Thursday morning saw the US Dollar index trading at a 6-week high as appetite in the US stock market continued to fall. However, a shock announcement on trade tariffs on Steel and aluminum drove the US Dollar lower and sent stock markets plunging.

President announces trade tariffs

Trump announced on Thursday that he will implement considerable tariffs on the import of steel into the US. The move triggered a considerable sell of in US stock markets and has left a bad taste in the mouths of many of American closest trading allies.

The president who tweeted his plan initially plans to sign an order to impose the tariffs next week. The tariffs include a 25% import tariffs on steel and a 10% import tariff on aluminum.

The majority of US steel imports originate from Korea, Brazil and Canada and it is likely that the new tariffs will be adversely met by the world trade organisation (WTO) who could argue that the president’s decision contravenes WTO rules.

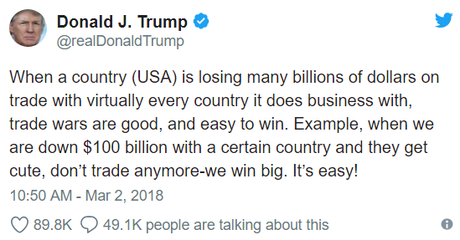

Trump’s take on trade wars

Whilst many of the US’s trading partners including the IMF and WTO condemned the decision Trump has proudly proclaimed that ‘Trade wars are good’. His latest tweet eluded to the facts that he considered the levy’s an easy win which would put a stop to the US losing billion dollars of trade.

Trump believes that the American steel and aluminum industries have been obliterated by trade policies and as per his pre-election manifesto he wishes to correct that.

“We must not let our country, companies and workers be taken advantage of any longer,”

IMF and Juncker warn of tariff consequences

Following Trump’s steel and aluminum tariff announcements the IMF heeded warning claiming that the proposed levies would cause international damage and damage the US’s own economy.

Releasing a statement, the IMF said

“The import restrictions announced by the US President are likely to cause damage not only outside the US, but also to the US economy itself, including to its manufacturing and construction sectors, which are major users of aluminum and steel’’.

Juncker president of the European Commission also fired warning providing cautionary consequences for the US. In a televised interview the European president stated

“If the Americans impose tariffs on steel and aluminium, then we must treat American products the same way,”

“We will put tariffs on Harley-Davidson, on bourbon and on blue jeans – Levi’s,”

Trump’s decision was also met with condemnation by the Canadian prime minister who claimed that Trump’s decision was absolutely unacceptable.

Canada currently exports 90% of its steel to the US and represent 41% of the USA’s aluminum imports.

The Presidents decision to add tariffs couldn’t really come at a much worse time for Canada, the NAFTA agreement seemingly hanging by a thread and Canadas GDP just this week missing expectations significantly, demonstrating the growth of just 1.7% against a forecast of 4%.

Whilst steel and aluminum production doesn’t represent a huge part of Canada’s economy,, more concern circles around supply chain for example parts that are created in Canada and shipped to the US and vice versa.

Trump takes aim at European car producers

Following Junkers comments on potential ways the EU could level the playing field by adding tariffs to Harley Davidson’s and Levi jeans Trump continued the tit-for-tat duel by suggesting Americans could impose tariffs on European built cars.

“If the E.U. wants to further increase their already massive tariffs and barriers on U.S. companies doing business there, we will simply apply a Tax on their Cars which freely pour into the U.S “

The back and fourth war or words and tweets will almost certainly continue this week. The primary auto builders all have a presence in the US. The BMW plant in South Carolina employs roughly 9000 and represent one of America’s largest employers.

US Dollar driven lower

As covered in the opening paragraph the US dollar index had strengthened to a 6-week high before Trump’s announcement.

Significant losses were seen on the INDEX whilst live US Dollar rates also reacted.

EUR/USD enjoyed nice jump following the announcement as investors shied away from the Dollar as fears of a European and Chinese retaliation surfaced. The EUR/USD rising from 1.2197 to 1.2255 an upward motion and trend that the Euro has been able to sustain with the pair closing at 1.2317.

Uplifts were also enjoyed by safe-haven currencies with the JPY also benefiting from Dollar weakness. The US Dollar – Japanese Yen slipping from 106.77 to 106.25, a trend that was accentuated by the new FED chairs speech on Thursday in which the new FED chair Jerome Powell stated that there was little evidence that US wages were increasing. This followed a week of mixed data from the US with core durable goods data missing forecast and demonstrating that the US continues to lag behind its 2% inflation target.