Wheee, this is fun!

Wheee, this is fun!

We've been shorting Oil (/CL) Futures at the $69.50 line since last week and we featured that play during last week's Live Trading Webinar. On Friday morning, in our PSW Report, I made the following call for our Members:

With all the heaving and hoing the market has done this week, we haven't actually gone anywhere – even with this morning's pop. We're clearly consolidating at S&P 4,200 but whether it's for a move up or down remains to be seen. Oil (/CL) is popping to $69.50 into the weekend and we are going to short into the weekend. We started shorting (again) at $68.50, so another round here will give us an average of $69 and then we take 1/2 off when we get back to $69 and we're left with our original short at a higher strike over the weekend – so that's the plan.

So at $68.50, we are happy with $1,000 gains per contract and we take 1/2 (2 in this case) off the table and set a stop at $69 on the last two (trailing 0.25 once we get below $68.50) to lock in at least $750 per contract as an average gain – which is still pretty good for a couple of days' "work." We don't want to play with oil shorts for too long as the July 4th weekend is coming and that should be another excuse to jack up prices and THEN we will go back to shorting.

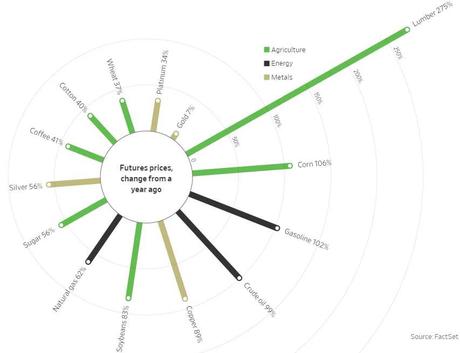

Oil is not the only commodity that's been flying higher: Lumber, iron ore and copper have hit records. Corn, soybeans and wheat have jumped to their highest levels in eight years. Oil, for it's part, just reached a two-year high. China’s producer-price index, a gauge of factory-gate prices, could climb to its highest level since August, 2008 on Wednesday amid rising commodity prices. All these commodities are competing for the same money – that's why we don't see oil particularly taking off. More likely, these high prices will lead to a slowdown of activity in the near future.

Oil is not the only commodity that's been flying higher: Lumber, iron ore and copper have hit records. Corn, soybeans and wheat have jumped to their highest levels in eight years. Oil, for it's part, just reached a two-year high. China’s producer-price index, a gauge of factory-gate prices, could climb to its highest level since August, 2008 on Wednesday amid rising commodity prices. All these commodities are competing for the same money – that's why we don't see oil particularly taking off. More likely, these high prices will lead to a slowdown of activity in the near future.

Manufacturers’ profit margins are shrinking because of higher costs for raw materials. Households are paying more for gas, groceries and some restaurant bills, curbing their ability to spend…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!