The same pattern keeps repeating itself throughout film history: as one revenue source dries up another emerges like some great savior from above. Hollywood has proven especially adept at chasing these endless sources of new money, be they from VHS, DVD, emerging European markets, China, or streaming. However, when that new cash cow suddenly goes away there's an inevitable period of inaction and contraction as the studios and their smaller competitors scramble to find a new formula for profitability.

That's what happening at Sundance Film Festival 2018, which has been dubbed by Variety as "the slowest Sundance ever." Once a hotbed of deals, all-night negotiations, and Miramax/Weinstein Co. largess, this year's festival has only really seen 5 notable acquisitions so far:

The bigger news has actually been away from the Festival. Apple scored a huge deal for Damien Chazelle, whose first movie, Whiplash, premiered at Sundance four years ago, to write and direct a limited TV series for them even though he's already committed to bringing a separate musical TV series to Netflix. As if sensing the need to one-up the competition, Netflix announced Charlie Kaufman as just the latest indie film champion to join their ranks, signing up to write and direct an adaptation of Ian Reid's best-seller I'm Thinking of Ending Things. Amazon hired The Big Sick's Oscar-nominated Emily Gordon to adapt The Nest into a movie. Ditto for playwright Ming Peiffer adapting Weike Wang's novel Chemistry.

That's all fine and good, but why aren't these streaming giants duking it out at Sundance right now? At this time last year, Netflix had already purchased 4 documentaries ( Casting JonBenet, Nobody Speak, Chasing Coral, and now-Oscar nominated Icarus) and dropped $12.5 million on Mudbound. Amazon spent almost as much to acquire The Big Sick. By the end of the festival, Netflix committed $36.5 million to 10 different titles and Amazon spent $24m on three movies, adding Long Strange Trip and Landline to The Big Sick. The next closest competitor was Sony, which needed $16 million to acquire Call Me By Your Name, Novitiate, and Brigsby Bear.

By comparison, Netflix and Amazon have yet to buy a single Sundance movie this year. Netflix's primary focus is currently on increasing global subscription numbers which means investing in more international productions. Buying some niche movie at Sundance? Meh. It'd better be a damn good movie. Buying a troubled Cloverfield sequel off of Paramount? Now we're talking.

Amazon, according to Reuters, might be moving out of the indie film business entirely: "Amazon expects to go after films with budgets in the $50 million range at the expense of indie projects costing around $5 million, one person familiar with the plans said on the condition of anonymity. Another person confirmed the overall strategy, adding that the Culver City, California, studio is still working out the details on how much of its film budget will go to these bigger releases."

Until Jeff Bezos names a replacement for Roy Price, the disgraced former entertainment chief, we don't really know for sure what Amazon will do. The TV division just committed an insane-sounding $250 million to produce a Lord of the Rings TV series. That price tag is said to be far above where the film division will go. So, we know their ceiling is far below blockbuster territory, but what about their floor? In recent months, film projects with similar budgets to The Big Sick ($5m) have reportedly approached Amazon for distribution only to be turned away without explanation.

In the coming days, as negotiations finalize it's entirely possible Netflix and Amazon will pick up a Sundance film or two. After all, the festival won't be over for a couple more days. But you can't count on that, which is why the festival has quite abruptly been reset to its pre-streaming stage when the prices were slightly more reasonable. The irony here is that streaming (coupled with Hollywood's love affair with tentpoles) has largely been responsible for redefining what kinds of movies are considered theatrical plays in 2018, yet with the streaming services suddenly abandoning Sundance the rest of the industry is left to figure out, "Shit, now how are we supposed to make money on these movies?"

That's the question everyone's still trying to figure out. One strategy has been to partner up to limit financial exposure, as seen with Neon and AGBO pooling their resources for Assassination Nation. Another strategy is to think way outside the box, such as Orchard partnering with online ticketing agency MoviePass to acquire American Animals, clearly hoping MoviePass's direct access to consumers will create new marketing opportunities.

