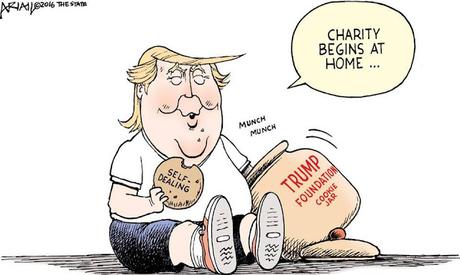

(Cartoon image is by Robert Ariail in The State.)

(Cartoon image is by Robert Ariail in The State.)The federal government doesn't make charities pay taxes. That's because the funds donated to those charities are supposed to be used for the good of people who need help. But that doesn't seem to have been a goal of the Trump Foundation. It was set up as a "charity" to avoid taxes, but it did not use its funds for charitable purposes. Instead, it operated as a piggy bank for the Trump family -- paying their personal expenses, and in violation of campaign laws, even donating money to Trump's presidential campaign.

Trump may have thought he was being smart in doing that, but it has caught up with him. The New York Attorney General has filed suit, demanding the Trump Foundation be disbanded and pay huge financial penalties for the wrongdoing. The trial is expected to start shortly before the mid-term elections.

Here is part of an article on this by Adam Davidson in The New Yorker:

Barring an unexpected change, the Donald J. Trump Foundation will be defending itself in a New York courtroom shortly before this fall’s midterm elections. The proceedings seem unlikely to go well for the institution and its leadership; President Trump and his elder children, Ivanka, Donald, Jr., and Eric, are being sued by New York’s attorney general, Barbara Underwood, for using the charity to enrich and benefit the Trump family. On Tuesday, the judge in the case, Saliann Scarpulla, made a series of comments and rulings from the bench that hinted—well, all but screamed—that she believes the Trump family has done some very bad things. The judge seemed frustrated, even confused, that the Trumps were fighting the case at all. At one point, she told a lawyer for the Trump children that they should just settle out of court and voluntarily agree to one of the sanctions: a demand by the Attorney General that they not serve on the boards of any nonprofits for one year. (The case will be tried in civil court, and the Trumps aren’t facing any criminal charges.) That’s far from the worst sort of punishment, but to accede to it would be a public embarrassment and an acknowledgement that the family did, indeed, use the foundation as something of a private slush fund to enrich themselves and reward their cronies. Judge Scarpulla made clear that she felt the children should agree to the sanction now, and that, if they don’t, she will probably impose a similar restriction “with or without your agreement.” The case against the Trumps appears damning. Charitable foundations are governed by a crucial compromise: they can operate without paying taxes on the condition that their leadership insures that all money spent is spent in pursuit of the public good. The case brought by Attorney General Underwood shows that the Trump Foundation was neither well-managed nor focussed on what would generally be considered the public good. Its operations were shockingly sloppy; at least one of the organization’s official board members said that he had no idea he was on the board and that the board had never met, to his knowledge. No surprise, then, that the other controls that normally govern nonprofits were absent. As David Fahrenthold, of the Washington Post, exposed in a series of stories in 2016, the Foundation did virtually none of the charitable things it claimed to be doing. In recent years, the only “contributions” to the charity seem to have been payments from business partners, not from the Trumps or the Trump Organization. The charity’s spending appears to have benefitted the Trumps themselves, not the public welfare. The organization had been operating this way for years, but, according to Underwood, in 2016 the Trump Foundation became an arm of the Trump political campaign, cutting checks to Trump’s political allies in key states just before the election. If true, this would mean that the Trump Foundation evolved from a mere tax-avoidance scheme into an instrument for carrying out potential acts of campaign-finance fraud. The Attorney General made clear that her evidence could support criminal cases against the Trumps, but she has no jurisdiction to bring such charges, since tax and campaign fraud are federal matters. She referred the case to federal officials, though it seems unlikely that the I.R.S. or the Federal Election Commission would choose to prosecute a sitting President or his children. During Tuesday’s hearing, the Trump Foundation’s lawyer, Alan Futerfas, asked that the trial not commence in October, because it was so close to the midterms. Judge Scarpulla laughed in response, did not change the trial date, and hinted that she is likely to require the President to testify. It is not clear, however, that such a trial would dramatically change how people vote; it was clear during the 2016 Presidential election, thanks to Fahrenthold’s reporting, that the Trump Foundation was almost certainly engaged in systematic fraud.