U.S. small-cap stocks surged to a record Wednesday as investors turned their focus to U.S. economic improvement and the smaller, nimbler companies that could be best-positioned to benefit.

Russell Investments' index of 2000 small-capitalization stocks rose 2.6% to 871.13 Wednesday afternoon, after hitting an all-time intraday high of 872.28 earlier in the session. Wednesday's rally came on the heels of a year-end surge. The RUT has gained 13% since touching a recent low Nov 15th. The S&P, which tracks larger companies, has added 7.3% over the same period.

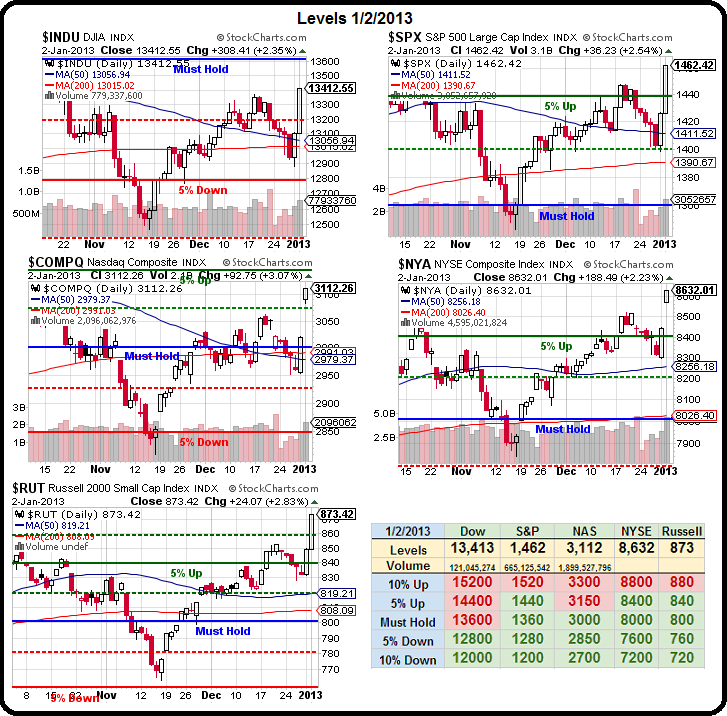

We came right up to the levels we expected and, in fact, the S&P finished the day at 1,452, which was my target for the S&P to finish 2012 (1,450) so it turns out I was one trading session off in the end. In yesterday's Morning Alert to Members, we worked out the short-term 4 and 5% lines we expected our indexes to test during the next couple of days and those were:

- Dow: 13,319 & 13,447 (finished 13,412)

- S&P: 1,442 & 1,456 (1,452)

- Nas: 3,028 & 3,056 (3,112)

- NYSE: 8,580 & 8,660 (8,632)

- RUT: 858 & 866 (873)

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.