Futures pump-jobs, big volume sell-offs at the open, low volume recoveries into the close and then a massive volume sell-off right at the bell to stick all the 401K and IRA suckers with all the crap stocks that are indexed under headliners like AAPL that the Banksters keep pumped up to cover their tracks while they head for the doors in the Christmas edition of Grand Theft – Stock Market.

Speaking of Grand Theft, the EU fined C, DB, RBS, JPM and SCGLF $2.3Bn for rate rigging on Libor but only gave wrist-slaps to UBS, BCS and C for being good little whistle-blowers, which is funny because UBS and BCS were essentially the ring-leaders.

HSBC, CRARF and JPM are still on the hot-seat for rigging Euribor and Tibor rates but the real news is that we may, in fact, have a free market going forward (yeah, right). Still, being forced to play on a level playing field gave GS and excuse to slap a 2-notch downgrade on rival C and, of course, this and many, many, many more fines and regulations to come are why we aggressively shorted XLF on Monday with our FAZ spread.

We were "only" up 233% at yesterday's close after our first two days and that's merely "on track" for what we hope will be a 3,900% gain on the .15 cash we used to fund the FAZ April $24/30 bull call spread at $1.20, offset with the short April $20 puts at $1.05. Also doing well today should be Monday's FXI short 2016 $33 puts ($3.20), which more than paid for the 2015 $40/48 bull call spread ($2.20) for a net $1 credit – but that's a longer-term play with "only" 900% upside potential – hardly worth mentioning…

We were "only" up 233% at yesterday's close after our first two days and that's merely "on track" for what we hope will be a 3,900% gain on the .15 cash we used to fund the FAZ April $24/30 bull call spread at $1.20, offset with the short April $20 puts at $1.05. Also doing well today should be Monday's FXI short 2016 $33 puts ($3.20), which more than paid for the 2015 $40/48 bull call spread ($2.20) for a net $1 credit – but that's a longer-term play with "only" 900% upside potential – hardly worth mentioning…

This morning, I already put out an early Alert to our Members, noting all the rotten economic news. You can read all about it on my Twitter account, which you should really follow if you want to find out cool things earlier than everyone else. Since then, we saw a 12.8% drop in Mortgage Applications and it seems that the inventory levels of apparel retailers in the U.S. stand at "alarming levels", according to Nomura Equity Research. Seems like our observations in the PSW 2013 Holiday Shopping Survey were right on the button so far, as was our short play on XRT (Jan $90 puts, still playable at $3.50 with XRT at $87.80)!

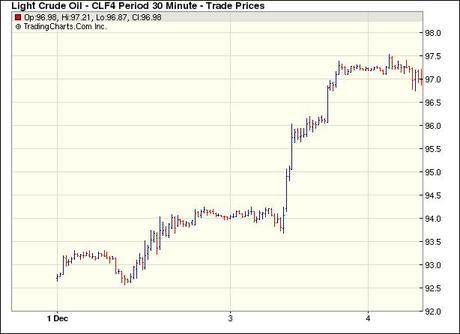

Oil was back to it's old tricks this morning and we caught it short at the $97.50 line in early morning Member Chat, picked up a quick .25 and then a slow .50 for $750 per contract gained on the day (so far). We expect another run-up into inventories as there was an API report showing a ridiculous 12.4M barrel draw last week and, as unrealistic as that number seems, it's still a great excuse for NYMEX traders to BUYBUYBUY and jack the prices back up. There's also an OPEC meeting but, as I noted in yesterday's Webinar, I simply don't see how they'll agree to cutbacks and, without them, we should be back on track to $85 oil.

Oil was back to it's old tricks this morning and we caught it short at the $97.50 line in early morning Member Chat, picked up a quick .25 and then a slow .50 for $750 per contract gained on the day (so far). We expect another run-up into inventories as there was an API report showing a ridiculous 12.4M barrel draw last week and, as unrealistic as that number seems, it's still a great excuse for NYMEX traders to BUYBUYBUY and jack the prices back up. There's also an OPEC meeting but, as I noted in yesterday's Webinar, I simply don't see how they'll agree to cutbacks and, without them, we should be back on track to $85 oil.

So, if you want to play Grand Theft NYMEX this year, I still like shorting the Jan 2014 contracts (/CLF4, now $97.10) and covering them with the Dec 2019 (/CLZ9, now $79.98). That means, if oil keeps going up, you just keep rolling the short calls until they are directly over your long calls (in Dec, 2019) and then you collect the net of the spread. If oil goes down, theoretically, you should maintain more of your long call value than the short calls you sell. The real beauty of this trade is we can do it over and over and over again, until oil is below $80 so let's track a theoretical 10 contract spread, which will use up $37,400 in margin in our Long-Term Portfolio and see how it goes.