Either way, the ongoing debate has slowed negotiations to a snail's pace. As Deb McIntosh, a financier behind two different Sundance 2018 movies, told THR, "There's a thoughtful and measured approach to the acquisitions due to the evolving competition for audience attention. Filmmakers want to understand and agree with their distributor's marketing and release strategy before getting into a deal. Financiers are making more sophisticated decisions about deal structure."

They have to. They can't keep flushing money down the toilet at Sundance.

Case in point: We have no idea what kind of return Netflix saw on its $36m investment at Sundance last year, other than "well, their subscription numbers kept growing." However, based on box office we do know that only four movies purchased at least year's Sundance grossed more than $4m - The Big Sick ($43m), Call Me By Your Name ($9m), Beatriz at Dinner ($7m), and, just barely, The Hero ($4.07m). In fact, one of the biggest acquisitions - Fox Searchlight's Patti Cake$, which cost the studio $9.5m - didn't even gross $1m.

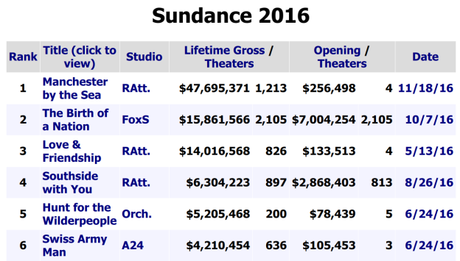

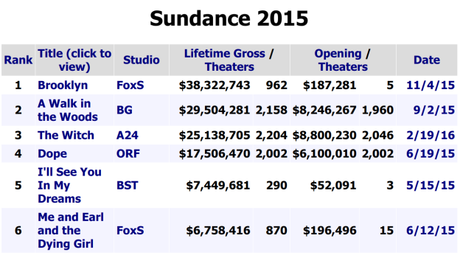

That's actually been the story for years. Sundance 2016 and 2015 each only produced 6 movies which grossed over $4m:

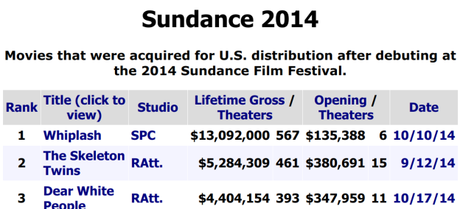

Sundance 2014 only had three:

And making $4m isn't some milestone goal. It's not even a bare minimum, not when it costs almost triple that just to get a movie into theaters with a traditional marketing campaign.

Netflix and Amazon ignored all of that, instead prioritizing what spending heavily at festivals signals to the industry (look at us supporting artists; don't you want to come work for us?) and what it means for the kind of prestige ( Manchester, The Big Sick, and Mudbound all turned into Oscar nominees) which can be used to lure in new subscribers. So, they drove up prices, overspent, and then experienced that post-Sundance hangover which has plagued many a studio that failed to see through the festival buzz that makes it hard to tell what simply plays well at a festival and what has some actual crossover appeal.

This, too, is a familiar Hollywood pattern. Someone with new money goes crazy at Sundance or Toronto just to make it clear how much money they have. Within years, that same company is either completely out of business or undergoing a shift in leadership and/or strategy. Netflix and Amazon might be falling into that latter category, both shifting strategy, Amazon still without a new film chief.

Or it might simply be that this year's Sundance offerings just aren't good enough. Maybe the streaming giants are waiting on Venice, Telluride, and Toronto for better options. Asked by Variety to anonymously size up Sundance 2018, studio executives and distributors used words like "awful" and boring" and wondered "Who are these movies for?"

Howard Cohen, co-founder of Roadside Attractions, the company which distributed Manchester By the Sea for Amazon, begs to differ, telling Variety, "There weren't that one or two films that galvanize a festival as there have been in previous years, but there were many good films. The complexion of any festival reflects the movies, and there were many that were interesting or varied or that dealt with the zeitgeist even if there wasn't one that made a big splash."

Now it's a matter of figuring out how to make money on these "not a big splash" movies. Beyond that, in 2018 how do you even get movies like that in front of wide audiences if tastemakers like Netflix and Amazon don't want them?