goods and services and pays more abroad than it exports and receives from abroad.

The Capital Account records transactions involving the purchase or sale of assets. Financial assets such as stocks and bonds and physical assets such as investments in plants and equipment.

Many governments see intervention as the only way to keep their balance of payments under control. Host countries get a balance-of-payments boost from initial FDI flows. Local content requirements can lower imports, providing an added balance-of-payments boost. Exports from the FDI can further help the balance-of-payments position.

When companies repatriate profits, they deplete the foreign exchange reserves of their host countries; these capital outflows decrease the balance of payments. Thus, a host nation may prohibit or restrict nondomestic firms from removing profits. But host countries conserve their foreign exchange reserves when international companies reinvest their earnings in local manufacturing facilities. This improves the competitiveness of local producers and boosts a host nation’s exports which ultimately improves its balance-of-payments position.

Host countries can promote FDI through financial incentives. interest loans to attract investment. Incentives can create bidding wars between locations vying for investment and the cost to taxpayers can exceed the benefits. Infrastructure improvements can result in better seaports for containerized shipping, improved roads, and improved telecommunications systems.

Host countries can restrict ownership that prohibit nondomestic companies from investing in certain industries or owning certain types of business. Another restriction is a requirement that nondomestic investors hold less than a 50 percent stake in local firms. Performance demands may dictate the portion of a product’s content that originates locally, stipulates the portion of output that must be exported, or requires that certain technologies be transferred to local businesses.

Countries can offer tax breaks on profits earned abroad or negotiate special tax treaties. They can apply political pressure on other nations to get them to relax their restrictions on inbound investments.

Home Countries can impose differential tax rates that charge income from earnings abroad at a higher rate than domestic earnings or impose sanctions that prohibit domestic firms from making investments in certain nations.