You shouldn't fear Futures Trading, it's no different than options but with more of an ultra sort of performance. A single NYMEX unhedged contract, long or short, costs $3,740 in margin and gives you control of 1,000 barrels of oil for a cost of only $5 in and out. That means you make or lose $10 per penny, per contract on any move in oil once you make your entry, so this is no joke and is for experienced day-traders only but, if you are an experienced day trader, you should try the futures – the transaction savings alone are a blessing!

You shouldn't fear Futures Trading, it's no different than options but with more of an ultra sort of performance. A single NYMEX unhedged contract, long or short, costs $3,740 in margin and gives you control of 1,000 barrels of oil for a cost of only $5 in and out. That means you make or lose $10 per penny, per contract on any move in oil once you make your entry, so this is no joke and is for experienced day-traders only but, if you are an experienced day trader, you should try the futures – the transaction savings alone are a blessing!

For instance, oil is now down to $96.82, so the above trade is already up $280 per contract ($2,800 for 10) on the short calls – that's how fast you make money in the Futures – and you don't have to wait for the markets to open (our oil shorts began at 4am today!). You don't HAVE to get up early either, we find opportunities like that throughout the day (see our Monthly Trade Reviews). We just had a seminar in Las Vegas where we did some live Futures Trading and we'll follow up with more in our Atlantic City Seminar in April. Meanwhile, tracking the above spread and discussing it will be educational.

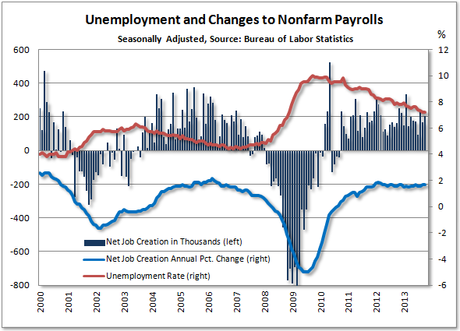

Meanwhile, we're all waiting on rate decisions from the BOE and the ECB but neither is likely to do anything. Later today we have the Fed's Beige Book, which I always enjoy reading (and highlighting the BS for our Members) and we just got (8:30) the ADP Jobs Report which shows a 215,000 gain vs 185,000 expected and, of course, that sent the markets lower because it's good news, which is bad (more chance of Fed tightening), even though 215,000 jobs is barely enough to keep up with US population growth. As you can see from the chart below, net job creation has been dead flat since late 2011 (but, shhhhhhh, why spoil the rally?):

Still, more jobs means more demand for Dollars and the Dollar has moved up to 80.85 and that means our short oil trade idea is looking good already. More demand for money means rates are rising and TLT is falling, back to $102.70 now and $102 is generally where the Fed panics and steps in – so we'll keep an eye on that one for an "obvious" trade today.

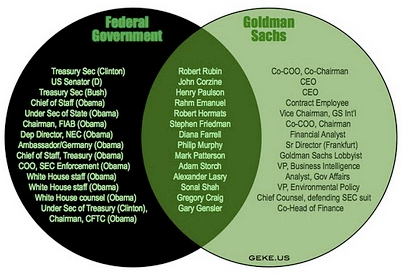

Vice Chairman and Managing Director of Goldman Sachs, Mario Draghi will make some market-moving announcements as part of his internship program with the ECB - the one where GS places their drones into postions of power around the globe to alter economic policy for their benefit. As you can see from the chart on the right – we have nothing to feel superior about – as we outsourced our own Government to the Banksters long ago...

Vice Chairman and Managing Director of Goldman Sachs, Mario Draghi will make some market-moving announcements as part of his internship program with the ECB - the one where GS places their drones into postions of power around the globe to alter economic policy for their benefit. As you can see from the chart on the right – we have nothing to feel superior about – as we outsourced our own Government to the Banksters long ago...

We'll see how the day progresses but, in general, we are still short overall and really mostly in CASH because it's simply a rough market to invest in and I'm not too keen on doing anything until after New Years. But, this is my job, so I still find trade ideas every day for those who feel compelled to play and there's nothing wrong with using some of that sideline cash to make a few holiday Dollars, although:

Every time someone says, “There is a lot of cash on the sidelines,” a tiny part of my soul dies. There are no sidelines. Those saying this seem to envision a seller of stocks moving her money to cash and awaiting a chance to return. But they always ignore that this seller sold to somebody, who presumably moved a precisely equal amount of cash off the sidelines. – Cliff Asness