MORE FREE MONEY!!!

MORE FREE MONEY!!!

That was the message from Fed Chair Jerome Powell yesterday as he told the Senate the the Fed would hold interest rates near zero pretty much no matter what and the Fed would keep buying as many TBills as they want to print to allow Infinite Stimulus to keep going well into 2022. “The economy is a long way from our employment and inflation goals,” Mr. Powell said, just days after the PPI Report showed the highest inflation in 20 years. Powell will deliver the same message to the House this morning.

Consumer confidence in the U.S. rose in February for the second consecutive month as Americans grew more upbeat about current business and labor market conditions, the Conference Board reported Tuesday. Still, nearly a year after the crisis erupted in the U.S., the nation has about 10 million fewer payroll jobs than in February 2020. Of course, 1M of those jobs were cleaning offices – they're not coming back…

The Fed’s semiannual report delivered Tuesday said that business leverage “now stands near historical highs” and that insolvency risks at small and midsize firms remain considerable. Noting that asset bubbles triggered recessions in 2001 and 2007-09, Powell was asked if he sees a link between elevated asset prices and the Fed’s easy-money policies.

“There’s certainly a link,” Mr. Powell said. “I would say, though, that if you look at what markets are looking at, it’s a reopening economy with vaccination, it’s fiscal stimulus, it’s highly accommodative monetary policy, it’s savings accumulated on people’s balance sheets, it’s expectations of much higher corporate profits…. So there are many factors that are contributing.”

While the markets recovered on Powell's testimony, they didn't go any higher because, as I said yesterday – what more can this guy say? He's telling you that the Government can spend as much as they want for as long as they want and the Fed will back them up by buying every note they issue and the Fed will continue to lend money at 0% – even though no one in the private sector will do anything close. That's nothing more than perpetuating an artificial environment.

While the markets recovered on Powell's testimony, they didn't go any higher because, as I said yesterday – what more can this guy say? He's telling you that the Government can spend as much as they want for as long as they want and the Fed will back them up by buying every note they issue and the Fed will continue to lend money at 0% – even though no one in the private sector will do anything close. That's nothing more than perpetuating an artificial environment.

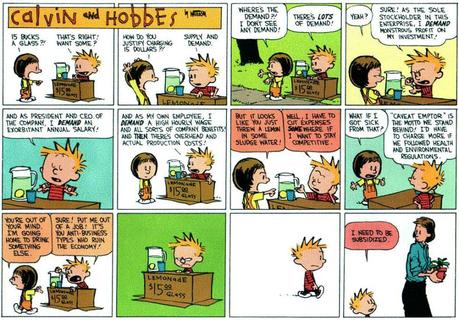

Our economy is like an orchid growing on Mars. It certainly couldn't survive out on the surface but as long as it stays inside it's glass bubble and we give it just the right amount of water and nutrients and sunlight – it will do just fine. Stop giving it any of those things and it can't possibly survive on it's own but that doesn't stop investors from running out and buying Martian Orchid Futures (/MO).

Meanwhile, on another planet we like to call State Governments – where they don't print their own money and budgets have to be balanced – it is now time to tax the rich. In New York this week, Governer Cuomo has proposed raiing taxes on people who make more than $5M/year. California has already done it and boosted state revenue collections by 1.2%. In New York, the State's top tax rate is 8.82% for people making over $100M per year and the new proposal will take it to 10.82% but New York City Taxes may take that all the way to 14.7% – those New York City Condos are looking a lot more expensive now, aren't they?

Lawmakers in New York state are also considering revenue proposals such as a mark-to-market tax on Billionaires, which would require them to pay capital-gains taxes as assets appreciate, even if they don’t sell. In Minnesota, where no one make $100M, Gov. Tim Walz has called for creating a new top income-tax rate of 10.85% for income above $1 million for married couples filing jointly and above $500,000 for single filers. Currently, the state’s highest income-tax rate is 9.85%. Mr. Walz also has proposed adding a tax at a 1.5% rate on long-term capital gains and qualified dividends between $500,000 and $1 million and at a 4% rate for such income of more than $1 million.

Lawmakers in New York state are also considering revenue proposals such as a mark-to-market tax on Billionaires, which would require them to pay capital-gains taxes as assets appreciate, even if they don’t sell. In Minnesota, where no one make $100M, Gov. Tim Walz has called for creating a new top income-tax rate of 10.85% for income above $1 million for married couples filing jointly and above $500,000 for single filers. Currently, the state’s highest income-tax rate is 9.85%. Mr. Walz also has proposed adding a tax at a 1.5% rate on long-term capital gains and qualified dividends between $500,000 and $1 million and at a 4% rate for such income of more than $1 million.

In Washington state, which doesn’t have an income tax, Gov. Jay Inslee has called for a new 9% tax on long-term capital gains above $25,000 for individuals or $50,000 for taxpayers filing joint returns. In Pennsylvania, Gov. Tom Wolf asked legislators to raise the 3.07% personal income-tax rate to 4.49% while expanding a tax-forgiveness credit. His administration says this combination would result in higher payments for the top one-third of taxpayers. The Pennsylvania proposal would raise taxes further down the income spectrum than would the plans in some other states: A single taxpayer without dependents who earns $49,001 or higher would pay more under the plan.

See the trend here? When you elect a Federal Government that "lowers your taxes", they do so by cutting back their aid to the states, who still have to fix your potholes and put out fires, etc. The states also have to balance their budgets so they HAVE to raise taxes – all you do when you cut Federal Spending is shift the burden to local governments and local governments do things like not improve the power grid – and then you sit in the dark and freeze for a week AND pay $28Bn more for your electricity.

All these subsidies do not result in a healthier economy – they result in being able to grow an orchid where orchids can't really grow but the moment you take away the subsidies – things start to collapse. That's why the Fed is making every possible excuse to keep the free money train rolling – they have no idea what will happen when it stops or, even worse, maybe they do….

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!