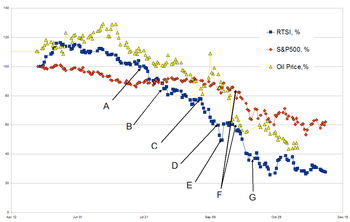

Russian main finansial index RTSI with S&P500 and Oil prices indexes. RTSI is based on http://www.rts.ru/ru/index/stat/dailyhistory.html?code=RTSI S&P 500 is based on http://finance.yahoo.com/q/bc?s=^GSPC&t=1y&l=on&z=l&q=l&c=, Oil Price is Wester Cride Spot Price based on http://kenmzoka.com/080219ExcelOilWTIChart.htm (Photo credit: Wikipedia)

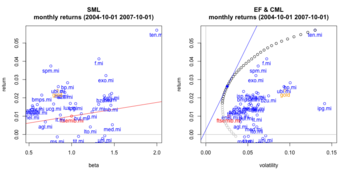

An estimation of the CAPM, Security Market Line and Capital Market Line for the FTSEMIB index between 1-10-2004 and 1-10-2007 for monthly data. (Photo credit: Wikipedia)

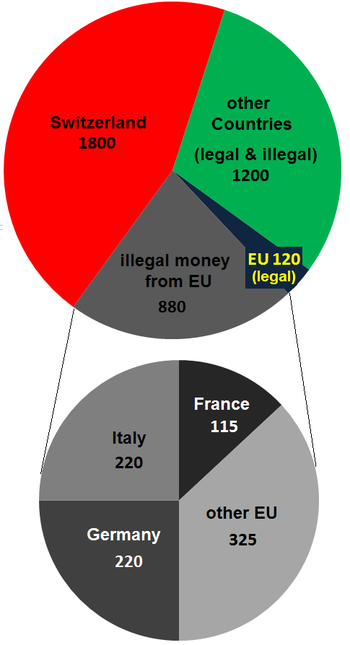

English: Swiss Capital market (Photo credit: Wikipedia)

Stock market of Brussels (Photo credit: Wikipedia)

The Global Capital Market

Learning objectives:

Describe the benefits of the global capital market.

- Identify why the global capital market has grown so rapidly over the last quarter century.

- Understand the risks associated with the globalization of capital markets.

- Compare and contrast the risks and benefits associated with the Eurocurrency market, the global bond market, and the global equity markets.

- Understand how foreign exchange risk impacts upon the cost of capital.

- This chapter discusses the form and function of the global capital market. The market is attractive because its size lowers the cost of capital for borrowers, and allows investors to diversify their portfolios, thereby reducing their risk.

Advances in information technology, together with the deregulation of financial services and the relaxation of regulations on cross-border capital flows have contributed to the growth of the global capital market.

The chapter explores the nature of the Eurocurrency market, the global bond market, and the international equities market.

The opening case explores the factors contributing to the 2008 global financial crisis. The closing case describes how ICBC, China’s largest bank, raised $21 billion in the international equities market.

- Another Perspective: To learn more about G-20 efforts to prevent future financial crises consider the iGLOBE G-20 To Replace G-8 As Economic Forum and also {http://www.businessweek.com/news/2011-09-22/el-erian-says-world-is-on-eve-of-another-financial-crisis.html}.

- LECTURE OUTLINE

Why Do Global Capital Markets Exist?

The rapid globalization of capital markets facilitates the free flow of money around the world. Traditionally, national capital markets have been separated by regulatory barriers.

Global capital markets, while providing many of the same functions of domestic markets, offer some benefits not found in domestic capital markets.

Capital markets bring together investors (corporations with surplus cash, individuals, and non-bank financial institutions) and borrowers (individuals, companies, and governments).

Attractions of the Global Capital Market

Borrowers benefit from the global capital market’s lower cost of capital and greater investment options.

Growth of the Global Capital Markets

Since 1990, the stock of cross-border bank loans has grown from just $3,600 billion to $32,430 in 2010. The international bond market shows a similar pattern of growth.

The two factors behind the growth are advances in information technology and deregulation of the financial services industry.

McKinsey & Company have been following the growth of the global capital markets. Detailed analysis can be found at {http://www.mckinsey.com/mgi/publications/gcm_sixth_annual_report/executive_summary.asp} and {http://www.mckinsey.com/mgi/publications/debt_and_deleveraging/index.asp}.

Global Capital Market Risks

A key risk of an unregulated capital market and looser control on cross-border capital flows is that individual nations may be more vulnerable to the destabilizing effects of speculative capital flows.

The Eurocurrency Market

A eurocurrency is any currency banked outside of its country of origin.

Genesis and Growth of the Eurocurrency Market

The eurocurrency market began in the 1950s when the Eastern bloc countries were afraid the United States might seize their holdings of dollars. Today, London is the center of the market.

Attractions of the Eurocurrency Market

The eurocurrency market is attractive to depositors and borrowers because it is not regulated by the government.

Drawbacks of the Eurocurrency Market

The eurocurrency market has two drawbacks.

First, because the eurocurrency market is unregulated, there is a higher risk of bank failure. Second, companies borrowing eurocurrencies can be exposed to foreign exchange risk.

The Global Bond Market

There are two types of international bonds:

1. foreign bonds are sold outside the borrower’s country and are denominated in the currency of the country in which they are issued.

2. eurobonds are underwritten by a syndicate of banks and placed in countries other than the one in whose currency the bond is denominated.

Attractions of the Eurobond Market

The eurobond market is attractive because

- it lacks regulatory interference

- it has less stringent disclosure requirements than domestic bond markets

- it is more favorable from a tax perspective.

The Global Equity Market

The largest equity markets are in the United States, Britain, and Japan.

Foreign Exchange Risk and the Cost of Capital

While it may initially seem attractive to borrow foreign currencies, when exchange rate risk is factored in, that can change.

Implications for Managers

Firms can often borrow in global capital markets at a lower cost than in the domestic capital market. Firms must balance the foreign exchange risk associated with borrowing in foreign currencies against the costs savings that may exist.

Why has the global capital market grown so rapidly in recent decades? Do you think this growth will continue throughout the next decade? Why?

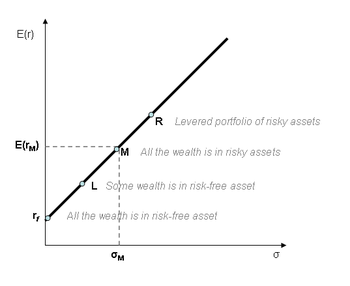

Capital market line plot (Photo credit: Wikipedia)